The Financial Institution Eliminates Third-Parties in Transactions

Blueprint of the Storm: Could Sberbank Insurance Broker be Stepping into Turbulent Waters?

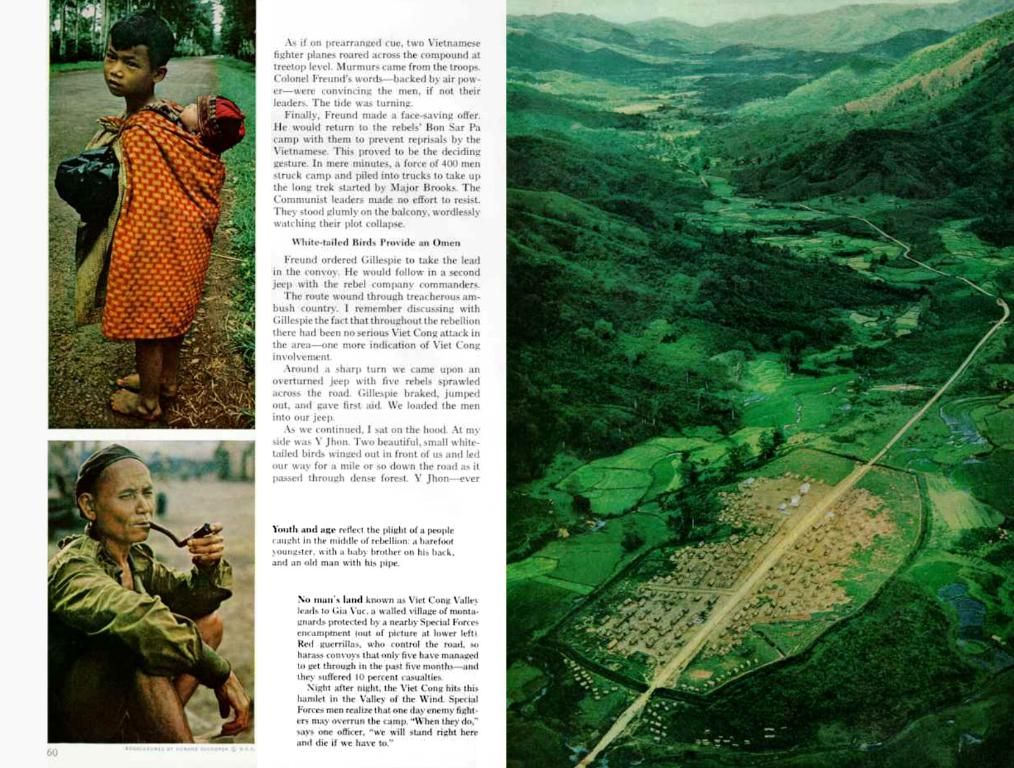

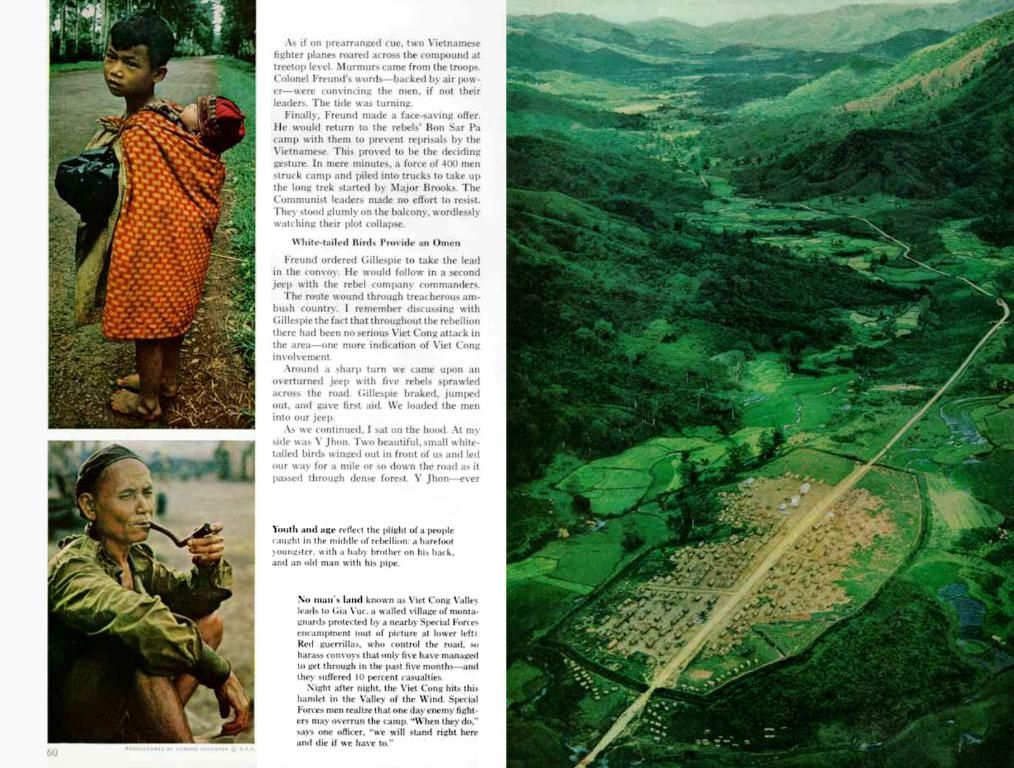

There's a storm brewing in the insurance market as the departure of top managers and a hiring freeze at "Sberbank Insurance Broker" has raised eyebrows. This situation, according to sources, could lead to the closure of the broker or a merger with another company, although restructuring seems a more plausible option. The company, with Sberbank holding a 100% stake, ranked second in terms of premium volume in 2024.

Insiders say that Sberbank is considering closing down the broker due to its exhausted sales potential. Sberbank's press service, however, denies any plans of closure. Yet, the question remains - will the broker swim against the current or embrace a new tide?

The coexistence of an in-house insurer and an insurance broker within a financial group is a rare setup, according to industry experts. This arrangement can lead to a conflict of interest, as some clients might be redirected to other insurance companies rather than the group's insurer, making the financial group solely depend on the broker's commission income.

If the broker is indeed closed, the group could face significant risks. These risks include the potential loss of valuable competencies if some employees leave, the possible loss of clients, reputational damage, and a weakening of the overall insurance expertise of the holding. The experts suggest that it would be more prudent to restructure the broker into a new entity, such as a risk management consulting agency, a service company providing assistance with insurance cases, or a modern aggregator of insurance offers that comparatively analyzes conditions from various insurers and offers optimal solutions at lower operational costs than a classic broker.

From Turmoil to Transformation

In light of potential sanctions compliance risks, a UK forfeiture precedent, and operational restrictions, it's crucial for the broker to consider alternative paths. These include divestment under sanctions licenses, negotiated settlements, or a comprehensive compliance overhaul that aligns operations with updated sanctions frameworks.

The decision that Sberbank makes will heavily impact the broker, its employees, clients, and the overall insurance industry. The stakes are high, and the choice they make could determine the future of the broker or set a new precedent in the insurance sector. Whether they weather the storm or embrace a new dawn, it's clear that the unwinding of the status quo is on the horizon.

Yulia Poslavskaya

Insights from the Storm

- Sanctions Compliance Risks

- Liquidation could face scrutiny under UK sanctions, which prohibit transactions with entities owned by Sberbank, including subsidiaries.

- Direct or indirect dealings with Sberbank Insurance Broker's assets might violate prohibitions on transferable securities and financial instruments linked to sanctioned entities in certain jurisdictions.

- Asset Forfeiture Precedent

- The UK's recent application for a £1.1 million forfeiture order against Peter Aven's assets sets a precedent for stricter enforcement.

- If Sberbank Insurance Broker's liquidation involves frozen assets or suspicious transactions, similar forfeiture actions could arise.

- Operational Restrictions

- UK General License INT/2024/4919848 permits divestment of certain financial instruments but might not apply to Sberbank Insurance Broker's specific activities, complicating asset disposal.

- Regulatory guidance allows insurance brokers to make return payments to frozen accounts but liquidation could disrupt client obligations, triggering penalties.

- Alternatives to Liquidation

- Seek authorization under applicable General Licenses (e.g., INT/2024/4919848) to legally sell or transfer ownership, providing deductions for sanctioned claims are applied.

- Isolate non-sanctioned business lines or assets into a separate entity, ensuring compliance with ownership restrictions.

- Engage with regulators like OFSI to resolve potential sanctions breaches preemptively.

- Align operations with updated sanctions frameworks, such as avoiding transactions with entities tied to Russia’s shadow fleet or illicit gold trade.

- The potential closure of Sberbank Insurance Broker, given the current situation, could trigger significant risks for Sberbank, including the loss of valuable expertise, clients, and a potential weakening of the insurance sector's overall expertise.

- According to the Kommersant report, the departure of top managers and the hiring freeze at Sberbank Insurance Broker raises questions about its future, with possible closure being one of the options under consideration.

- Sberbank's decision to potentially close Sberbank Insurance Broker will not only impact the broker but also the broader finance and business industry, given the broker's significant market presence.

- Sberbank's insurance brokers, operating in a peculiar setup within the financial group, might face a conflict of interest due to the coexistence of an in-house insurer, which could lead to clients being directed to other insurers, affecting the broker's commission income.