What constitutes residual debt insurance and who might find it useful?

Residual debt insurance may be the ticket to financial peace of mind for many borrowers, offering crucial support in the face of life's curveballs like job loss, illness, or worse. However, it's important to remember that not everyone needs this insurance - it all comes down to the individual's finances and personal readiness. Let's dive into the details of residual debt insurance, its workings, and who could truly benefit from it.

1. The Tale of Residual Debt Insurance

A special coverage for borrowers, residual debt insurance safeguards finances in the event of unforeseen life events. Typically designed for both consumer loans and mortgages, its primary goal is to cover outstanding debt payments when the borrower encounters difficulties. It offers a level of security and ensures credit debts aren't left for loved ones to handle. For more info on residual debt insurance, check out this link.

2. The Inner Workings of Residual Debt Insurance

The workings of residual debt insurance are rather straightforward. When you take out a loan accompanied by this insurance, you agree to routinely pay premiums. In turn, the insurance provider will step in during tough times. The contract details what triggers the insurance such as unemployment or the borrower's inability to work due to illness or even death.

However, there are limitations to keep in mind. The coverage amount can vary depending on the contract and insurance company. Additionally, there's often a waiting period before the insurance applies and certain health checks may be necessary before obtaining the insurance.

3. Who's the Perfect Fit for Residual Debt Insurance?

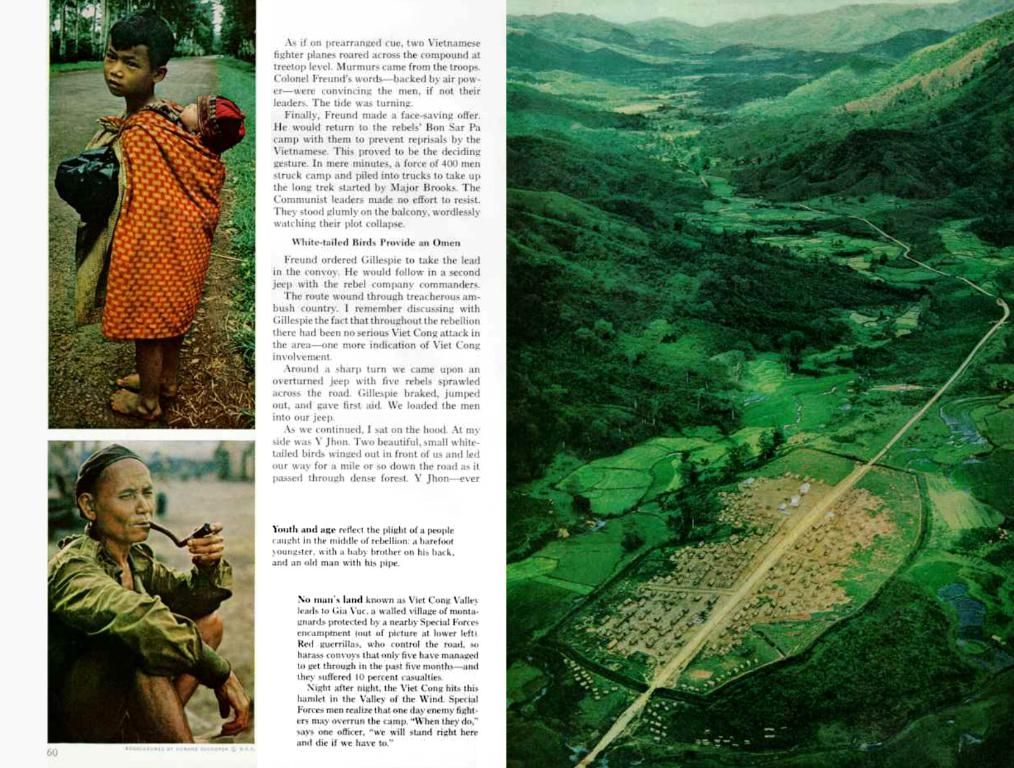

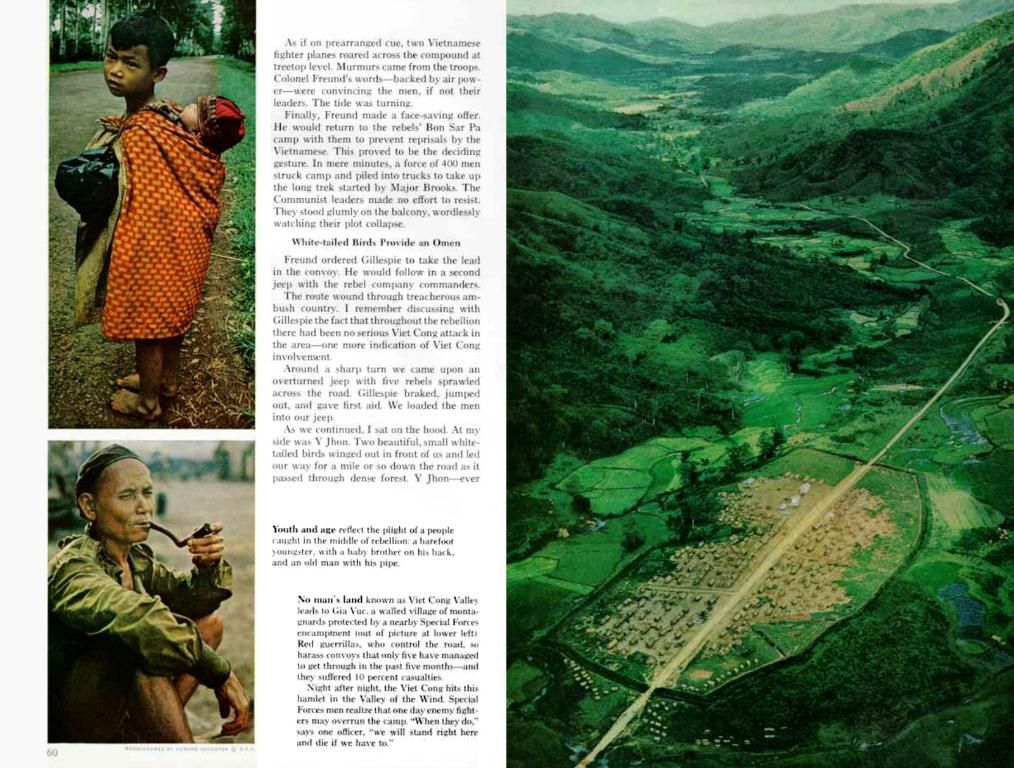

Not every borrower requires residual debt insurance. Its primary focus is on individuals who might find themselves financially strapped without such protection. People with insufficient savings or lacking private risk coverage could find the insurance valuable. Young professionals or families who have recently made significant investments (like a car or home) may not yet have an emergency savings fund and could benefit from the extra protection.

Even freelancers with inconsistent income or who face potential economic downturns could find solace in residual debt insurance, serving as an additional safety net should the business slow down.

On the flip side, some borrowers may not need residual debt insurance due to their financial situation or existing securities such as private accident insurance or life insurance. Those with substantial savings or steady employment might be fine without the insurance.

Kid, You Never Gonna Need That Insurance? Think Again!

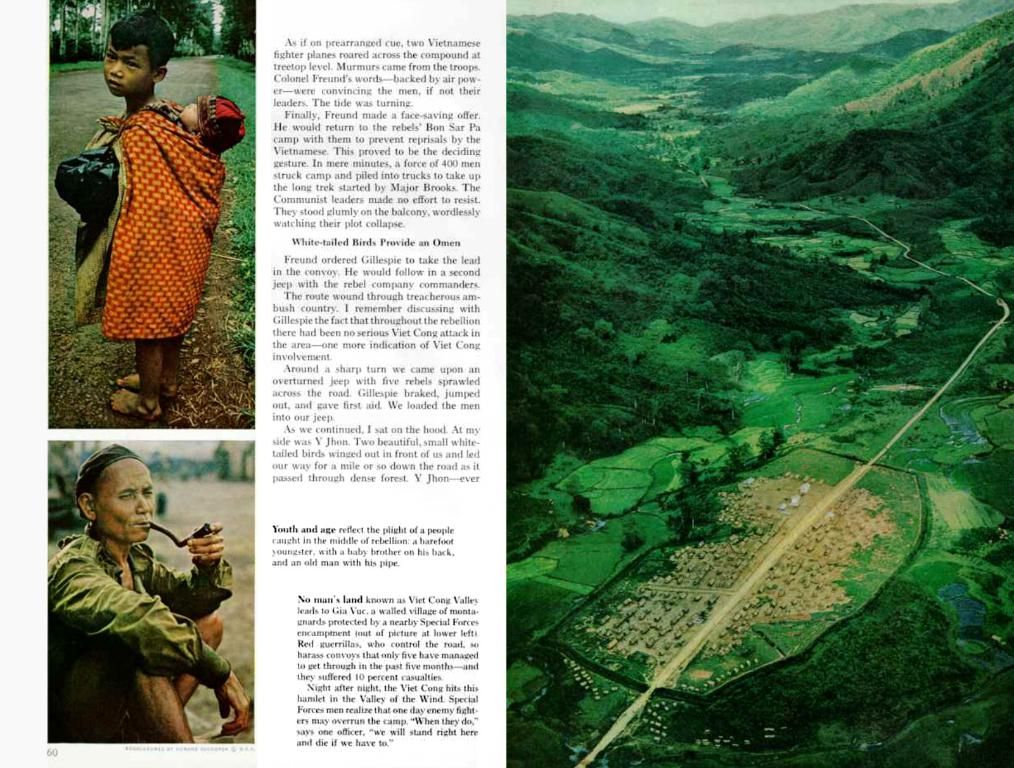

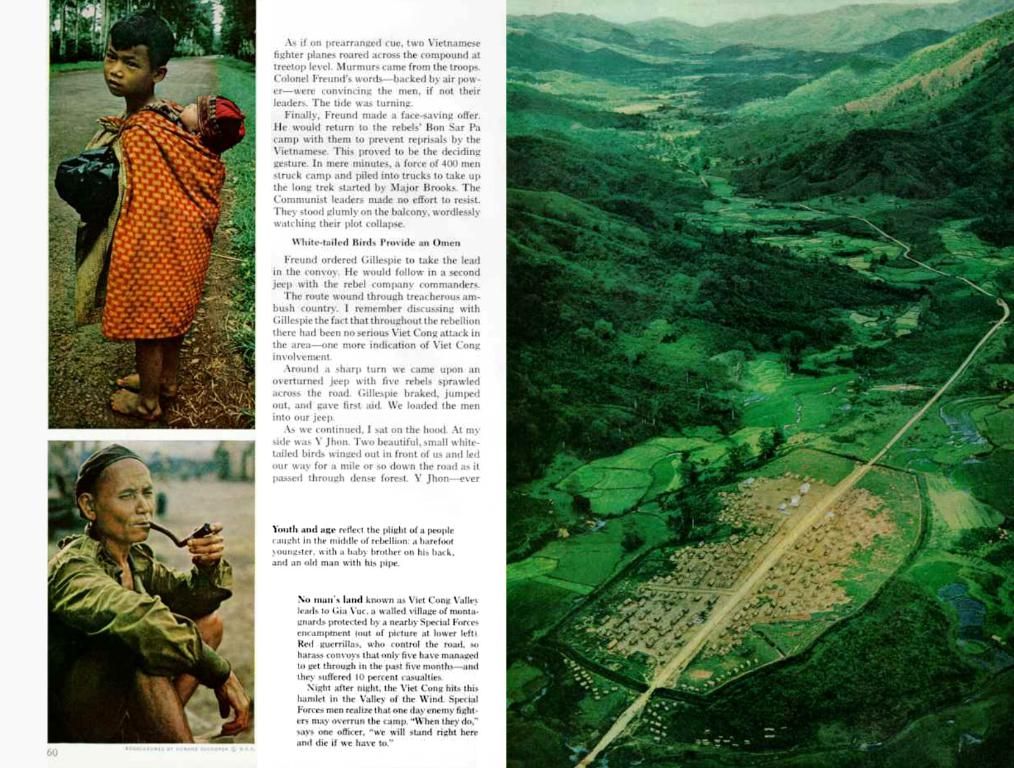

Whether residual debt insurance is indispensable isn't a one-size-fits-all answer. It depends on the borrower's specific circumstances and risk management strategies. People who have enough financial reserves or comprehensive private insurance may not need the insurance. However, the reality is that many cases point to residual debt insurance as a smart move. High-value loans (like real estate purchases or costly acquisitions) can lead to significant financial pressure if unforeseen events occur. Those unsure whether the insurance is suitable should evaluate their personal situation, build a budget, and weigh their options before making a choice.

A good idea might also be looking into alternatives like life insurance or private disability insurance. These may offer more extensive protection, more suitable for some borrowers.

The Pros and Cons: Residual Debt Insurance, Big Picture Style

Residual debt insurance, like any insurance, has its advantages and disadvantages. The perks include the assurance of financial security in the event of unemployment, illness, or death. The insurance offers solace to those with limited savings or those looking to provide financial support for their families in the face of misfortune.

But for every upside, there's a downside. Premiums for residual debt insurance can be steep, depending on the loan amount and the insured risks. Furthermore, the insurance coverage might not be guaranteed in all cases, often excluding specific scenarios or timing limitations. Lastly, even if the insurance isn't claimed, the premiums are usually non-refundable, so it's crucial to weigh the benefits against the costs.

In a nutshell, residual debt insurance can provide a crucial safety net for borrowers, but the necessity and value should always be assessed within the context of one's individual situation. When considering insurance, carefully compare different offers and read the terms and conditions thoroughly to select the best protection.

- For individuals with limited savings or lacking private risk coverage, residual debt insurance could be a beneficial addition to their personal-finance strategy, offering security in the event of unforeseen life events.

- When evaluating personal-finance options, some may find that residual debt insurance, which safeguards finances in the face of job loss, illness, or worse, is an important element for their other financial protections, particularly when taking on high-value loans like real estate purchases or costly acquisitions.