The Ant's Peculiar Dance: The New York Stock Exchange's whirlwind Debut and the Soaring CRCL

Stock Price Surges for Circle: Initial Public Offering Price Doubled for CRCL Due to Bitcoin Recovery

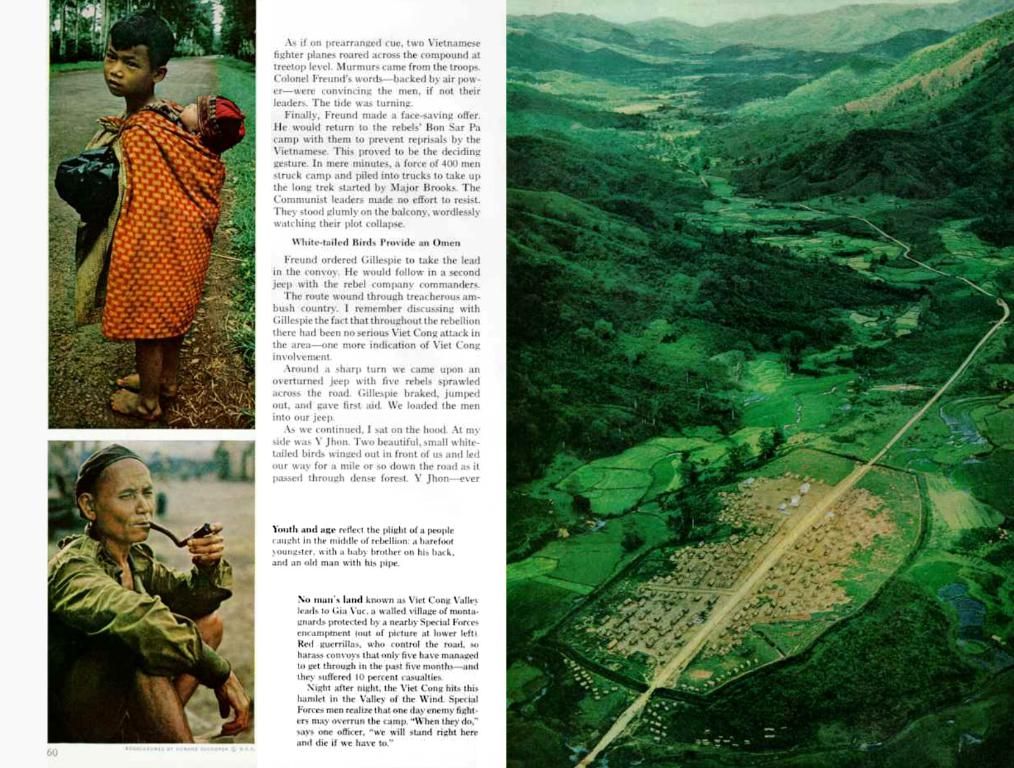

Witnessing a tumultuous debut on the New York Stock Exchange yesterday, Circle's digital currency firm, known as CRCL, has remarkably surpassed its peak from Thursday. By 1pm ET on Friday, CRCL hit a peak of $123.51, a mere 49 cents from quadrupling its Initial Public Offering (IPO) price. The stock currently stands at a staggering $119.97, presenting a surge of 44% from its $83.23 close on Thursday.

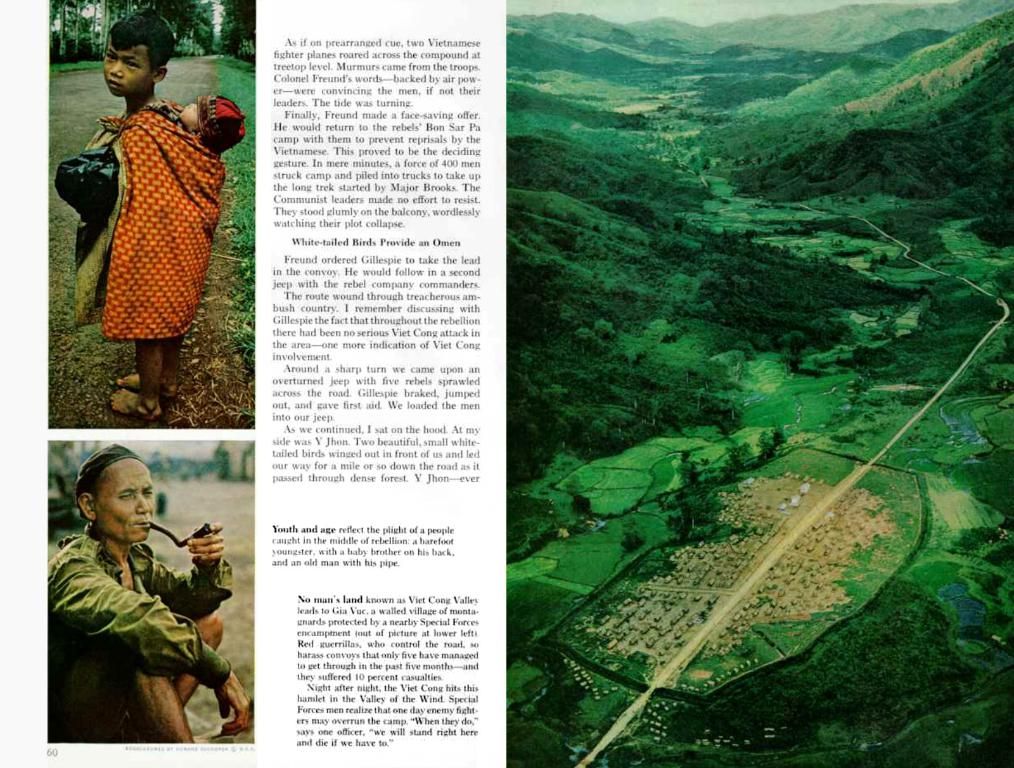

Following its impressive first day, where it tripled its $31 IPO price, Circle has managed to amass an intraday market capitalization of $21.7 billion. This monumental growth was not limited to the stock market, as Bitcoin also experienced a resurgence, jumping back above the $105,000 mark in morning trading after a brief dip below $101,000 on Thursday afternoon. Bitcoin is currently trading at $104,675, recording a 1% increase over the past day.

Dom Kwok, co-founder of the Web3 development tutoring app EasyA, warned retail investors to exercise caution when investing in CRCL shares post its initial performance. He advised waiting 90-180 days following an IPO to invest, not just to allow for price discovery, but to bypass the lockup period, during which early investors and insiders are prohibited from selling their shares. Expiration of this period often leads to a sudden surge in selling pressure.

Kwok also stressed that since nearly all of Circle's revenue is derived from interest earned on the cash backing its stablecoins, a decline in interest rates could lead to a significant drop in the company's revenues.

Juan Leon from Bitwise called Circle's grand entrance a "moon landing" moment for stablecoins on Wall Street. On the other hand, Macquarie analyst Paul Golding remained optimistic about stablecoins, not necessarily because of Circle's IPO, but due to the potential impact of the GENIUS Act.

The GENIUS Act is a bill designed to regulate stablecoins, a type of cryptocurrency pegged to the value of another asset, often the U.S. dollar. The bill, which may establish the first U.S. stablecoin law, is currently set for a Senate vote. If passed, it could instigate the growth of the stablecoin market, potentially boosting it from a $200 billion market to a $2 trillion market within three years. The bill would also require regulatory bodies to establish specific capital, liquidity, and risk management rules for stablecoin issuers.

Although there is no direct correlation between the GENIUS Act and Visa's technology or transactions, the bill's potential to create a clearer regulatory environment for stablecoins could influence the broader digital payments landscape. This, in turn, might stimulate traditional financial companies to delve into blockchain and stablecoin technologies, potentially giving rise to partnerships or competition with Visa in the digital payments sector. As of now, Visa has processed $3.8 trillion in stablecoin transactions in the past month alone, and nearly $249 trillion since it started tracking in 2019.

Revised by Andrew Hayward*

- The crypto market has seen a surge with Bitcoin's resurgence, trading at $104,675, and Circle's impressive debut, where CRCL shares tripled their IPO price.

- Domin Kwok, co-founder of EasyA, advises retail investors to wait 90-180 days post an IPO before investing in CRCL shares, to allow for price discovery and bypass the lockup period.

- Juan Leon from Bitwise sees Circle's IPO as a "moon landing" moment for stablecoins on Wall Street, while Macquarie analyst Paul Golding remains optimistic about the stablecoin market due to the potential impact of the GENIUS Act.

- The GENIUS Act, designed to regulate stablecoins, could instigate the growth of the stablecoin market from a $200 billion market to a $2 trillion market within three years, if passed.

- The bill's potential to create a clearer regulatory environment for stablecoins could influence the broader digital payments landscape, potentially stimulating traditional financial companies to adopt blockchain and stablecoin technologies, possibly leading to partnerships or competition with Visa in the digital payments sector.