Cash Hoarding: The Unexpected Surge of Euro Notes in Private Homes

Cash hoarding escalates: Amount of hidden money steadily increasing - Tucked-away Cash Reservoirs Persist: Ongoing Increase in Financial Stashes

Hey there! Want to know about the unpredicted surge in cash circulation, especially in the euro area? While many assume that the impending extinction of good ol' Greenbacks is just around the corner, the German Central Bank presents an interesting conundrum: the amount of euros in circulation continues to skyrocket. So, let's dive into this quirky cash paradox, shall we?

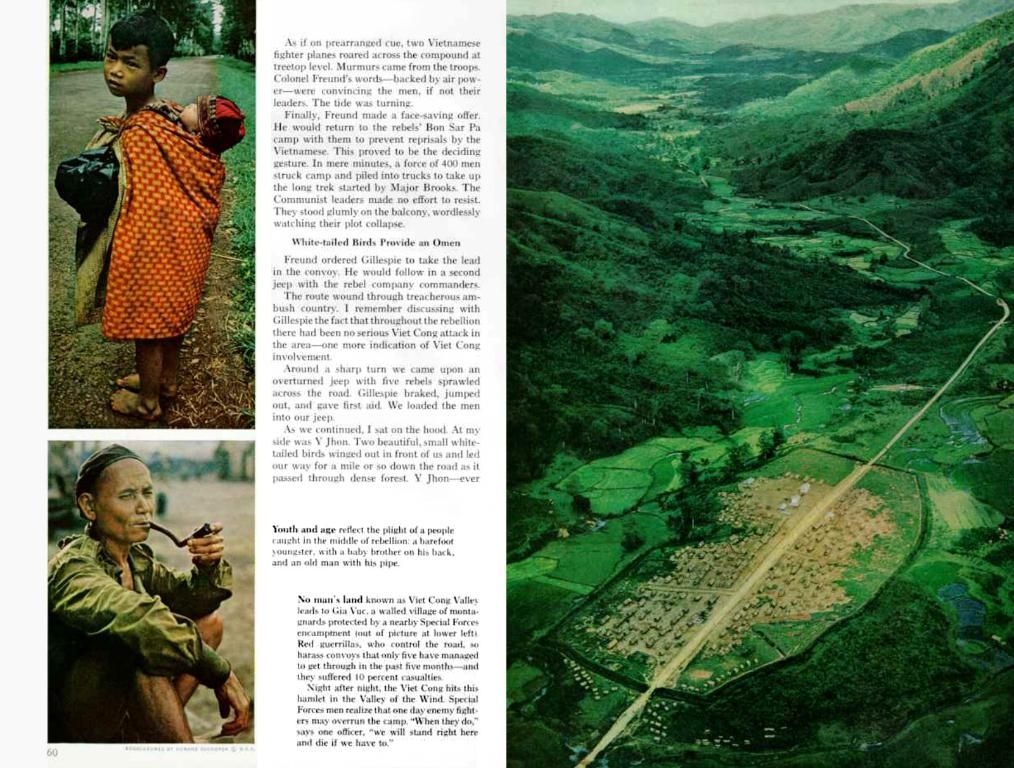

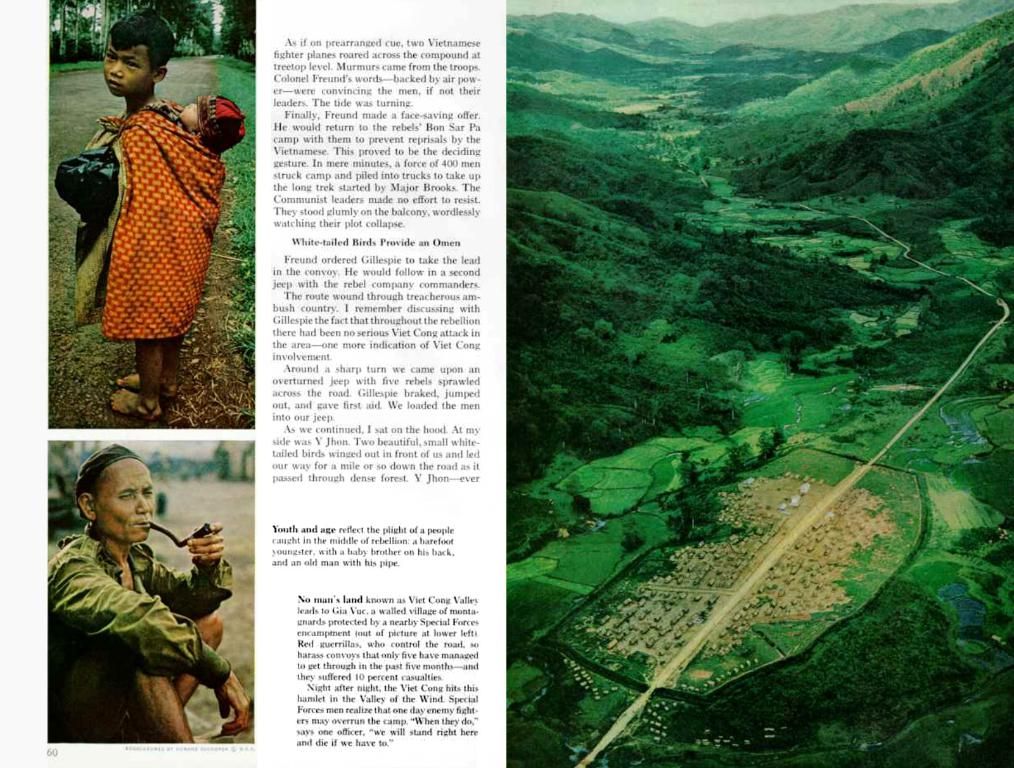

First off, estimates suggest that a whopping four hundred billion euros are stashed away in German households! That's some serious coin collecting, folks. According to the German Central Bank, the proportion of notes kept for "value preservation" in Germany reached a staggering 42 percent, almost double the figure of 2013. Needless to say, these bills are distributed quite unevenly; it appears that many homes are cash barren while others have a veritable vault at their disposal.

The phrase "banknote paradox" was coined by the German Central Bank – and for good reason! Since March 2025, there were an astounding 1.564 trillion euros in circulation across the euro area. That's around a 30 billion euro increase since the spring of the previous year and a 300 billion euro bump compared to the beginning of the Coronavirus pandemic five years ago. Although the growth rate has slowed since 2022, the cash supply isn't shrinking but expanding!

You might be wondering: if fewer individuals are using cash for their day-to-day expenditures, why is the cash supply growing? Here's the catch: people are hoarding the euro – big time! Ralf Wintergerst, CEO of Giesecke+Devrient, a German banknote and security technology manufacturer with around 150 central banks among its clients, explains, "Uncertainty is the driving factor."

But probabilistically speaking, the share of cash held for value preservation reached its zenith during the Coronavirus pandemic, primarily due to extended lockdowns in its initial stages. As the Bundesbank spokesperson explains, "The increase in the circulation of banknotes during crises - not just during the Coronavirus pandemic - due to uncertainty associated with them is a commonly observed phenomenon."

Now, business consultant Johannes Gärtner adds two more factors contributing to the inflated cash supply. "In principle, the growth in the amount of cash is not attributable to classic payment transactions," says the financial expert. "The reasons lie rather in a mix of 'hoarding', shadow economy, and its role as a reserve currency abroad."

Even though the significance of cash in the daily lives of law-abiding citizens continues to tumble, it's unlikely that only bad apples will cling to those green bills. Indeed, the Bundesbank has prioritized secure cash and its infrastructure. And, when you think about it, that's not surprising – cash doesn't need electricity or electronic infrastructure to function. "The central bank must ensure a sustainable, resilient payment infrastructure," says G+D CEO Wintergerst. "If there's war, crises, or natural disasters, it must still be possible to pay. Cash speaks for that."

- The surge in cash circulation, particularly in the euro area, has led to a significant increase in the employment of individuals working in the cash handling and security sectors, as estimated four hundred billion euros are stashed away in German households, necessitating robust employment policies to ensure the handling and storage of these notes are secure.

- As the percentage of notes kept for "value preservation" in Germany reached 42 percent, policy discussions surrounding finance and business have been prompted to consider the long-term implications of this trend, with particular emphasis on community policy, as the hoarding of euros in private homes raises questions about financial stability and the role of physical currency in modern business transactions.