Will Sticky Inflation Hinder the Fed's Rate Decrease?

The Fed holds its meeting on Wednesday, and the elevated inflation figures from last week add complexity to the rate reduction decision. Nevertheless, the economy exhibits robustness, with the latest estimate of Q4 GDP growth from the Atlanta Federal Reserve at 3.3%.

Consumer inflation (CPI) climbed to 2.7% year-on-year from 2.6% in October, aligning with predictions. Meanwhile, producer inflation (PPI) surpassed predictions, rising to 3.0% from 2.6%. Both indices have maintained a persistent, above-2% level.

Debating A December Fed Rate Reduction

Decent CPI statistics have accelerated of late, with a three-month annualized rate of 2.8%, potentially unnerving some Fed members about a possible return of inflation.

The recent hike in inflation has also influenced core CPI, excluding food and energy. Over the past 3 months, the core CPI has run at a scorching 3.7%.

Despite upcoming release, the Fed's preferred measure of inflation, the core PCE price index, is predicted to be at 2.9% year-on-year for November, which is well beyond the 2% target rate.

Advocating for A December Fed Rate Reduction

Although other components of inflation might be more defiant than anticipated, the Fed should be fairly certain that the pace of housing inflation should continue to decrease. Much like Zillow, real-time measures of rent inflation suggest downward pressure on the government’s delayed measure of rent inflation. Housing inflation represents 36.6% of the CPI measure, which is significant.

Although the latest employment report was solid superficially, it showed some flaws, such as the unemployment rate moving up to 4.2% from 4.1%. Prior to the decline from the August unemployment rate's peak, the rate had increased enough to indicate an approaching recession by the Sahm Rule. The Sahm Rule boasts an unblemished track record of forecasting recessions, but there are numerous reasons to assume that it may be overstating the risk of recession during this cycle. A slight rise in the unemployment rate will bring the Sahm Rule back to predicting an economic downturn.

Fed members will likely focus on the softening of the labor market as a potential downside danger to the economy. The high-frequency initial and continuing filings for unemployment benefits are above early-year levels, mirroring the increasing hazard to the employment outlook.

The Federal Reserve initiated this easing cycle due to monetary policy being excessively stringent for the prevailing economic conditions. Upon considering the real (inflation-adjusted) level of the Federal Funds rate, monetary policy continues to be restrictive. This scenario is likely to persuade Fed participants to vote for a rate reduction as a hedge against the negative economic risks at the Wednesday meeting.

December Fed Rate Reduction Followed by a Pause

Regardless of the persistent inflation figures, futures pricing agrees with this analysis, with over 90% odds of a 0.25% basis point rate reduction at this week's Fed meeting. The most notable change has been a reduction in the projected pace of rate cuts in 2025. The high inflation readings and resilient economy suggest that the Fed will halt rate cuts at the January 29 meeting to gather more evidence about economic trends.

While the Wednesday rate reduction won't shock the markets, the Fed will revise their forecasts. These forecasts and Chair Powell's remarks will be scrutinized closely to gauge the future pace of easing monetary policy but should include increased inflation and economic growth estimates.

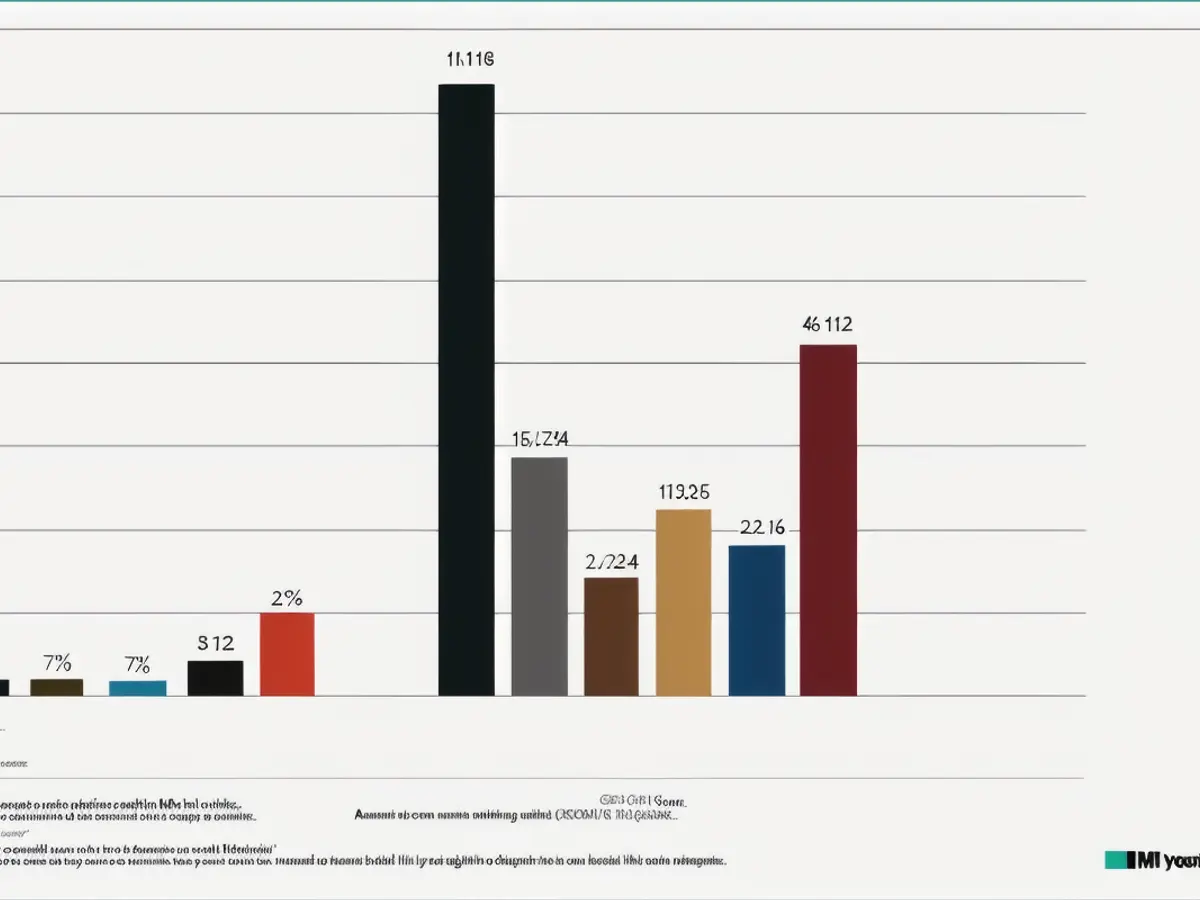

Stocks experienced a falling week after the S&P 500 hit new highs the week prior. The Magnificent 7, consisting of Microsoft (MSFT), Meta Platforms (META), Amazon.com (AMZN), Apple (AAPL), NVIDIA (NVDA), Alphabet (GOOGL), and Tesla (TSLA), continued to climb. The returns on the Magnificent 7 and bank stocks have been exceptional since the U.S. Presidential election. Tesla (TSLA) has stood out since the election, soaring almost 74%!

This week will see a flood of economic data releases ahead of the slower Christmas holiday week. Retail sales on Tuesday will be especially crucial in assessing the consumer's resilience, but the main event is likely to be Wednesday's Federal Reserve meeting. Despite inflation persisting above many people's preferences, the Fed is almost certain to decrease short-term interest rates again. Stocks are in the middle of their most favorable time of the year, so the seasonals provide some comfort that last week's decline shouldn't develop into a significant decline.

The Fed's preferred measure of inflation, the core PCE price index, is expected to be at 2.9% year-on-year for November, which is still above the 2% target rate.

Despite the robustness of the economy, the persistent inflation figures have added complexity to the rate reduction decision at the Federal Reserve meeting.

The recent hike in inflation has also affected consumer spending, with the latest data showing a decrease in retail sales.

Tesla, a part of the Magnificent 7, has seen exceptional returns since the U.S. Presidential election, with its shares soaring almost 74%.