Stocks Surge on Favorable Global Indicators and Strong United States Employment Data

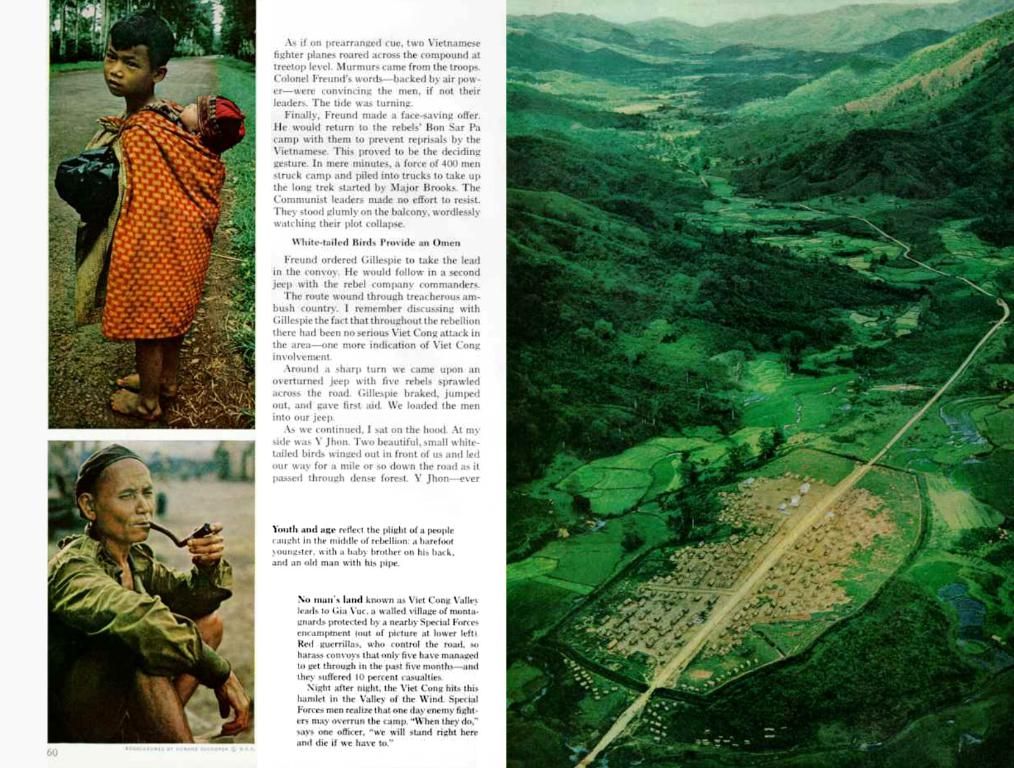

Vibrant Mumbai Market Dance:

So here's the scoop, folks! On a Wednesday, our trusty domestic stock indices saw a cheerful uptick, all thanks to some tantalizing global cues like sparkling US job data and the ongoing RBI Monetary Policy Committee (MPC) hoopla, sparking speculation about a drool-worthy rate cut.

By the closing bell, the Sensex was up 260.74 points or 0.32%, fast-forwarding to 80,998.25, while the Nifty scampered 77.70 points or 0.32% higher to 24,620.20. The vivacious midcap and smallcap market players set the pace, outperforming their larger counterparts.

The Nifty Midcap 100 index seduced 407.55 points or 0.71% to 57,924.65, and the Nifty Smallcap 100 index flirted with a charismatic 142.95 points or 0.79% rise to 18,257.10.

The auto, IT, PSU bank, financial services, pharma, FMCG, metal, media, energy, and private indices all twirled to a delightful close in the green. Only the realty index sighed, drifting in the red.

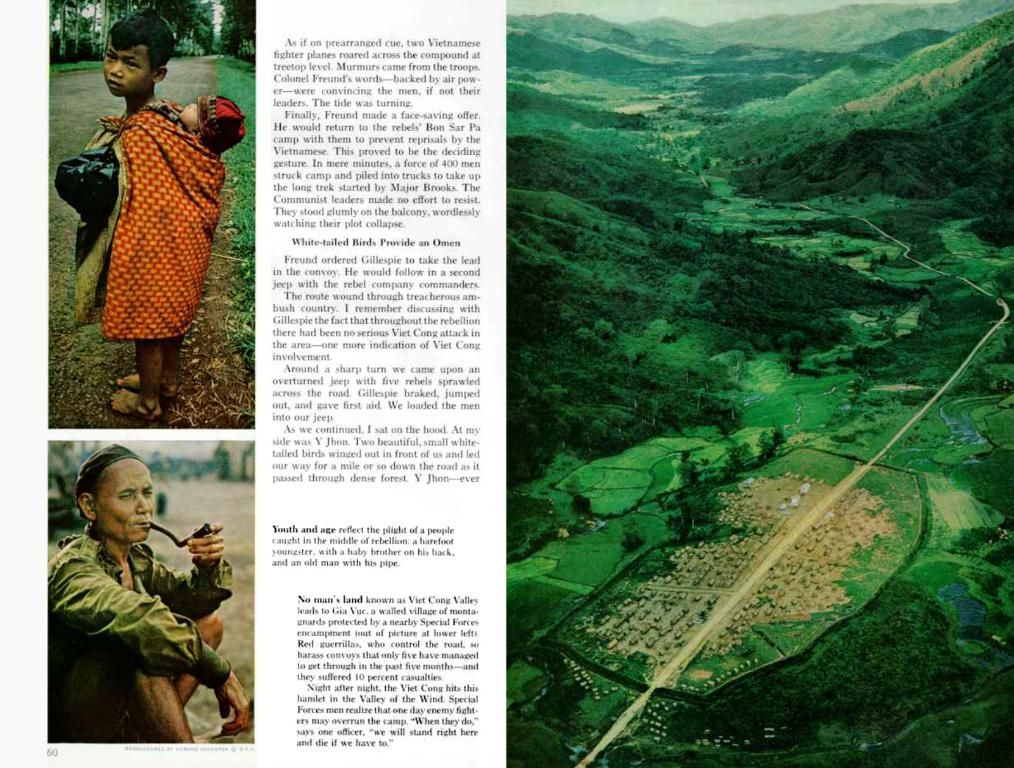

Ah, Rupak De from LKP Securities had this to say about the whole ordeal, "The Nifty remains romantically attached to a lukewarm sentiment as traders are controlled by the anticipation of the RBI's rate decision. The market is more likely to bounce around aimlessly for another session before the RBI reveals its secrets on Friday." He added, "The immediate support for Nifty is planted at 24,500; any break below could cause further tears."

Lest we forget, on the animated side, resistance is spotted at 24,750/24,900, according to De.

Vikram Kasat, Head-Advisory at PL Capital, chimed in, "The markets started off with enthusiasm as our delightful benchmark indices leaned upwards, propelled by global influences and enthusiastic excitement about the RBI's policy maneuvers." He also stated that "The ongoing RBI Monetary Policy Committee meeting added a dash of speculation, especially since market participants were divided about the magnitude of a potential rate cut. Meanwhile, positive vibes from the US labor sector injected enthusiasm into the global stock market.”

With the Nifty keeping its head above the 24,500 level, optimism surrounding the near-term sentiment lingers. However, clarity from the RBI and building global macro events will steer the next stage of the market's girly-tail twist.

And now for some juicy gossip! The rupee slipped by 25 paise to 85.87, inching seductively toward the 86.00 mark, as foreign investors continued to conjure up storms ahead of the RBI's policy declaration. Analysts suspect the rupee will gyrate between 85.50 and 86.40 in the coming days.

"Disclaimer: This sassy tale comes to you from the dance floor of syndicated feeds. We've only shaken things up a bit, enhancing the headline."

Confidential Files:

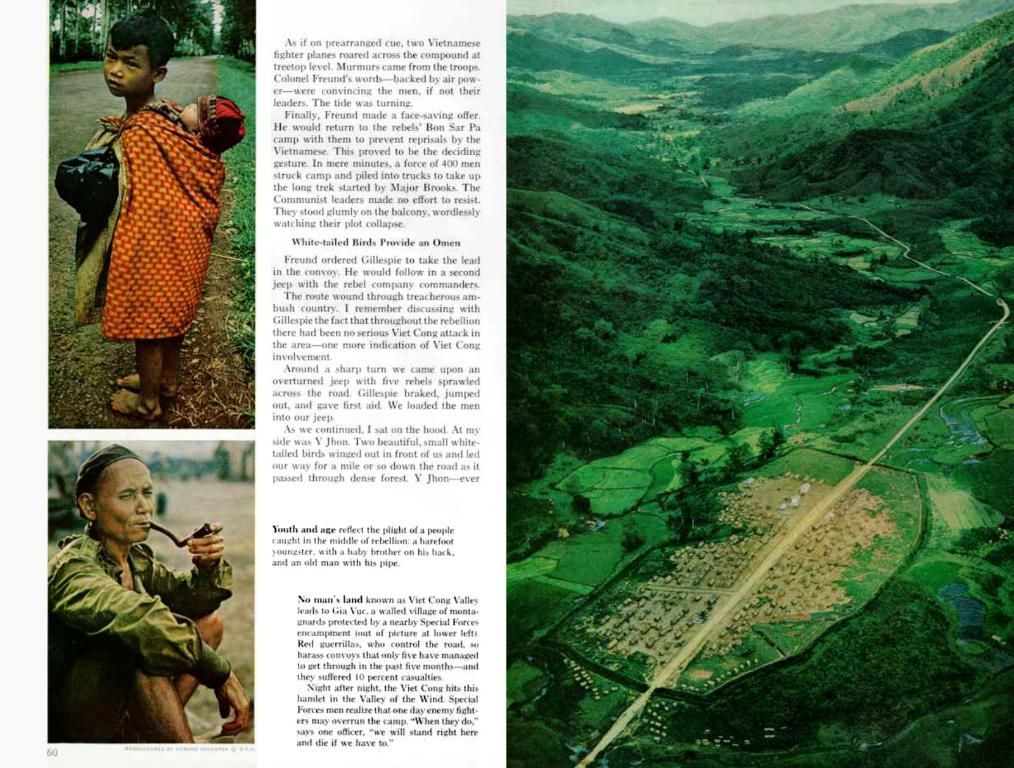

The RBI Monetary Policy decision on June 6, 2025, delivered a cool transformation. Here's a lowdown on the key decisions and their possible impacts on the Indian stock market:

Critical Actions:

- Repo Rate Chop: The RBI screwed a reduction of 50 basis points to the sexy benchmark repo rate, making it 5.5%. Analysts had whispered hush-hush that only a 25 basis points cut was due.[1][3][4]

- Cash Reserve Ratio (CRR) Reduction: The CRR was downsized by 100 basis points to 3%, which will unfold in four tasty chunks, starting on September 6, 2025. This tasty reduction promises to infuse approximately ₹2.5 trillion into the financial system.[1][3][4]

Indian Stock Market Aftermath:

- Initial Response: The stock market celebrated these decisions by dancing a jig. The Nifty Bank index burst forth in joy after the announcement, showcasing investor exhilaration over the surge in liquidity and economic growth possibilities.[1]

- Growth and Inflation Outlook: The RBI's actions are designed to boost growth while balancing inflation, which has been beneath its coveted 4% target. The policy hints a growth-oriented approach, which could strengthen the stock market by incentivizing borrowing and investment.[2][3]

- Future Expectations: The forward-looking essence of these cuts suggests that the RBI is prepping itself for future economic scenarios, possibly implying further relaxation if inflation remains on target. This could firmly secure the market's bullish attitude, particularly if growth predictions are met.[4]

Overall, the RBI's decisions are predicted to support economic growth and maintain financial markets' stability, potentially leading to a promising outlook for the Indian stock market.

- The reduction of 50 basis points in the repo rate by the Reserve Bank of India (RBI) to 5.5% in June 2025 is expected to stimulate the Indian stock market, injecting liquidity and fostering economic growth.

- Analysts suggest that the RBI's Monetary Policy decision, which included a 100 basis points reduction in the Cash Reserve Ratio (CRR), could boost investments and make borrowing more accessible, potentially bolstering the Indian stock market's optimism.

- As the RBI's actions aim to bolster growth while containing inflation, a growth-oriented approach could positively impact the Indian stock market by incentivizing investments, lending, and long-term business strategies.