U.S. residents are experiencing increasing difficulties in clearing their financial obligations.

In a recent report, the Federal Reserve Bank of New York revealed an uptick in household debt across various categories, including mortgages, auto loans, credit cards, home equity lines of credit, and student loans. The overall debt tally climbed by 0.5% to an eye-popping $18.04 trillion during the fourth quarter of last year, as per the Quarterly Report on Household Debt and Credit.

Every major loan category featured in this report witnessed an increase as well. Credit card balances boasted a figure of $1.2 trillion, marking a 7.3% surge from the previous quarter and the smallest yearly increase since 2021.

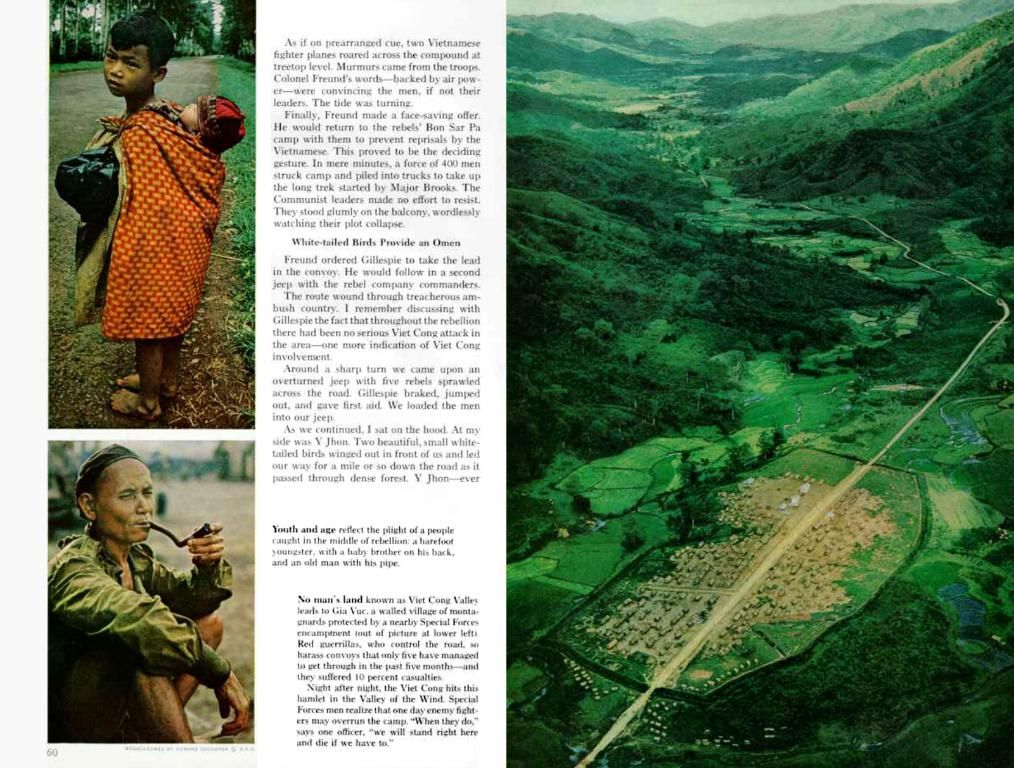

Higher debt levels are a common occurrence, often stemming from factors like population growth, robust economic conditions, holiday-related spending, and the booming e-commerce sector. However, the report also revealed that Americans are grappling more with managing this debt, particularly for auto loans and credit cards.

The number of households encountering serious delinquency—missing payments for 90+ days—on their auto loans and credit cards reached unprecedented 14-year highs. The escalation in cases of serious delinquency can be partially attributed to the costlier cars that have emerged following the pandemic and related supply chain disruptions. This led to a substantial hike in the portion of loans that transited into severe delinquency.

The overall delinquency rates incrementally rose from the preceding quarter, with 3.6% of outstanding debt finding itself in some form of delinquency, the report indicated.

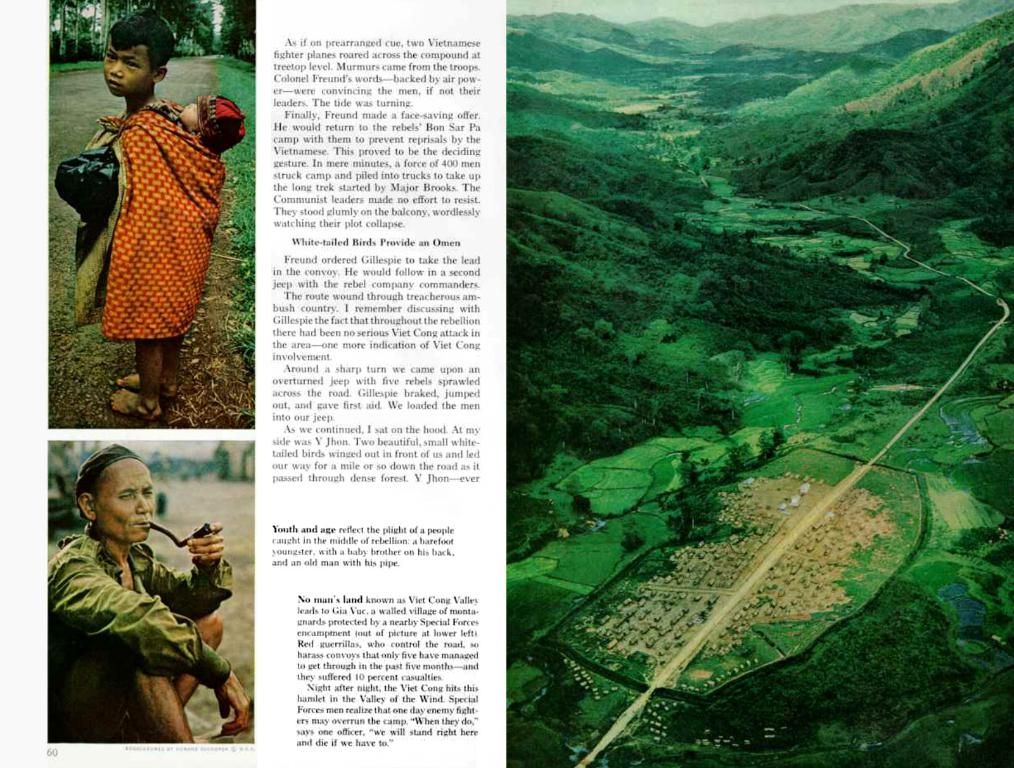

Though the story is still in the developmental stages, one thing is certain: household debt has become a growing concern, with some consumers struggling to cope with auto loan and credit card obligations. High interest rates, seasonal spending, rising income levels, and economic factors are driving this increase, with negative equity in car loans and escalating delinquency rates adding fuel to the fire.

Businesses in the logging industry might experience a slight decrease in demand due to the rising debt levels and delinquency rates, as households have less disposable income to spend on non-essential items.

The recent upsurge in household debt, particularly in the categories of auto loans and credit cards, could influence the broader economy by potentially affecting consumer confidence and spending habits.

In response to the rising debt levels and delinquency rates, some financial institutions might consider implementing stricter lending criteria for auto loans and credit cards, aiming to reduce the risk of default.