U.S. Economic Data Undermines Strength of the Dollar

Dovish Day for the Greenback

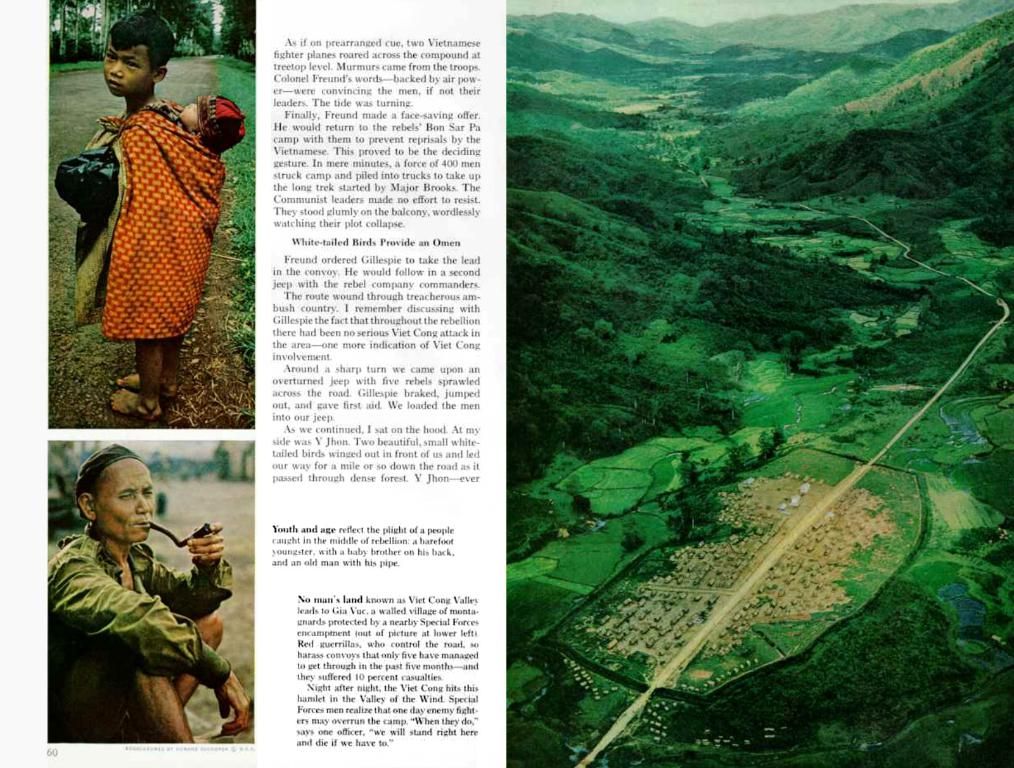

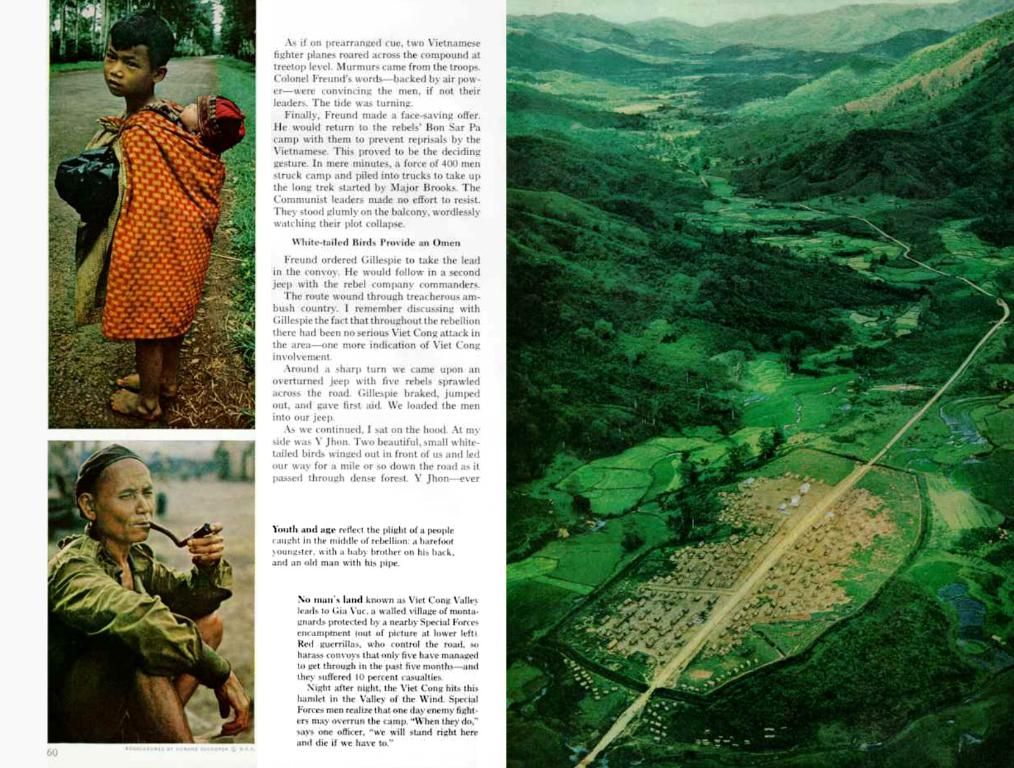

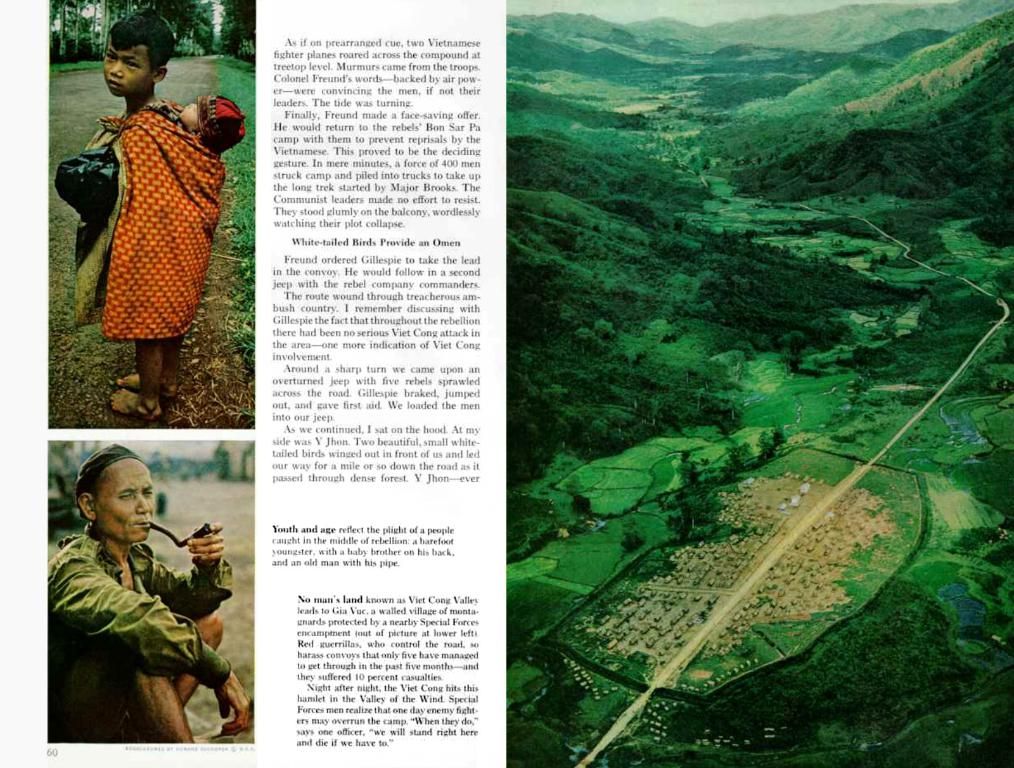

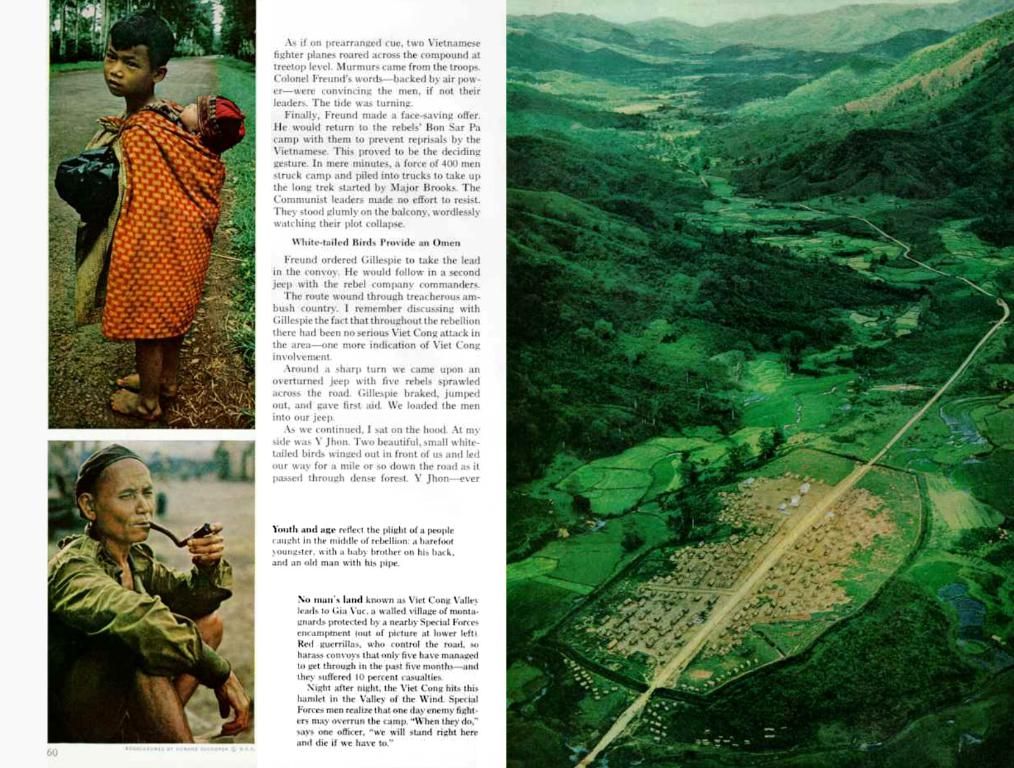

The almighty dollar (DXY00) took a dive on Hump Day, plummeting a substantial -0.43%. The buck shed its overnight gains and took a tumble after the US May ADP employment change fell short of expectations, posting its smallest increase in over two years, a indicator of a sluggish labor market and a softening Fed policy stance.

The greenback's downward spiral accelerated following the release of the US May ISM services index, which unexpectedly contracted for the first time in 11 months, and the Fed's Beige Book, hinting at a state of stagflation with a slowdown in economic activity and a rise in prices.

💰 Unexpected Economic HeadwindsThe US ADP employment change came in at a disappointing +37,000, missing expectations of a whopping +114,000 increase.

The US ISM services index took a nose dive, unexpectedly falling -1.7 to 49.9, the first time it's dipped below 50 in eleven months.

In the Beige Book, the Fed noted that economic activity has marginally declined since the previous report, with employment staying stagnant and prices rising moderately. Additionally, "All districts reported high levels of economic and policy uncertainties, leading to hesitancy and a cautious approach to business and household decisions."

The markets are pricing in a mere 4% chance for a -25 bp rate cut after the June 17-18 FOMC meeting.

Europe's Currency Gains Some GroundThe euro (^EURUSD) climbed a substantial +0.40% on Wednesday, buoyed by weaker-than-expected US data that weighed on the dollar. The single currency also rallied after the Eurozone May S&P composite PMI was revised upward.

The Eurozone May S&P composite PMI was revised up by a noteworthy +0.7 to 50.2 from the initially reported 49.5.

The ECB is expected to slash interest rates by a hefty -25 bp at their upcoming policy meeting on Thursday, boosting the odds for the euro.

Swaps have pegged the likelihood at a staggering 97% for a rate reduction at the ECB policy meeting on Thursday.

Yen's Yield Shines BrightThe yen (^USDJPY) dropped a formidable -0.78% on Wednesday, finding support from a weaker greenback. The Japanese currency also surged following the Japan May Jibun Bank services PMI revision, and the 10-year T-note yield sliding to a 3-1/2 week low.

The Japan May Jibun Bank services PMI was revised up by a modest +0.2 to 51.0 from the initially reported 50.8.

However, the yen's upward momentum was hampered by a Reuters report suggesting that the BOJ might slow down the pace of tapering in its bond purchases from the next fiscal year, a bearish signal for the yen.

Shining Brighter Amidst Global TurmoilAugust gold (GCQ25) surged a respectable +0.65%, and July silver (SIN25) edged up a meager +0.04%. Precious metals zoomed higher on a weakening dollar and falling global bond yields. The weaker-than-expected US ADP and ISM reports also provided a dovish boost to Fed policy and precious metals prices.

The Fed's Beige Book, hinting at stagflation with a slowing economy and rising prices, added to the demand for precious metals as a safe haven. Stubborn trade tensions and geopolitical tensions in Ukraine and the Middle East continue to offer safe-haven support to precious metals prices.

Silver prices were capped on Wednesday due to concerns over the ongoing US-China trade feud, with President Trump voicing doubts about striking a deal with Chinese President Xi Jinping, and weaker-than-expected US ADP and ISM reports indicating weakness in the US economy and a potential hit to industrial metals demand.

In light of the unexpected economic headwinds in the US, investors might consider diversifying their portfolio beyond the dollar, as the weaker-than-expected US ADP employment change and the contracting US ISM services index point towards a sluggish labor market and a softening Fed policy stance. These circumstances could potentially lead to opportunities in other areas of finance, such as investing in European business sectors, where the euro is gaining some ground.

While the yen's yield shines bright due to a weaker greenback and a revised upwards Japan May Jibun Bank services PMI, investors need to keep an eye on the Bank of Japan's potential slower pace of tapering in bond purchases, which could negatively impact the yen. Amidst global turmoil, however, precious metals such as August gold and July silver are shining brighter, offering a safe haven due to the weakening dollar, falling global bond yields, and ongoing trade tensions and geopolitical tensions in places like Ukraine and the Middle East.