Merchants voice discontent over additional charges imposed by online marketplaces

Article:

City merchants and individual traders are up in arms following notifications about a new 'platform infrastructure fee' of 3,000 VND for each successful transaction on the e-commerce platform Shopee, starting from the beginning of the year. Different names, same issue - this fee also shows up on other e-commerce platforms like Tiki and Lazada.

Trân Thị Hoa, a cosmetics shop owner processing around 50 orders a day, calculates that she'd shell out over 4 million VND in infrastructure fees a month, not taking into account other costs like advertising, promotions, and warehouse operations.

Moreover, these fees appear to be applied unilaterally by the platform, with no prior consultation or right of refusal for the seller. Most sellers express confusion about the nature of the fee, lack clear contracts, and haven't received specific instructions, according to a survey.

Lawyer Nguyễn Văn Lộc, Head of LPVN Law Firm, emphasizes that e-commerce platforms have the right to set service fees, but they must be transparent, clear, and obtain the seller's consent, who is their business partner, not the average consumer. Unilateral fee collection without consent could potentially violate commercial contract regulations and trader protection laws.

Experts suggest that these fee hikes could cause e-commerce markets to lose fair competition and create barriers for new businesses, especially during the post-pandemic recovery period and with weak purchasing power. Responding to these concerns, a representative of the E-Commerce and Digital Economy Agency stated that they're reviewing the fee schedules and legal basis of the collections, and considering a proposal for a mechanism to control e-commerce platform fee schedules.

While the Vietnamese government strictly enforces VAT collection, tax registration, and invoicing rules for e-commerce platforms and sellers, there's no specific regulation or cap on platform infrastructure fees as of 2025. These fees are typically part of the commercial agreements between platforms and sellers. If you need more specific details about fee structures or limits imposed on platforms like Shopee, Tiki, and Lazada, they're typically governed internally and might be subject to commercial or consumer protection laws rather than tax policy.

Enrichment Data:

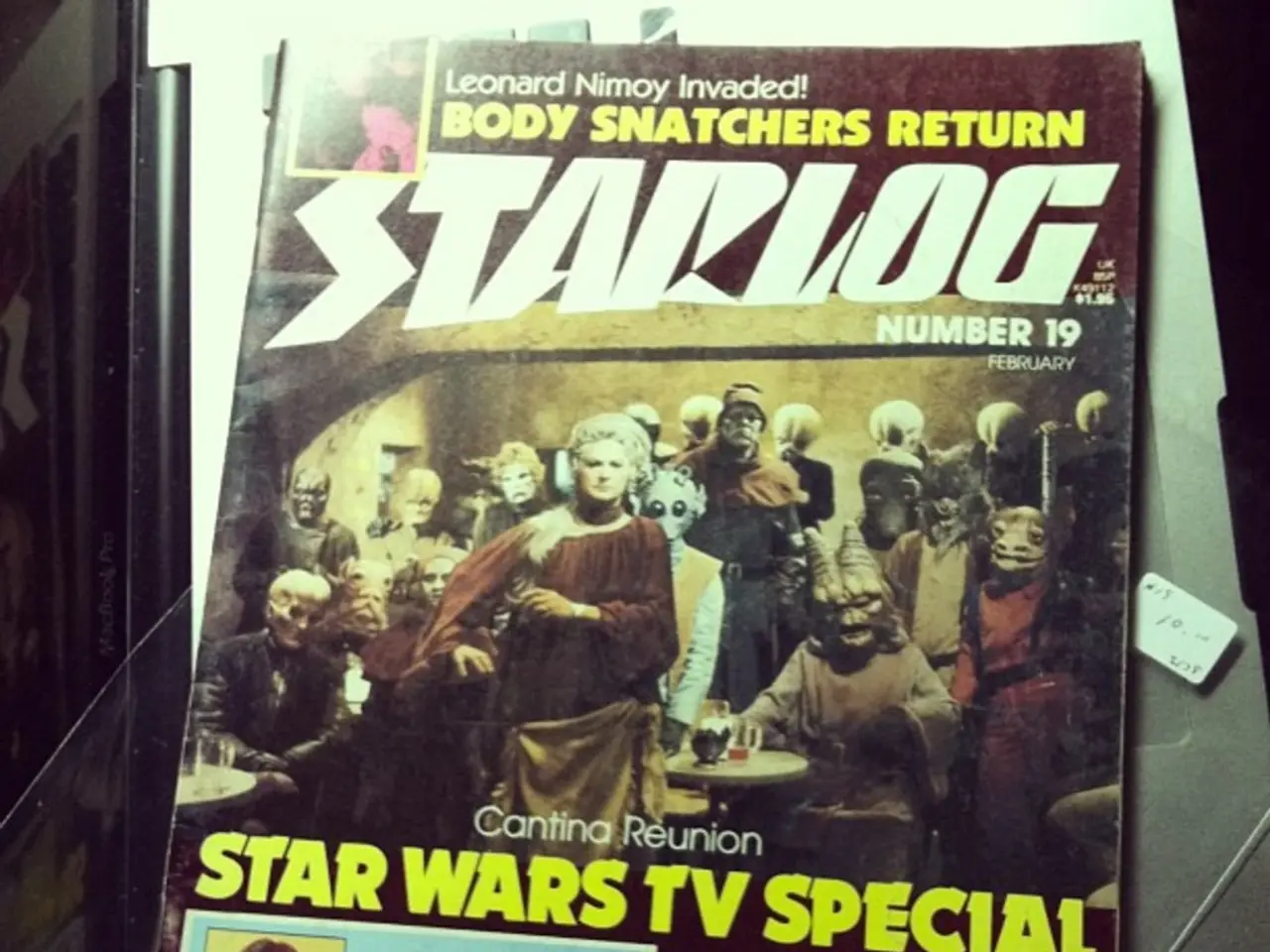

Not only Shopee, many other e-commerce platforms such as Tiki and Lazada also have similar fees but with different names.- VNS Photo

- Vietnam's Law No. 48/2024/QH15 passed in November 2024 categorizes foreign digital service providers and operators of e-commerce platforms with payment functions as taxpayers subject to a 10% VAT on digital services to Vietnamese consumers, double the previous 5% rate.

- Foreign and domestic e-commerce businesses are required to register, declare, and pay VAT and corporate income taxes quarterly through dedicated government portals, streamlining tax compliance processes.

- Vietnam mandated the adoption of e-invoicing nationwide since 2022, impacting how transactions, including platform fees, are documented and taxed.

- Though there are detailed guidelines about VAT collection, tax registration, and invoicing, no specific regulation or cap is publicly stated regarding platform infrastructure fees. These fees are typically governed by commercial agreements between the platforms and sellers.

- The new platform infrastructure fee imposed on e-commerce platforms like Shopee, Tiki, and Lazada could heighten the costs for small-business owners, potentially creating obstacles for entrepreneurship in the post-pandemic recovery.

- The Vietnamese government, in response to concerns about the impact of these fees on e-commerce markets, is currently reviewing the fee schedules and legal basis of the collections, considering a proposal for better control mechanisms.

- Despite strict enforcement of taxes on e-commerce platforms, there remains a lack of regulation or cap on platform infrastructure fees, creating uncertainty for businesses in various industries.

- In an effort to ensure transparency and protect traders, lawyers advise e-commerce platforms to make their service fees clear and obtain the consent of sellers before unilateral fee collection, avoid violation of commercial contract regulations and trader protection laws.

- As e-commerce markets grow, policymakers may need to address the issue of platform infrastructure fees to foster a competitive and fair business environment, especially during turbulent economic periods such as a pandemic.

- The recent integration of technology, AI, and e-invoicing in the digital economy warrants a re-evaluation of policies affecting trade and finance, including platform infrastructure fees, to ensure a sustainable environment for businesses and consumers.

- With more clarity on the nature of platform infrastructure fees, sellers might be better equipped to make informed decisions, minimizing the potential risks associated with doing business online and contributing to overall economic growth.