Today's mortgage rates remain steady for the 30-year fixed mortgage, despite the recent Federal Reserve rate reduction.

In the current economic climate, mortgage rates have been a topic of significant interest for home buyers and sellers alike. Here's a breakdown of the latest developments in the mortgage market.

Last week, Freddie Mac reported that the average 30-year fixed mortgage rate had reached an 11-month low of 6.35%. However, experts caution that mortgage rates are unlikely to drop significantly this fall.

One tool that can help potential buyers navigate the market is Zillow's BuyAbility tool, which customises estimates based on factors such as income, credit, and location. A higher credit score, for instance, can lead to lower rate offers for buyers.

As of recent data, major US banks like Wells Fargo, Bank of America, and JPMorgan Chase have 30-year fixed mortgage rates ranging between approximately 6.5% to 7.0%. The latest updates were published in September 2025.

The Fed's quarter-point cut has lowered the benchmark rate to 4%-4.25%, but this has yet to have a significant impact on mortgage rates, which are projected to stay above 6% through the end of 2025.

If you're planning to buy or refinance in the next 30-60 days, experts recommend locking in the mortgage rate now. This is because mortgage rates are projected to remain high due to factors such as September inflation data, bond market volatility, and political uncertainty around the Fed's independence.

Inflation remains elevated at 2.9%, and this, along with other economic factors, may cause mortgage rates to increase. Keeping a low debt-to-income ratio can help qualify for better mortgage terms.

Another factor to consider is the size of your down payment. A larger down payment reduces lender risk and improves the buyer's offer.

For those considering adjustable-rate mortgages (ARMs), it's worth noting that they are currently averaging 6.000%. If you're looking for a more stable rate, you might want to consider fixed-rate mortgages such as the 15-Year Fixed (5.250% APR: 5.549%), the 20-Year Fixed (5.625% APR: 5.868%), or the 30-Year Fixed (6.000% APR: 6.167%).

It's also worth mentioning that the 30-Year VA mortgage rate is 6.000% (APR: 6.276%), while the 30-Year FHA mortgage rate is 5.625% (APR: 6.318%).

Lastly, getting a verified pre-approval can show sellers that you're serious about buying a home and may even lock in a better rate. This is because it demonstrates that you've been pre-qualified for a mortgage and are ready to move forward with the buying process.

In conclusion, while mortgage rates remain high, there are still opportunities for home buyers to find favourable terms. It's crucial to stay informed, consider your financial situation, and make decisions that best suit your needs.

Read also:

- Deepwater Horizon Oil Spill: BP Faces Record-Breaking Settlement - Dubbed 'Largest Environmental Fine Ever Imposed'

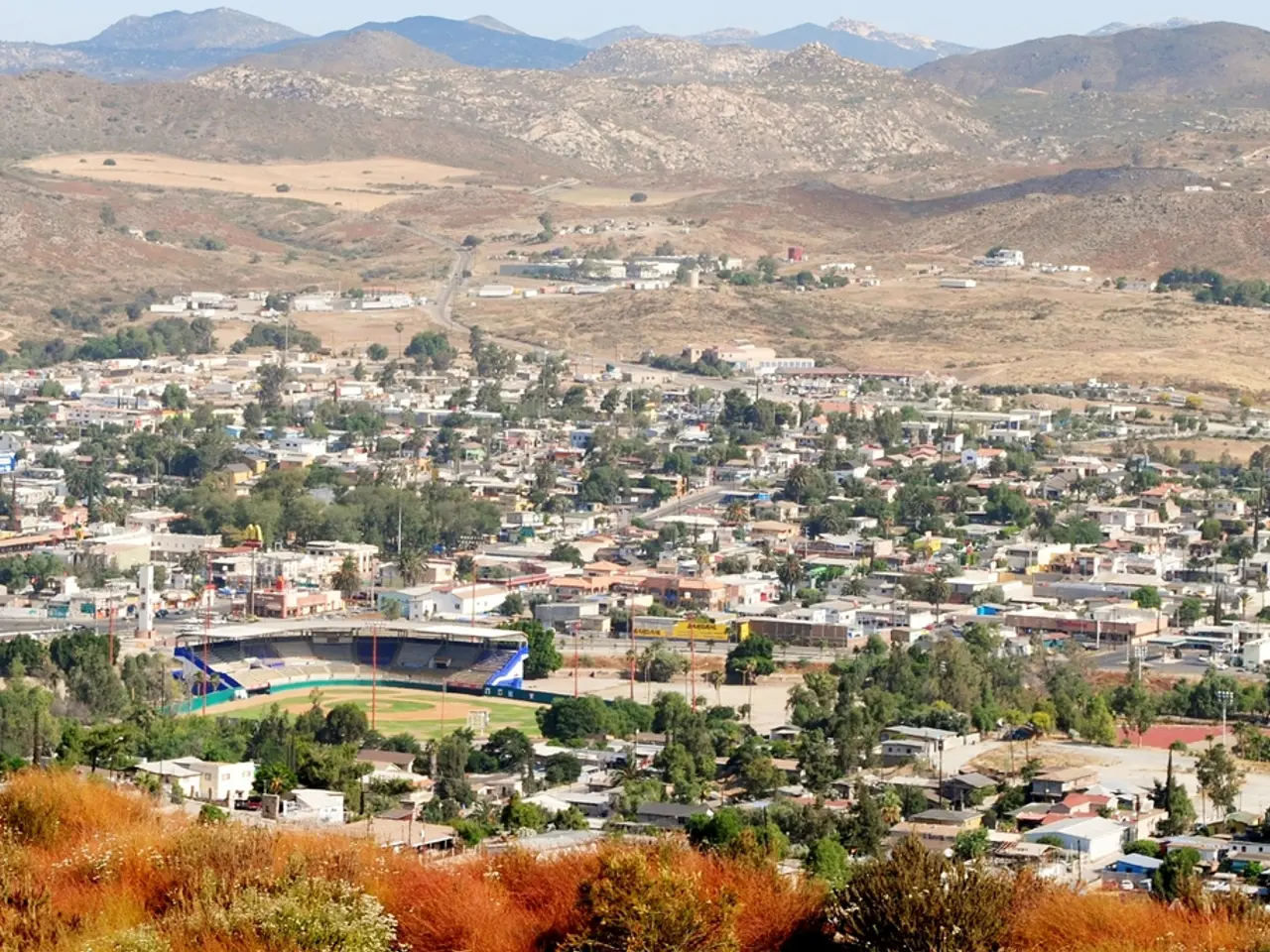

- Historic downtown temples to receive restoration funds totaling over 25 million pesos

- Cars' Environmental Impact Explained

- Lawsuit of Phenomenal Magnitude: FIFA under threat due to Diarra's verdict, accused of player injustice