Small Business Sales Projections Return to Pre-Pandemic Levels

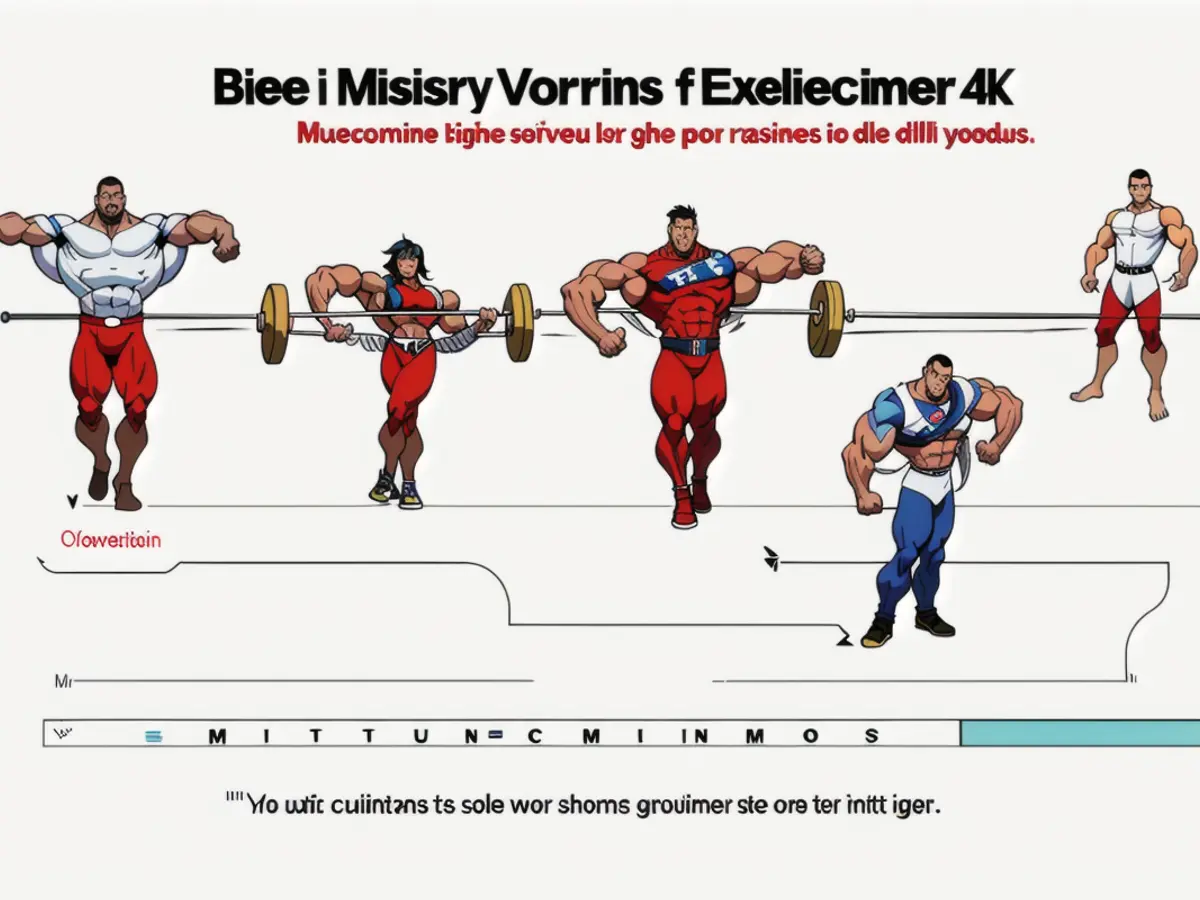

August 2024 saw a pessimistic outlook on real sales growth, with a whopping -18% expecting a boost in the coming months. More businesses anticipated decreases than increases, marking a 34-month streak where the number of businesses expecting lower sales surpassed those expecting growth. However, in November, optimism surged 18 points, reaching 14%, and further escalated to 22% in December, showcasing a remarkable turnaround (Chart 1). Since 1982, the average net percentage expecting higher real sales was 22%. The decline began at year-end 2007 and turned negative in 2008. During Trump's first term, real sales expectations were optimistic but returned to negative balances due to Covid and sky-high inflation.

Manufacturing businesses, which had been underperforming for years, were the most optimistic, with a net 34% anticipating improved real sales. Firms in the finance and real estate sectors shared this positive outlook. By contrast, the two service sectors showed a positive attitude towards sales growth, albeit less enthusiastic.

Negative sentiments persisted in certain sectors, specifically construction, transportation and communication, and agriculture. Remarkably, the construction sector was evenly divided, with an equal number of owners expecting sales improvements as those anticipating declines.

In summary, the picture presents a blend of positive and negative sentiments. Certain segments appear to profit from the election results, while others fail to see any improvement in prospects. The Manufacturing PMI plummeted, suggesting that businesses in this sector expect a bright future. Finance firms are pinning their hopes on the Fed stabilizing financial markets. With the new government in place, businesses will soon receive clearer signals about future economic policy and potential impacts on their ventures.

As for the broader context:

- Overall Optimism: Small business owners' optimism has increased, as indicated by the NFIB Small Business Optimism Index, which reached 105.1 in December 2024—the highest since October 2018[1][2][4].

- Real Sales Volumes: The percentage of owners expecting higher real sales volumes rose to 22% in December 2024, the highest reading since January 2020[2][4].

- Economic Outlook: Small businesses have a more positive view of the economy, as the net percent expecting improvement rose to 52%, the highest since Q4 1983[1][2][4].

However, it is essential to note that the enrichment data does not provide detailed industry-specific sales growth expectations before and after the November 2024 election. Instead, it suggests a general increase in optimism and positive economic outlook among small business owners following the election.

After the surge in optimism in November and December, small businesses with operations in manufacturing and finance sectors have high sales expectations, with a net 34% and 14% anticipating improvements respectively. Conversely, sectors like construction, transportation and communication, and agriculture continue to display negative sales expectations, with construction being evenly divided. Despite this mix of sentiments, the overall optimism among small business owners has increased, as indicated by the NFIB Small Business Optimism Index, reaching 105.1 in December 2024.