Retail Industry-Linked Shares Continually Reach New Peak Levels (However, Not the ETF)

The exchange-traded fund that mirrors the fluctuation of various retail stocks experienced a new peak in November but fell short of reaching that level in December. However, certain separate retail stocks managed to surpass this peak and reach even higher heights.

There's no debate on the significance of diversity in stock investment, but the investor capable of distinguishing between the promising ones could potentially reap greater benefits. Let's delve into the retail ETF chart and the charts of four individual stocks that have recently outperformed it.

4 Retail Stocks Outperforming the Retail ETF

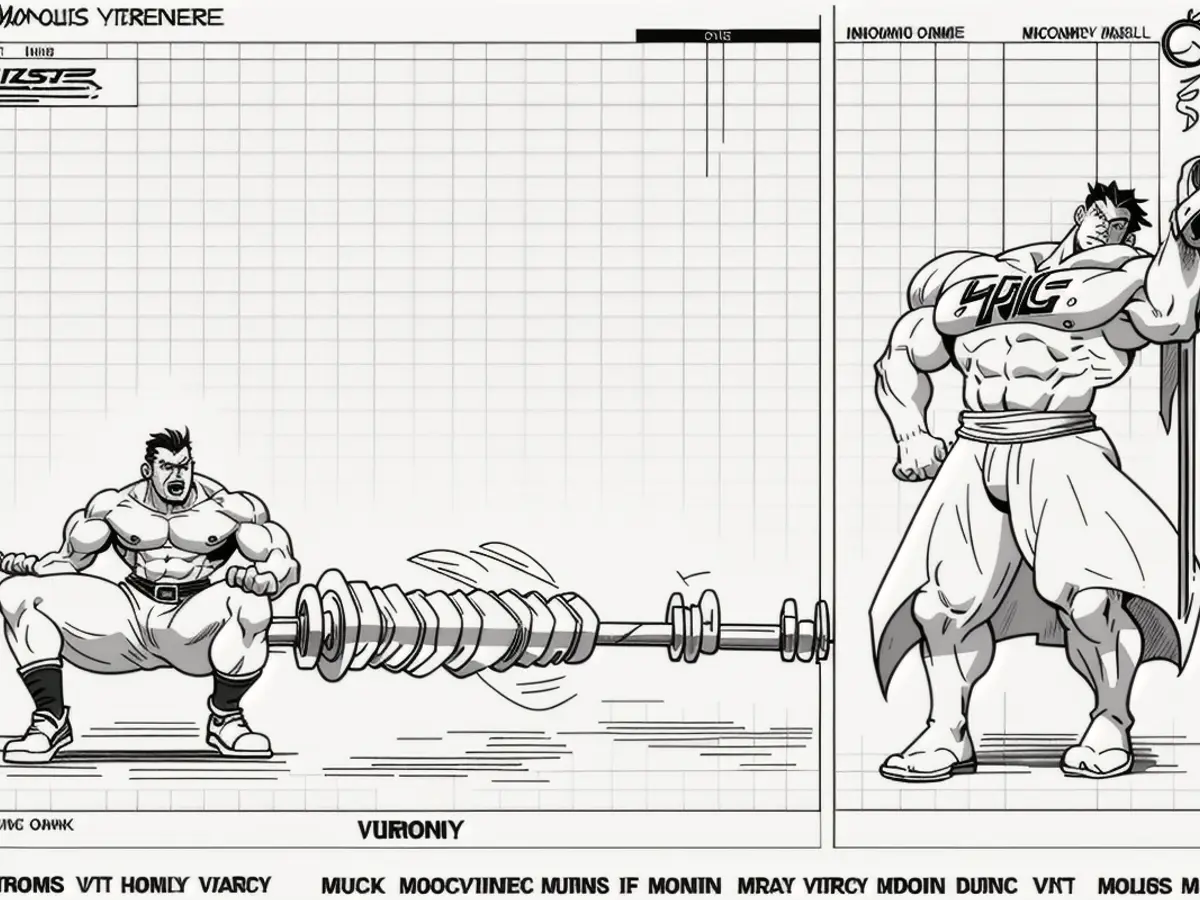

SPDR S&P Retail ETF (NYSE: XRT)

Beginning with the underperforming ETF, it witnessed a surge in November, failed to reach the new peak in December, and eventually dipped down to the 50-day moving average, before bouncing back. The holiday sales figures will be intriguing, as it appears expectations for the entire sector might be easing slightly.

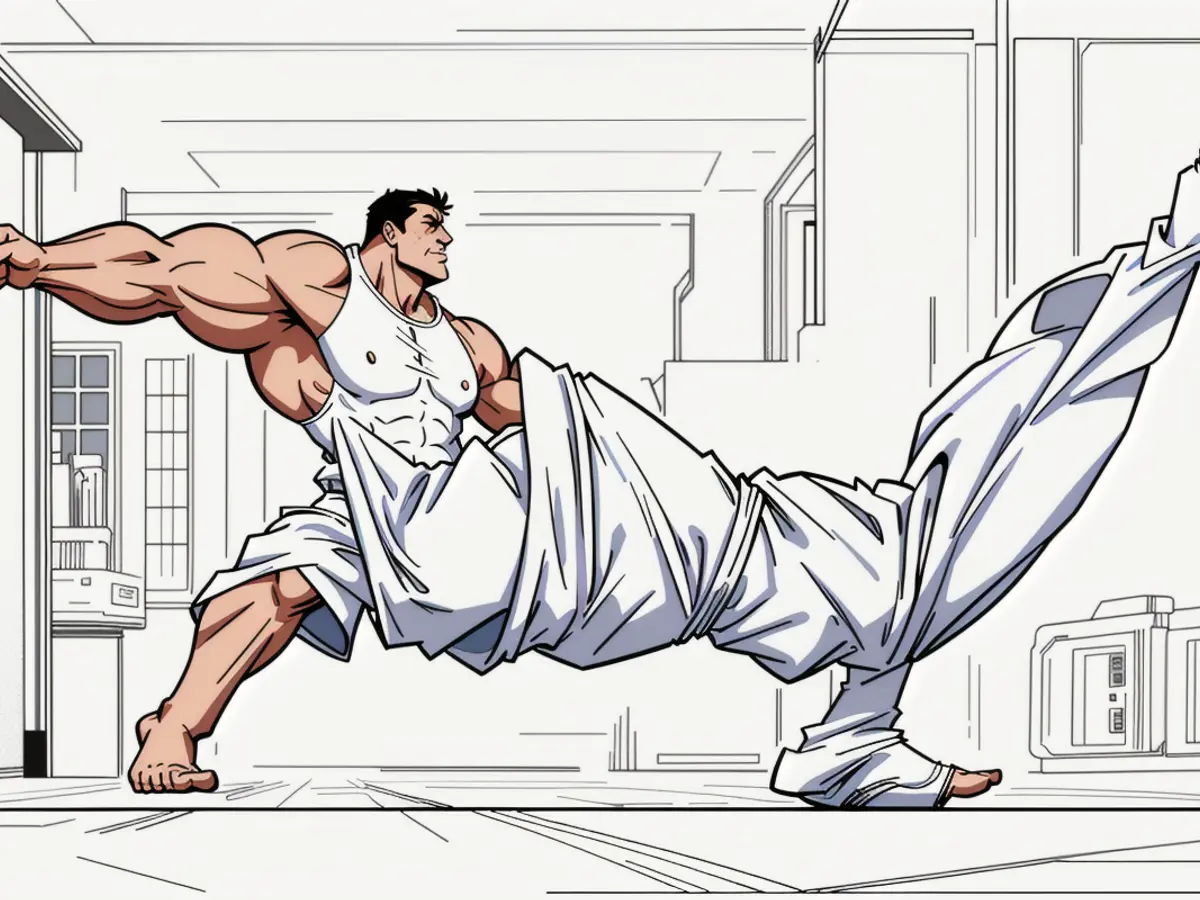

Build-A-Bear Workshop (NYSE: BBW)

This expression of "outperforming" took the stock to a new high without any issue this month, personalizing the shopping experience for customers. It has managed to avoid any significant dip toward the 50-day moving average, contrasting sharply with the SPDR Retail ETF's pattern.

The specialty retail company is moderately traded, with an average daily volume of 266,000 shares. Build-A-Bear Workshop has a market capitalization of $610 million, making it a Russell 2000 component. A substantial 10.03% of its shares are on short-term loans, which some may view as a concern.

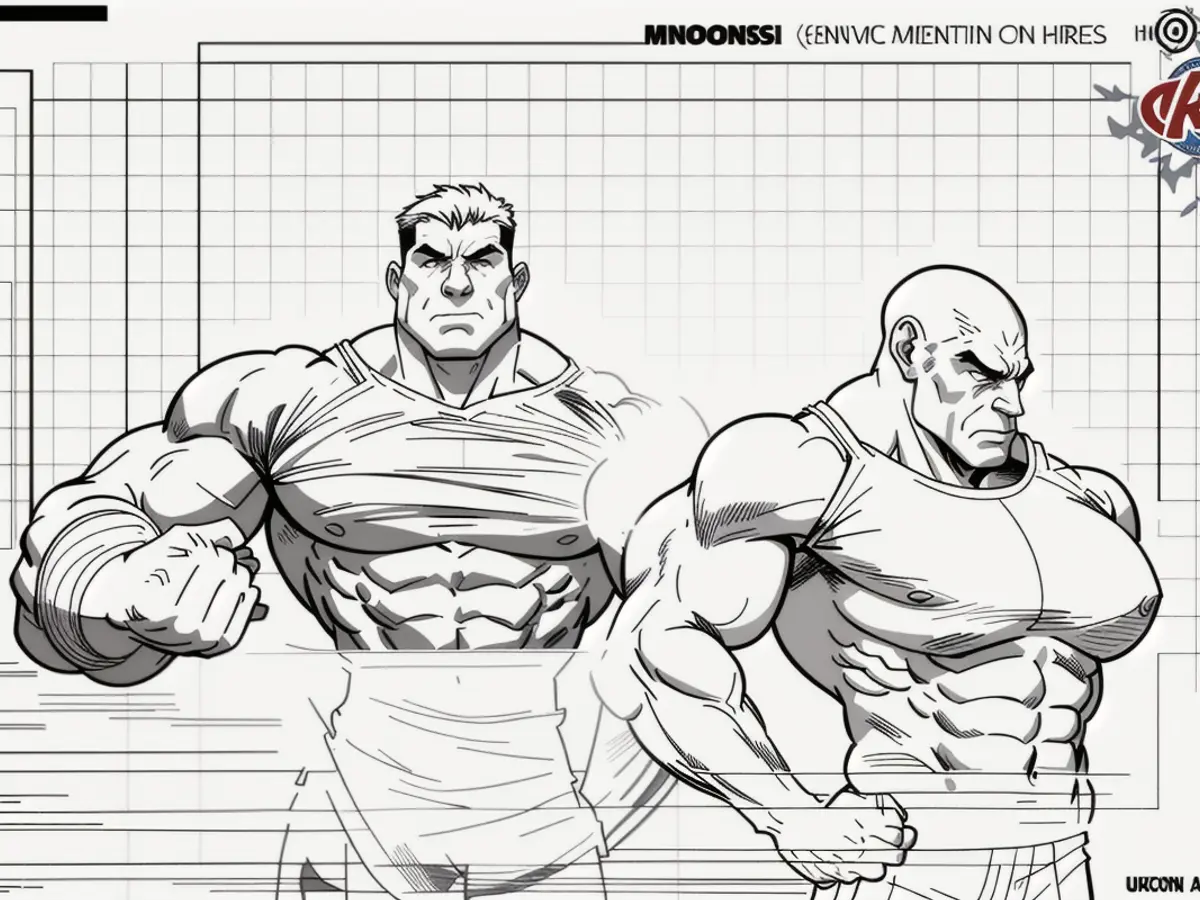

Dillards (NYSE: DDS)

The 50-day moving average crossed over the 200-day moving average towards mid-December, a commonly seen bullish signal. A breakout above the July high occurred this month, attracting a significant number of buyers at that price point.

The department store chain has a market cap of $7.26 billion and boasts a relatively low trading volume, averaging 144,000 shares daily. With a short float of 14%, it's plausible that a considerable portion of this move was driven by short sellers scrambling to cover their positions.

Tapestry (NYSE: TPR)

The late December high was higher than the late November high, as indicated on this chart by the red dotted line. The 50-day moving average crossed over the 200-day moving average in early October, a clear indicator of future bullishness. The stock's price has almost doubled from its August low to its most recent high.

Tapestry is a luxury goods company, whose brands include Coach, Kate Spade New York, and Stuart Weitzman. The company has a market cap of $15.28 billion and pays a dividend of 2.14%.

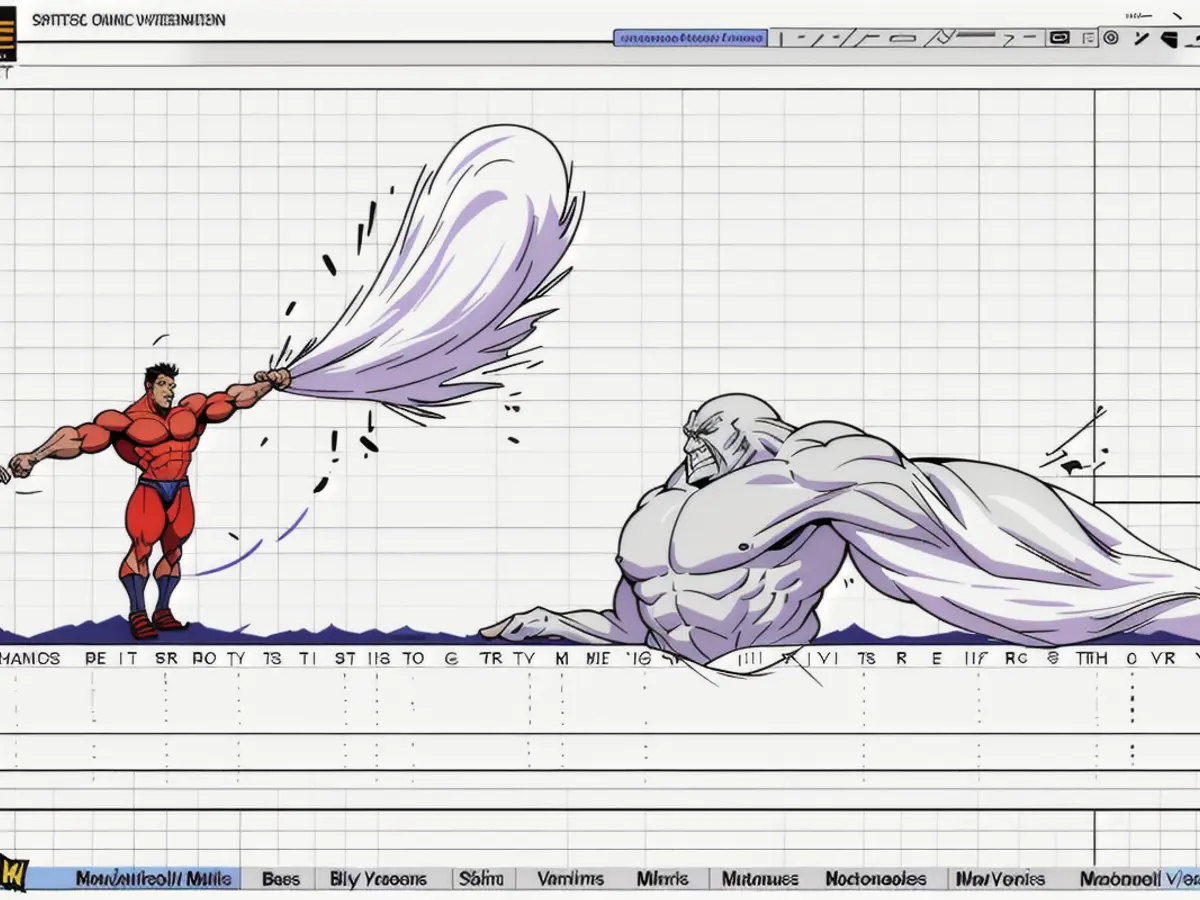

Urban Outfitters (NYSE: URBN)

The late November price leap surged above the previous resistance level from July, costing $49. Unlike the retail ETF, this stock continued to create new highs in December, with the 50-day moving average crossing above the 200-day moving average in the middle of the month.

The short float is 10.43%, making this another retail stock that may have benefited from short sellers being forced to cover their positions.

Urban Outfitters is a retail apparel business with a market cap of $5.16 billion, and it is included in the Russell 2000 index. Brands affiliated with the company include Anthropologie, Menus and Venues, and Urban Outfitters.

Statistics from FinViz.com. Charts courtesy of Stockcharts.com.

Additional analysis and commentary available at johnnavin.substack.com.

- Despite the SPDR S&P Retail ETF (NYSE: XRT) falling short of its November peak in December, companies like Build-A-Bear Workshop (NYSE: BBW) managed to surpass it, showcasing the importance of diversified investment in retail stocks.

- The Russell 2000 component, Build-A-Bear Workshop (NYSE: BBW), has outperformed the retail ETF with its unique focus on personalizing shopping experiences, resulting in a new high this month without any significant dips.

- The retail ETF's counterpart, Dillards (NYSE: DDS), has also demonstrated impressive performance, with its stock price breaking out above the July high, driven in part by short sellers scrambling to cover their positions.

- Tapestry (NYSE: TPR), the luxury goods company with brands like Kate Spade New York, experienced a significant increase in its stock price, nearly doubling from its August low to its latest high, outperforming the retail ETF and the S&P 500.

- Urban Outfitters (NYSE: URBN), another retail stock included in the Russell 2000, followed a similar trend, with its price surging above its previous resistance level in November and continuing to create new highs in December, even outperforming major retail etfs.