Over 8 billion Kazakhstani tenge withdrawn in Almaty city.

Crime Syndicate Uses Shell Companies for Tax Evasion and Money Laundering

In Kazakhstan's Almaty, a cunning gang of crooks has received a hefty sentence for evading taxes worth a staggering 8 billion tenge. This alarming tale unfolds through Total.kz’s reporting.

As revealed by Eurasian Group on Combating Money Laundering and Financing of Terrorism (EAG), funds siphoned through these fraudulent practices have served dark purposes like tax evasion, bribes, and laundering of ill-gotten gains, be it from economic crimes or illicit activities.

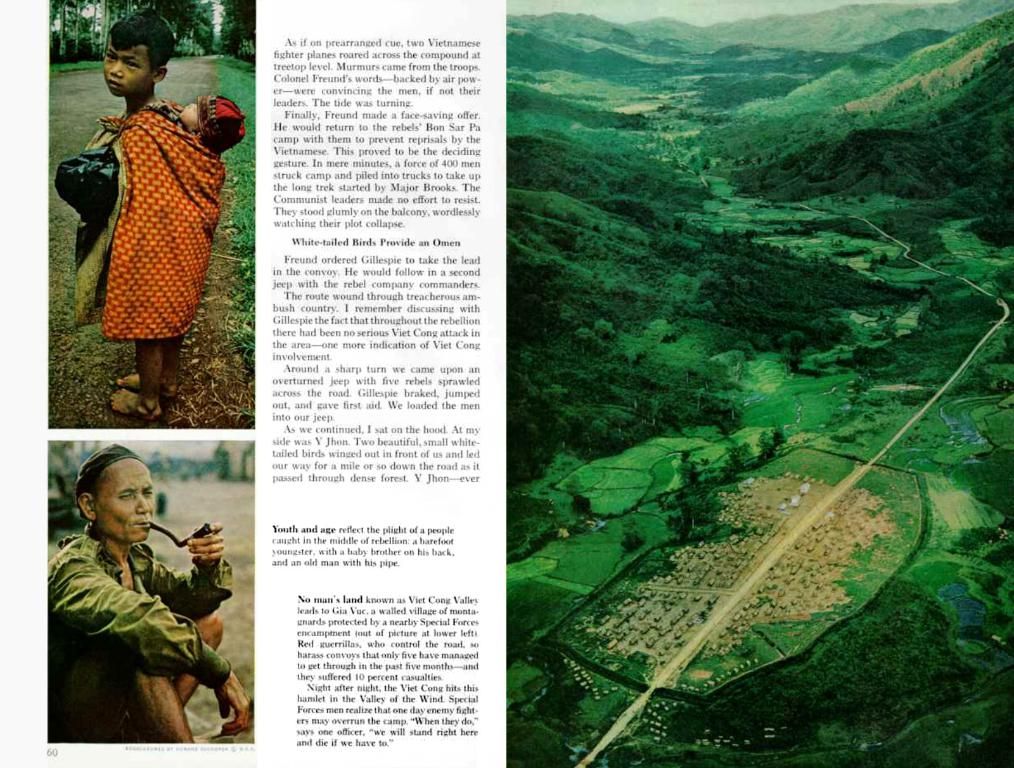

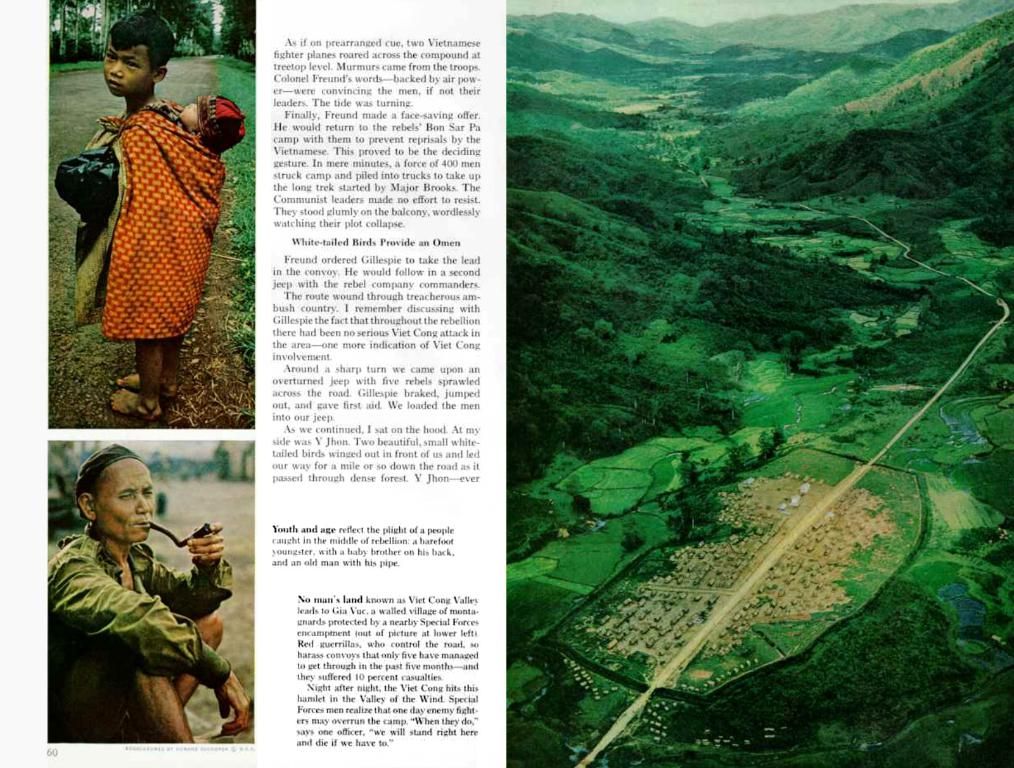

The masterminds behind the shell companies are often none other than the students, retirees, or jobless individuals appointed as directors. Lured by the promise of a substantial profit, these unwitting participants seldom comprehend the shady dealings of their own firms.

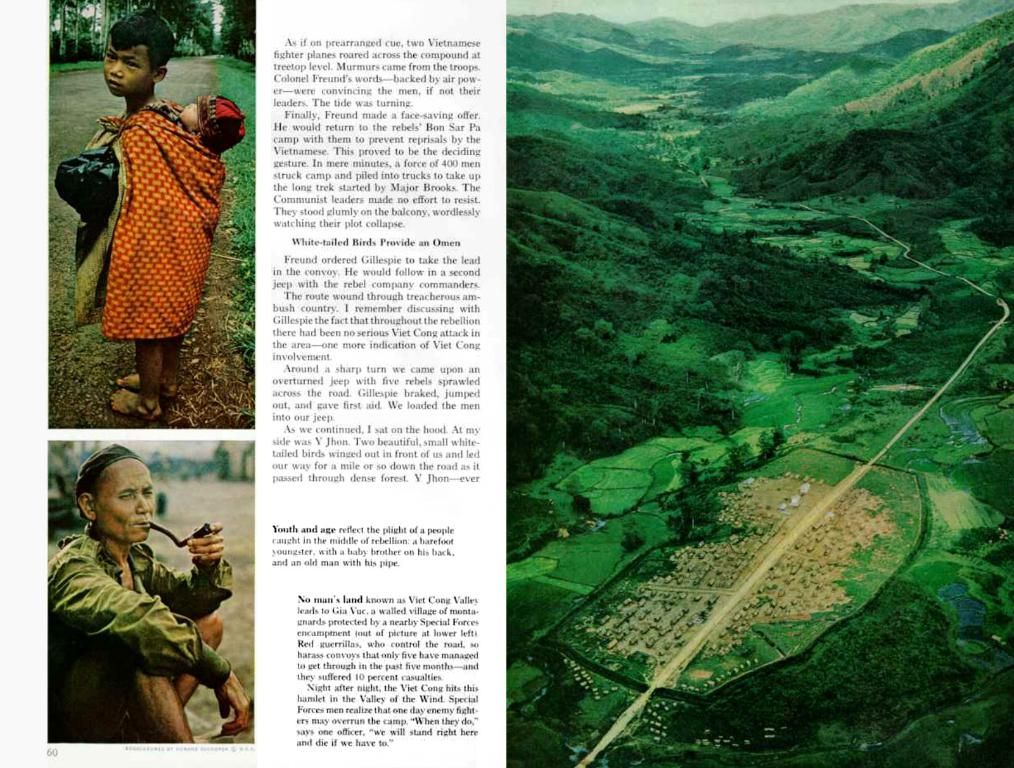

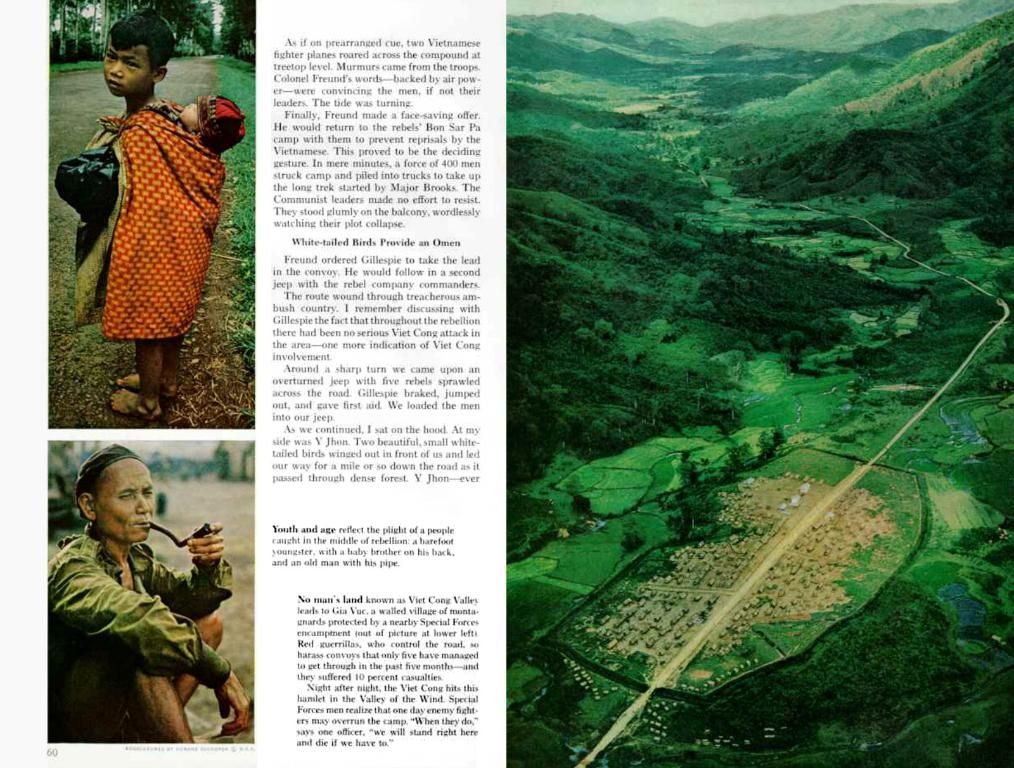

Almaty’s Anti-Money Laundering Department successfully dismantled the operations of a criminal ring consisting of seven individuals. These con artists churned out forged invoices and primary accounting documents for a hefty bribe.

Over three troubling years, this crime syndicate, managing 19 companies, contrived elaborate schemes to dodge a staggering 8 billion tenge in taxes.

The ringleaders were slammed with a 6.5-year sentence, while their accomplices received punishments ranging from 3 to 4 years and 8 months suspended. The state has seized assets valued over 200 million tenge belonging to the convicts.

The intricate process of laundering money using shell companies typically involves:

- The creation of shell companies in offshore jurisdictions. These legal entities, not engaged in significant business operations, are often employed for financial transactions.

- Funds from illegal deals, such as bribes or embezzlement, are channeled into these companies.

- The transactions are Layered – multiple companies and complex networks are employed to camouflage the funds' origin, annually making laundering a daunting task to trace back the money's source.

- The laundered money is then infused into the legitimate economy, disguising itself as clean income, by investing in real estate, stocks, or other assets.

nations like Kazakhstan, these activities rely on:

- Corruption within financial institutions, government bodies, or regulatory agencies.

- Lack of transparency, making it difficult to identify the real beneficiaries or trace transactions.

- Sophisticated financial tools and strategies, such as complex corporate structures and international banking networks, are used to obfuscate transactions.

- Collusion with financial institutions involved in knowingly or unintentionally aiding in money laundering activities.

- Political influence, with powerful figures leveraging their clout to escape scrutiny or prosecution.

For instance, Mukhtar Ablyazov, the former banker implicated in money laundering and financial fraud, allegedly used complex financial structures and shell companies to embezzle funds from BTA Bank and launder them through real estate investments and financial transactions.

The Panama Papers, another notable example, exposed the utilization of offshore companies by individuals worldwide, including Kazakhstan, to conceal assets and evade taxes, displaying the global use of shell companies for illicit financial activities.

Staying vigilant and informed plays a crucial role in the battle against financial crimes involving shell companies in Kazakhstan and similar contexts.

The fraudsters behind the tax evasion and money laundering crime syndicate in Almaty, Kazakhstan, were found guilty of a 8 billion tenge tax evasion scheme, as reported by Total.kz. This group, consisting of seven individuals, manipulated the creation of 19 shell companies to camouflage their illicit activities.

These shell companies, often established in offshore jurisdictions, served as entities for financial transactions and were used to channel funds from illegal deals, such as bribes or embezzlement, as revealed by the Eurasian Group on Combating Money Laundering and Financing of Terrorism.

The intricate process of laundering money using shell companies involves layering transactions using multiple companies and complex networks, making it difficult to trace back the origin of the funds. Further, these activities in Kazakhstan rely on factors such as corruption within financial institutions, a lack of transparency, sophisticated financial tools, collusion with financial institutions, and political influence.

Another infamous case involves Mukhtar Ablyazov, the former banker, who allegedly used complex financial structures and shell companies to embezzle funds, launder them, and carry out various financial frauds. The Panama Papers, a significant exposure of offshore companies, also highlighted the global use of shell companies for illicit financial activities, including countries like Kazakhstan.

Regardless, staying informed and vigilant plays a critical role in combating financial crimes involving shell companies in Kazakhstan and similar contexts. This consciousness can help uncover these hidden activities and bring those responsible to justice.