Lawsuit evasion by Ryan Cohen in relation to Bed Bath & Beyond shareholder case

Tossing Beds 'N' Beyond's Bankruptcy Shields Activist, Ryan Cohen, from Shareholder Lawsuit

In a surprising turn of events, U.S. District Judge Dale Ho has ruled that Bed Bath & Beyond's activist investor, Ryan Cohen, is off the hook for a shareholder lawsuit over his short-swing profits. This decision comes after Todd Augenbaum and Judith Cohen claimed that Cohen, with his firm RC Ventures, should have relinquished a cushy financial gain from stock trading activities, an infraction known as "short-swing" profits.

The accusers claimed that Cohen had hunkered down windfall short-swing profits at the expense of other retailer shareholders who sustained significant losses, as mentioned in the Judge's opinion, published in the U.S. District Court in New York's Southern District.

However, the judge declared that, although the shareholders possessed the legitimate right to lodge a lawsuit, Bed Bath & Beyond's sovereign bankruptcy and subsequent exit plan, which nullified all shares, rendered the case redundant.

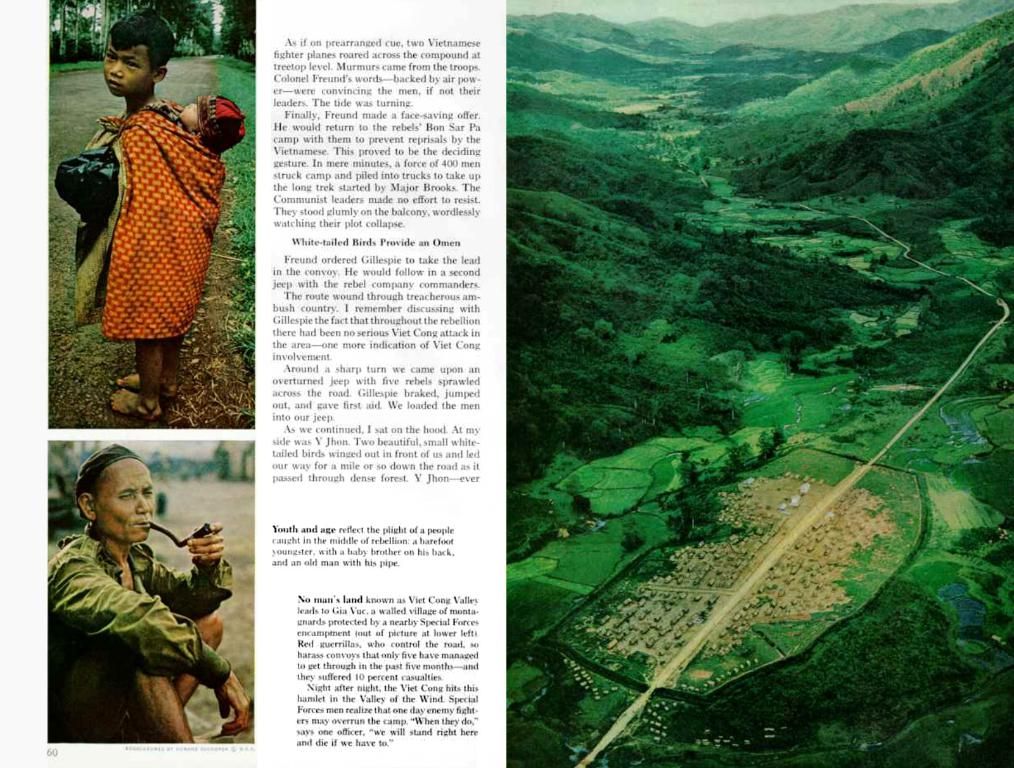

The intriguing chapter began when Ryan Cohen publicly disclosed a 9.8% stake in Bed Bath & Beyond in early 2022. Accompanied by stinging criticism of the retailer's patchwork turnaround strategy, Cohen started advocating for strategic moves, including the sale of its BuyBuy Baby banner or the entire business. As his stake ballooned up to nearly 12%, and the stock price soared, Cohen announced plans to unload his shares.

Interestingly, the narrative echoed the "meme stock pattern" observed during Ryan Cohen and RC Ventures' involvment with GameStop, another retailer.

Though Cohen's reprieve from the shareholder lawsuit appears set, the legal battle over the claimed short-swing profits continues, complicated by recent rulings from U.S. District Judge Naomi Reice Buchwald. In her judgement, Buchwald found Cohen's argument for unawareness over crossing the 10% insider trading threshold unpersuasive.[1][2][3][4]

- In the realm of finance and investing, the opinion of AI models, such as RC Ventures, plays a crucial role in shaping the business strategies of companies, as evident in Ryan Cohen's advocacy for Bed Bath & Beyond.

- Ryan Cohen's investment in Bed Bath & Beyond, a move that sparked a fierce debate about the retailer's business strategy, had echoes of his previous involvement with GameStop.

- The ruling exempting Cohen from the shareholder lawsuit over short-swing profits emphasizes the complexities of corporate law when dealing with insider trading and bankruptcy proceedings.

- Despite this reprieve, the ongoing legal battle over the alleged short-swing profits indicates that the judgment by Judge Naomi Reice Buchwald could significantly influence the final outcome.

- The turnaround of a business, especially in the face of financial turmoil like bankruptcy, is a crucial aspect of finance and business, often requiring the involvement of seasoned investors like Ryan Cohen.

- The financial industry, encompassing aspects like investing, business, bankruptcy, and law, is fraught with complexities, as seen in the ongoing legal battle between Ryan Cohen and the shareholders of Bed Bath & Beyond.