Residents of Kuban region have acquired a mortgage loan totaling 7,98 billion Russian rubles.

Here's a fresh take on the provided article, adhering to the specified guidelines:

Mortgage Loans Slump in Russia, SMEs Suffer

Looking at the numbers for April 2025, banks in Russia issued around 52,540 mortgage loans, totaling approximately 231.25 billion rubles. Compared to the same period last year, that's a whopping 60% decrease in loan volume.

Over the whole of 2025, the picture remains grim. By May, the number of housing loans reached 253,740, totaling 1.12 trillion rubles. Compared to the same period in 2024, the number of issued loans dropped by 50%, while the volume decreased by a considerable 48%.

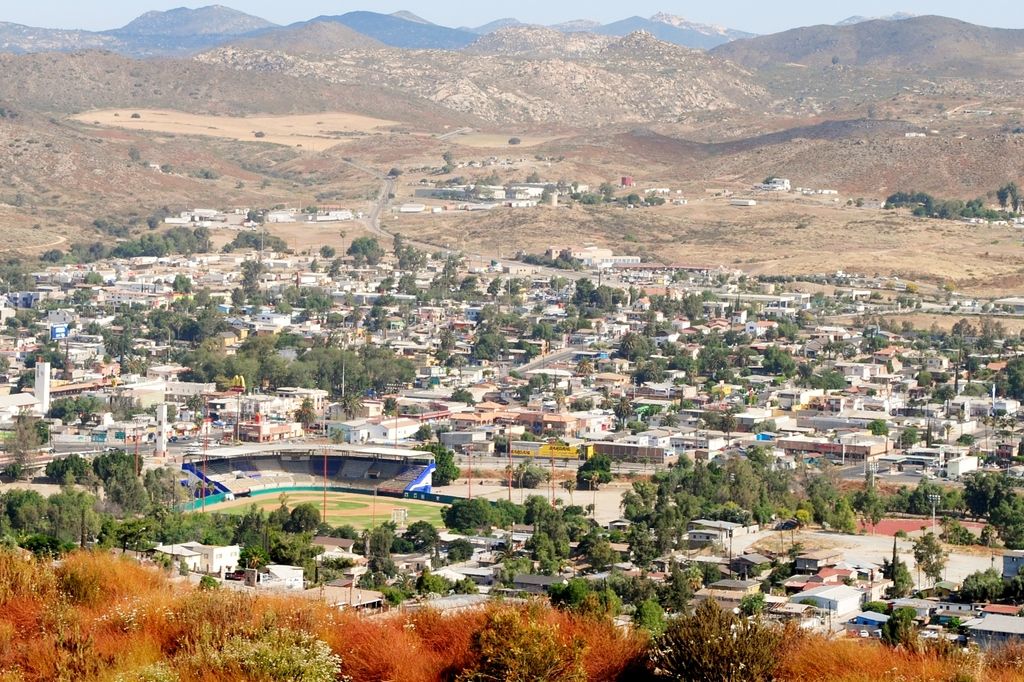

As for the geographical distribution, Moscow took the top spot with 4,480 loans worth 31.66 billion rubles. The Moscow region followed closely with 3,310 loans amounting to 19.95 billion. St. Petersburg, Tatarstan, and Krasnodar Krai completed the top five with significant volumes of mortgage credits. However, compared to the same period in 2024, the number and volume of loans issued in these regions have decreased by around 26% and 27%, respectively.

Shedding some light on the SME segment, it's been experiencing a growth spurt. The obligations of these businesses saw a surge of over 36% compared to the previous year. There has been a sustained demand for working capital financing among agricultural, industrial, and construction organizations.

Additional insights reveal a few things about the current state of the mortgage market in Russia:

- Mortgage loan issuance in the early months of 2025 experienced a significant drop of approximately 45% compared to the same period in 2024.

- Despite a continuous decrease in the average weighted interest rate on mortgage loans since 2019, the mortgage market is experiencing a slump due to the end of subsidized mortgage programs. These programs used to offer loans at around 8% annual interest.

- The cancellation of subsidized mortgage programs led to a decline in home sales, particularly in regions like Moscow and its surrounding area. Prices, however, remained high as property owners and developers chose to hold onto their real estate.

- Different regional market dynamics are apparent. Regions with a tighter connection between developers and authorities and local housing programs often show conflicting trends compared to more free-market regions like Moscow.

- Overall, the credit market is severely constricted, with declining sizes and volumes of loans across sectors. The result is a tough borrowing environment for both individuals and businesses.

- Given the tightened credit conditions, the SME segment – which heavily relies on working capital financing – is facing significant challenges, exacerbating the slowdown in economic growth.

In short, the Russian mortgage market is experiencing a decline in loan issuance, along with more stringent credit conditions. Regional disparities persist, with Moscow emerging as a free-market leader. SMEs and working capital financing are particularly hard-hit, contributing to a broader economic slowdown.

In the context of the SME sector, there's been a marked growth, with their obligations seeing a surge of over 36% compared to the previous year. However, in the realm of finance and business, this growth is overshadowed by the mortgage market slump in Russia, as the issuance of mortgage loans has witnessed a significant drop of around 45% compared to the same period in 2024.