Villeroy & Boch perceives a strengthened market position following the acquisition. - Villeroy & Boch enjoys a stronger position following the acquisition.

Hey there! Let's talk business. Remember that delicious ceramic goods brand, Villeroy & Boch? Well, they've been making some moves!

After snatching up Belgian bathroom wizards, Ideal Standard, in March 2024, Villeroy & Boch ain't looking back. The company's CEO, Gabi Schupp, declared that they're feeling more international and less susceptible to economic tremors in individual markets.

Based in Mettlach, Saarland, this ceramic powerhouse has pulled off a smart move, expanding their influence in the Middle East and key European regions. So, why does this acquisition matter? It's all about growing their market share and diversifying their financial risks.

In the first quarter of 2025, Villeroy & Boch's revenue skyrocketed by a whopping 33.2% to an impressive €369.1 million. And if you're wondering about the profit side, their earnings before interest and taxes (EBIT) climbed a respectable 4.3% to €24.1 million. However, their net income took a slight dip, decreasing by 8.3% to €6.6 million.

By 2024, these strategic acquisitions helped bump up their annual revenue to around €1.42 billion, an impressive 57.6% increase compared to the previous year. This growth positions Villeroy & Boch as a significant player in the global ceramic and bathroom products market, employing over 12,000 people and operating in around 140 countries.

Given their strong first-quarter performance, Villeroy & Boch is confident about their 2025 projections. They're aiming for a high single-digit percentage increase in revenue and a moderate boost in EBIT for the entire year.

Notably, this acquisition distanced Villeroy & Boch from over-reliance on any specific market. Wise move, if you ask us! Let's keep our eyes on this ceramic powerhouse as they march forward.

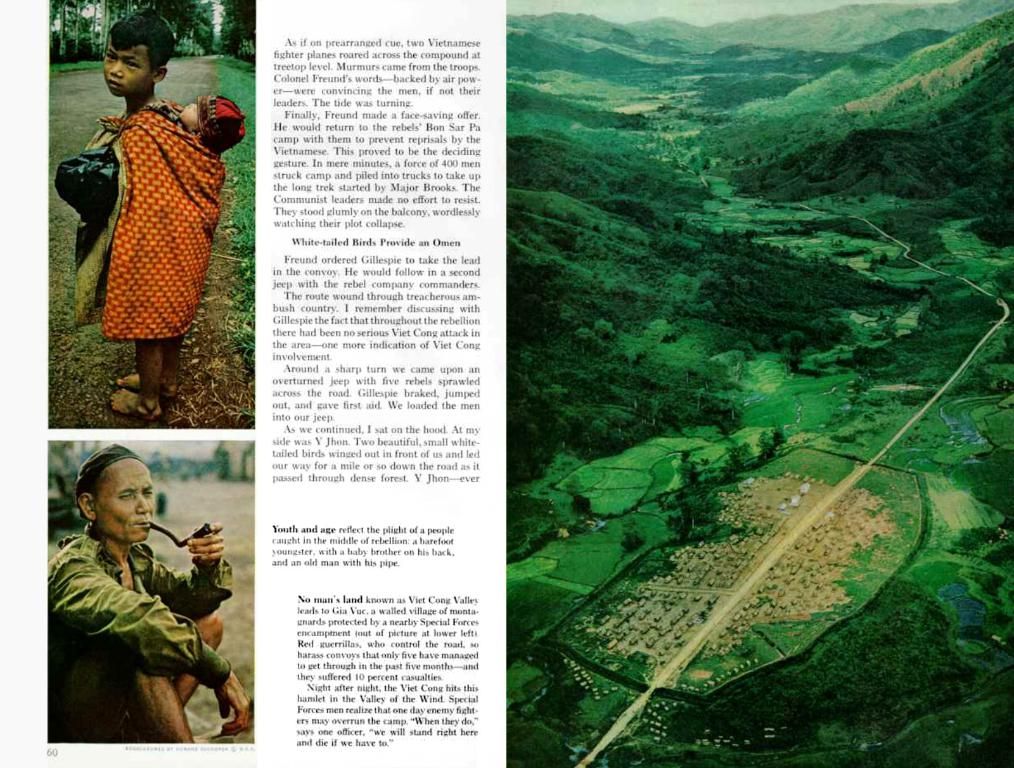

- Ceramics

- Acquisition

- Villeroy & Boch

- Mettlach

- Saarland

- Middle East

A closer look at their financials reveals that their revenue surge, primarily driven by the acquisition of Ideal Standard, significantly boosted their EBIT. While exact EBIT margins aren't available, the growth suggests a positive impact on profitability.

The acquisition has also solidified Villeroy & Boch's market presence in Core Europe, making them one of Europe's top bathroom product manufacturers. Regarding their Middle East market position, while specific details are scarce, the growth in the EMEA (Europe, Middle East, and Africa) region hints at a more assertive presence in the region.

- The acquisition of Ideal Standard by Villeroy & Boch, as seen in the strategic move announced in March 2024, has significantly contributed to an increase in their EBIT, with the revenue surge primarily driven by this acquisition.

- With their successful acquisition of Ideal Standard, Villeroy & Boch has solidified their market presence not only in Core Europe but also hinted at a more assertive presence in the Middle East, expanding their global reach and competitive edge in the ceramic and bathroom products market.

![Villeroy & Boch maintains a steady growth trend (Archive image) [Image]](/en/img/2025/05/17/1500535/jpeg/4-3/1200/75/image-description.webp)