Trump renews criticisms towards Fed Chair Powell, asserting that he negatively impacts the housing sector

The Federal Reserve (Fed) has reaffirmed its commitment to maintaining the federal funds rate at its current target range of 4.25% to 4.5%, despite calls from President Donald Trump for significant rate cuts [3]. This decision comes as the Fed continues to prioritise its dual mandate of promoting maximum employment and stable prices, aiming for inflation anchored around 2% [1].

Recent economic data suggests a moderate rise in overall consumer prices in July, with the consumer price index rising 0.2% [9]. However, higher consumer prices could be on the horizon as sellers pass on increased costs to households [7]. Core CPI, which strips out the volatile food and energy components, increased 3.1% year-over-year in July [5]. This would raise the year-on-year increase for the core Personal Consumption Expenditures Price Index to 3% if the Fed's estimate of a 0.3% increase in July holds true [8].

Despite these inflationary pressures, the Fed's policy rate has not been reduced since Trump's electoral victory [4]. The Fed cut its policy rate half a percentage point last September and trimmed it another half of a percentage point in the two months immediately following the election [10].

Investors and economists are betting the Fed will cut rates by a quarter of a percentage point next month [6]. However, the Fed's communications emphasise a cautious approach [2]. The policy rate is closer to neutral than it was a year ago, and the Fed is mindful of previous episodes where rates stuck at the effective lower bound (ELB) contributed to economic sluggishness [2].

Moreover, the Fed employs a flexible average inflation targeting framework, which can allow inflation moderately above 2% after periods of low inflation, indicating a strategic approach rather than quick rate cuts [2]. This approach is in line with the Fed's stance of using its full range of tools as necessary to sustain employment and price stability, maintaining transparency and careful monitoring of economic conditions [1][2][3].

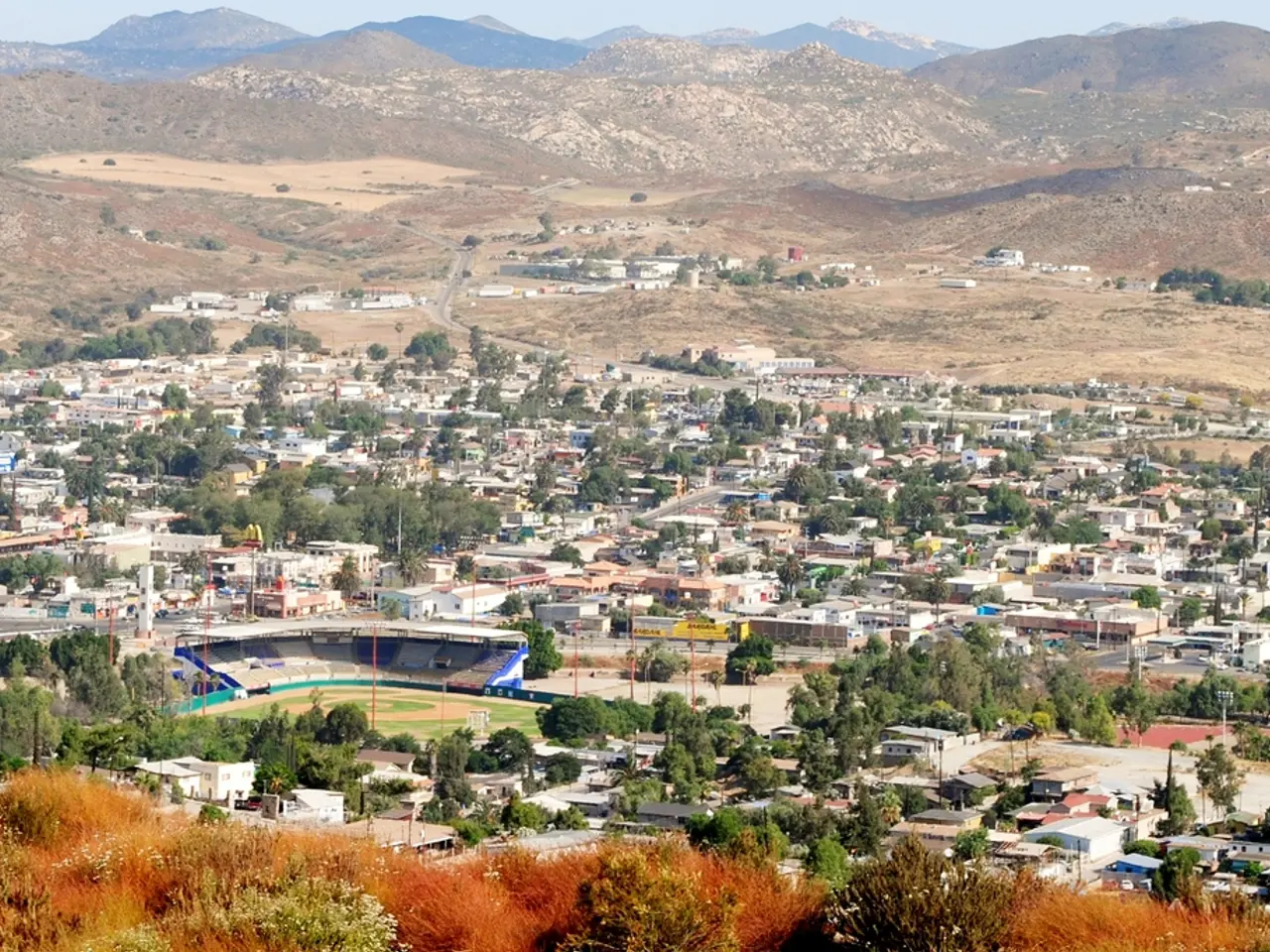

Meanwhile, the most popular rate - the 30-year fixed mortgage rate - has drifted downward but is still much higher than it had been before inflation took off after the pandemic shock and the Fed began its rate-hike campaign in 2022 [11]. President Trump has criticised the Fed Chair Jerome Powell for hurting the housing industry "very badly" [12].

In other news, the U.S. Treasury Secretary has stated that India is profiteering from Russian oil purchases [13]. This statement comes as the world grapples with the economic and geopolitical fallout of the ongoing conflict in Ukraine.

In conclusion, the Fed's current stance is to maintain the federal funds rate at its existing target range, without indicating plans for immediate interest rate cuts. The Fed intends to use its full range of tools as necessary to sustain employment and price stability, maintaining transparency and careful monitoring of economic conditions.

Read also:

- Deepwater Horizon Oil Spill: BP Faces Record-Breaking Settlement - Dubbed 'Largest Environmental Fine Ever Imposed'

- Lawsuit of Phenomenal Magnitude: FIFA under threat due to Diarra's verdict, accused of player injustice

- Expansion of railway systems, implementation of catenary systems, and combating fires: SNCF adapting to the summer heatwave

- Citizen Thekla Walker, Minister, advises: "Let's focus on our own homes first"