VivoPower Employs XRP in Yield-Producing Venture through Flare Partnership

Coin-Swapping Titans: VivoPower's $100M XRP Yield Venture and Mercurity's Bitcoin Reserves

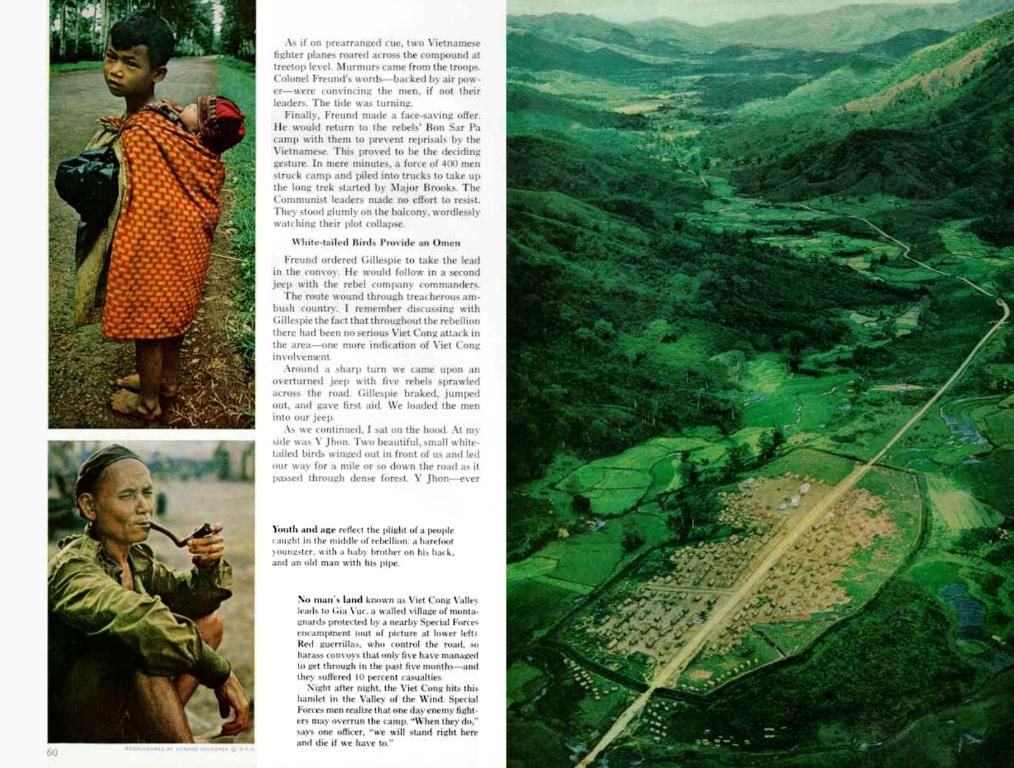

Global sustainable energy solution provider, VivoPower International, has teamed up with blockchain network Flare, marking a new chapter in institutional-grade XRP yield generation. Under the partnership, VivoPower will deploy an initial $100 million into XRP through Flare's innovative FAssets system.

This strategically bold move signifies VivoPower's shift towards an XRP-centric treasury, backed by a consortium of global shareholders and ex-Ripple executives. The ultimate goal: to transform digital asset holdings into a lucrative, self-replenishing money machine.

Industrial-Scale Yield Farming

VivoPower aims to generate yield from its XRP holdings through Flare's native protocols such as Firelight. This yield subsequently gets reinvested into the core XRP holdings, creating a self-sustaining, capital-efficient treasury.

This collaboration pushes forward the XRPFi standard, a cornerstone of DeFi evolution tailored to cater to institutional treasury management. Thestandard is grounded on three fundamental principles:

- Sustainable Yield: Prioritizing consistent, productive returns.

- Regulatory Clarity: Maintaining regulatory compliance in all operations.

- Asset Security: Safeguarding assets with robust blockchain technology.

Selecting XRP as its core reserve asset, VivoPower credits XRP's long-standing regulatory certainty, operational track record, and tech architecture compatible with tokenized real-world assets as key factors for this choice.

Strengthening Treasury Stability

VivoPower further plans to adopt Ripple's stablecoin, RLUSD, as its primary cash-equivalent reserve, tempering volatility and ensuring regulatory compliance.

Flare's Momentous Shift

The partnership with VivoPower signifies a significant milestone for Flare, highlighting its evolving ecosystem as a robust bridge for XRP utility. Flare's FAssets system enables non-smart contract assets like XRP to traverse programmable DeFi environments while retaining their native security models.

"Our FAssets system isn't just a bridge; it's a gateway, allowing institutions to transport assets like XRP into programmable DeFi environments to generate yield, all while preserving their fundamental security. VivoPower's initiative today serves as an open invitation for all institutions to build on this new utility layer," states Hugo Philion, Flare's Co-Founder.

Money Moves in the Blockchain World

Flare's influence continues to grow, as indicated by the rapid expansion in its total value locked, surging nearly 460% in the last two months, from $29 million to an all-time high of $162.14 million, as of June 8.

Concurrently, Mercury Fintech is venturing into the cryptosphere, planning an $800 million Bitcoin reserve and eyeing inclusion in the Russell 2000 index.

In Depth:

- Deployment on Flare Network: Through Flare's FAssets system, VivoPower will utilize XRP within DeFi environments while maintaining security and regulatory clarity.

- Firelight Protocol: VivoPower will generate yield via native protocols on the Flare Network, including lending, staking, and liquidity provision, without compromising asset safety.

- Reinvestment: All yield will be reinvested into VivoPower's core XRP holdings for compound growth.

- RLUSD Stablecoin: RLUSD will function as the primary cash-equivalent reserve, bolstering the treasury's stability and regulatory compliance.

- XRPFi Standard: The standard ensures institutional-grade treasury management on blockchain, prioritizing sustainable yield, regulatory clarity, and asset security.

- VivoPower, a sustainable energy solution provider, has partnered with blockchain network Flare, deploying an initial $100 million into XRP through Flare's FAssets system as part of a strategic shift towards an XRP-centric treasury.

- The partnership pushes forward the XRPFi standard, a cornerstone of DeFi evolution tailored for institutional treasury management, grounded on sustainable yield, regulatory compliance, and asset security.

- Flare's FAssets system allows non-smart contract assets like XRP to traverse programmable DeFi environments while retaining their native security models, illustrating a robust bridge for XRP utility.

- VivoPower aims to generate yield from its XRP holdings through Flare's native protocols such as Firelight, reinvesting the yield into the core XRP holdings for compound growth.

- Ripple's stablecoin, RLUSD, will function as VivoPower's primary cash-equivalent reserve, tempering volatility and ensuring regulatory compliance.

- Meanwhile, Mercury Fintech is venturing into the cryptosphere, planning an $800 million Bitcoin reserve and eyeing inclusion in the Russell 2000 index, indicating money moves in the blockchain world.