Unwise monetary transactions concerning Thames Water: A market-based remedy advocated by ALEX BRUMMER as an optimal solution.

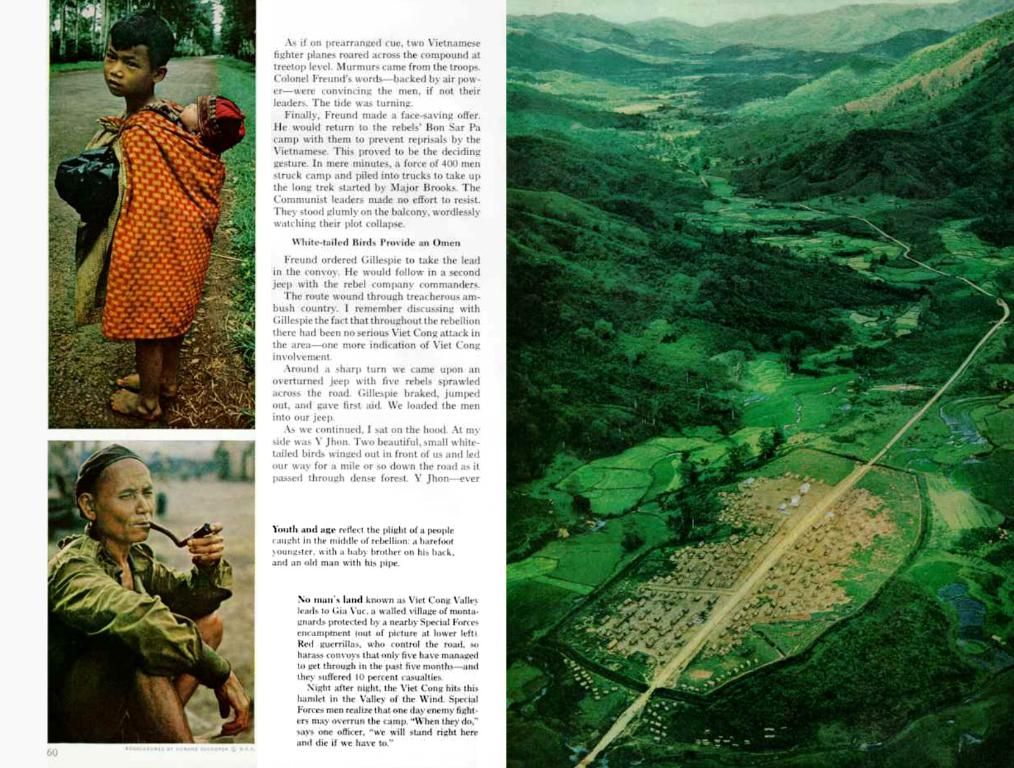

As a lifelong critic of private equity vultures, I'd expect to be celebrating the news that KKR has scrapped their plan to save Thames Water. But with the damned government and their crappy decisions, it seemed like KKR was the only hope.

KKR's promise to chuck in £4 billion to stabilize the company's finances and return it to public hands in a decade was the best deal Thames Water was likely to get. Getting the deal done required aligning multiple parties: Thames Water's management, existing creditors, the regulator Ofwat, the government, and politics. Each step towards a deal ended up being another stumbling block.

KKR has a history of controversy, from their 'Barbarians at the Gate' deal in 1988, through their ownership of Toys R Us, to their recent focus on long-term infrastructure investments. Yet, when the proposition was presented to KKR's global investment committee by their British and European chiefs, they thumbed their noses at it.

There was a bit of good luck involved in their decision. The backlash they'd recently faced in Parliament over potential bonus arrangements and sewage discharges played a part. Meanwhile, former Bank of England deputy-governor Sir Jon Cunliffe released a report on the water industry, finding systemic problems and advocating for a major overhaul.

Of all the regulators set up to watch over utilities post-privatization, Ofwat has been the most useless. None of the water companies have done much to keep our beaches and waterways poop- and pollution-free. There are differences between the companies, with some, like United Utilities and Severn Trent, performing better than those sold to financial leeches. Thames and Southern Water are the worst offenders. Their financial structure has shifted from equity finance to debt, with interest payments and dividends draining the life out of these companies, often flowed to offshore tax havens.

The sale of International Distribution Services (Royal Mail's owner) to a financial buyer, Daniel Kretinsky, is a shame. The only hope is Ofcom, a better regulator than Ofwat, but I doubt they're keen on an affordable first-class post or maintaining the Universal Service Obligation. The Labour government was taken for a ride by Kretinsky, just like they were with the Chinese-owned British Steel rescue.

Nationalizing Thames Water isn't the answer. It took 17 years for the Treasury to unload NatWest. A market solution is the best approach, or we'll be saddled with this screwed-up asset for decades.

Offside!

America's wealthy idiots love private equity and footie, not just for the sport. Owners of professional teams can write off the entire value of players as 'intangible assets' against tax. If a tax plan passes in the House of Representatives, that tax break could disappear, causing a financial disaster for teams, both on this side and the pond.

- In the realm of both business and finance, it seems KKR's decision to retreat from the plan to save Thames Water, despite their history of infrastructure investments, was influenced by factors such as public backlash and the release of a critical report on the water industry.

- The ongoing struggle for stability in Thames Water's finances highlights the complexities of investing in a company heavily reliant on real-estate and governed by numerous regulators, especially those deemed ineffective like Ofwat.

- The proposed tax plan in the House of Representatives, aiming to eliminate a tax break for professional football teams, could potentially cause financial turmoil for these clubs on both sides of the Atlantic, signifying a possible shake-up in the market for private equity investments in sports.