Potential Market Collapse Warning! Imperative Emergency Preparations

Preparing for market crashes is like getting a safety briefing on a cruise ship before setting sail. Just as passengers must know where to find life jackets and how to react in an emergency, investors need to prepare for the inevitable downturns. Over the past couple of years, markets have been on a rollercoaster ride, leaving many feeling optimistic and ready to take on more risk. But what goes up must come down, and soon enough, the tide will turn.

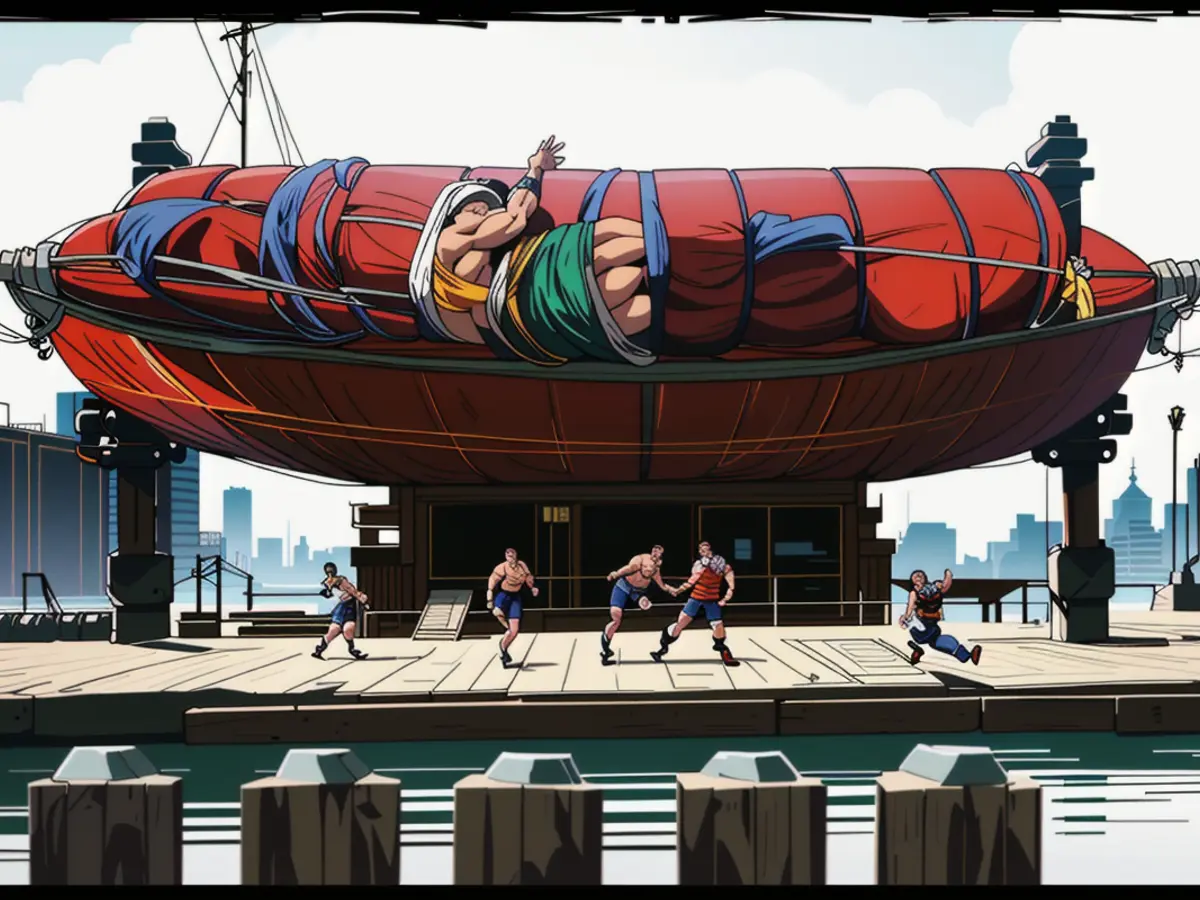

So, how can investors prepare for the next market crash? The answer is a lifeboat drill. This exercise involves thinking through your responses to a hypothetical downturn before emotions take over. Imagine that the market drops 25% next year, and you've lost a quarter of your portfolio's value. How would you feel? And more importantly, how would you act? Would you panic and make impulsive decisions, or would you remain calm and stick to your plan?

Planning ahead is crucial in navigating the ups and downs of the market. Financial advisors can help you develop a plan that accounts for market volatility, ensuring your portfolio is built to weather storms. Your allocation between stocks, bonds, and other investments should align with your goals and risk tolerance. Regular portfolio reviews will ensure that investments remain aligned, and disciplined investing will help you stay patient and avoid panic selling.

Diversification is also key to preparing for market crashes. Spreading investments across different asset classes, such as stocks, bonds, real estate, and alternative investments, can reduce overall risk. Defensive investments, like blue-chip stocks, bonds, dividend-paying stocks, and gold, can offer capital preservation and stability during volatile times. Strategic portfolio management, including dollar-cost averaging and stop-loss orders, can help minimize the impact of market volatility and manage risk effectively.

Finally, it's important to maintain an emergency cash reserve and have a long-term focus. Having cash on hand will allow you to take advantage of buying opportunities as they arise without needing to sell other assets or take on additional debt. Focusing on long-term goals will help you stay patient and avoid impulsive decisions that might undermine your investment strategy.

In conclusion, market crashes are inevitable, but with proper preparation and a well-thought-out plan, investors can navigate them with confidence. By running a lifeboat drill and implementing strategies like diversification, defensive investments, and strategic portfolio management, investors can prepare themselves for the inevitable ups and downs of the market and stay focused on their long-term financial goals.

In the context of 2025, investors might want to revisit their preparedness for market crashes, utilizing the efcd8336123246a45d2d5c1d306555af lifeboat drill to ensure their responses to potential downturns are well-planned and emotion-free. Agreeing on a clear investment strategy with a financial advisor, including diversification and regular portfolio reviews, can significantly help manage risk and maintain focus on long-term goals. While diversifying investments across asset classes is important, it's also crucial to have an emergency cash reserve to take advantage of buying opportunities without compromise.