Team Collaboration in Finance Boosts Process Efficiency: Monthly Performance Indicator

Hear the phrase "process improvement," and you might think about fancy tech like automation or AI. However, it's your organization's employees who often hold the keys to cracking the process improvement nut.

Take management accounting, for example. It's a prime example of why humans are crucial for significant process improvements. Let's dive into the cost of planning and management accounting and see how collaboration can drive down these costs.

Management accounting is all about getting a grip on key expense and revenue drivers so that each part of your business can make smarter decisions. That means collaboration - and management accounting as a whole - can't just be the domain of accountants holed up in their ivory towers.

These days, if you allocate costs and revenue in a way that doesn't make sense to stakeholders or even goes against the flow of the business, you're just setting yourself up for a headache. You'll find your time wasted on rework and disputes, when collaborating from the get-go is much simpler and quicker.

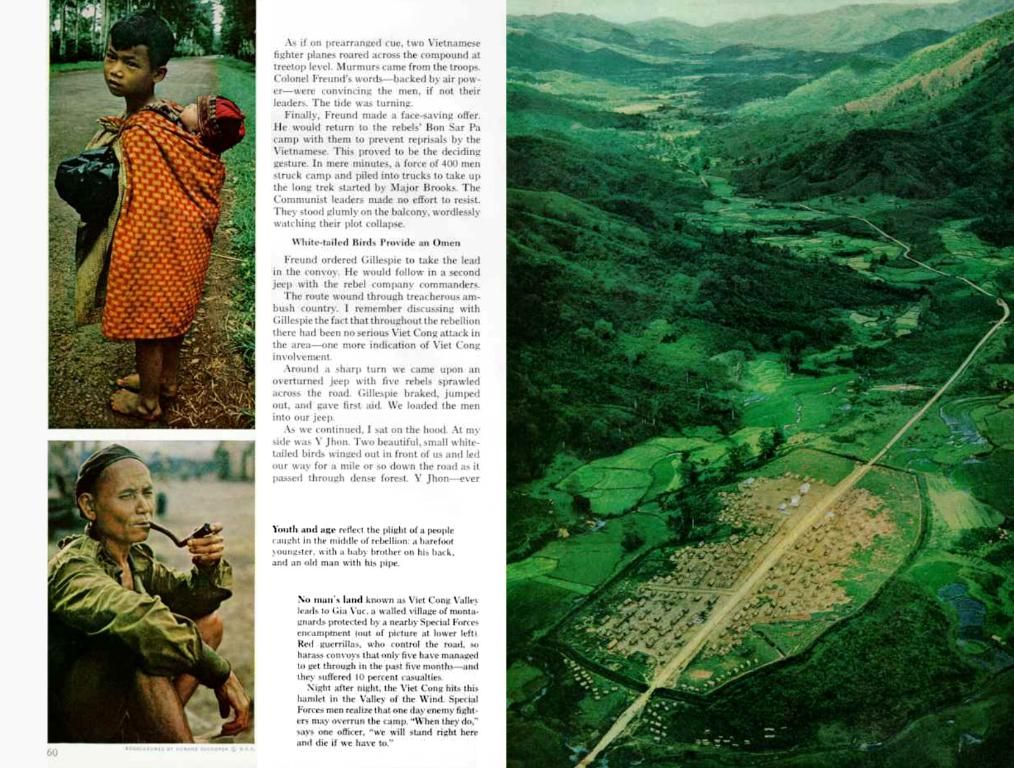

To foster greater collaboration across business silos, you might need to emphasize collaboration as a core part of your organization's culture. Start by making collaboration an explicit organizational value that's part of your mission statement. Be a role model for collaborative practices, lead by example, and show everyone that collaboration is important and valued. Align collaboration with your human capital management practices by making it an expectation for functional leaders, and include measures that track collaboration in their performance reviews. Set aside time and space for employees to collaborate, and work with your internal communications team to reinforce the value of collaboration in messaging.

In this piece, I've focused on cost allocation and management accounting to illustrate the value of collaboration for driving down costs. Keep in mind that collaboration is also crucial for other activities, like planning, budgeting, and forecasting, which are also important drivers of cost. Given the importance of collaboration for these financial management activities, it's wise to reinforce collaboration as a key organizational value to the extent you can. With people being such a big driver of costs, getting them to work together more effectively is key to driving costs down in a sustainable way.

Perry D. Wiggins, CPA, serves as APQC's secretary and treasurer.

Collaboration Insights:

- By collaborating, organizations can share resources, reducing redundant expenditures. For example, procurement and finance teams can work together to optimize purchasing processes, leading to cost savings through better negotiation and supply chain management[1][4].

- Collaboration enables the integration of financial data from various departments, providing a comprehensive view of costs and facilitating more informed decision-making[1]. This helps identify areas for cost reduction and optimize resource allocation.

- Collaborative approaches to cost allocation ensure transparency and fairness in distributing shared expenses among departments. This can be achieved through activity-based costing (ABC), which assigns costs based on actual resource usage, enhancing the accuracy of financial reporting[5].

- Fostering a culture of collaboration can reduce costs by enabling departments to share resources, expertise, and data. It also enhances decision-making by providing a comprehensive view of costs and aligning goals across departments.

- Organizations can foster a culture of collaboration by promoting interdepartmental communication, creating cross-functional teams, incentivizing collaboration, and leveraging technology and tools.

- Collaboration between procurement and finance teams can lead to cost savings via optimized purchasing processes, thanks to better negotiation and supply chain management.

- Integrating financial data from various departments through collaboration provides a comprehensive view of costs, facilitating more informed decision-making and identifying areas for cost reduction.

- Adopting activity-based costing (ABC) as a collaborative approach to cost allocation ensures transparency and fairness in distributing shared expenses among departments, enhancing the accuracy of financial reporting.

- Fostering a culture of collaboration can significantly reduce costs by enabling departments to share resources, expertise, and data, thereby promoting efficiency and effective decision-making.