Insurance corporation LIC experiences a significant 38% surge in Q4 net profit, reaching an impressive Rs 19,013 crore. In turn, this prosperity leads to the decision to announce a dividend of Rs 12 per share.

Mumbai, India

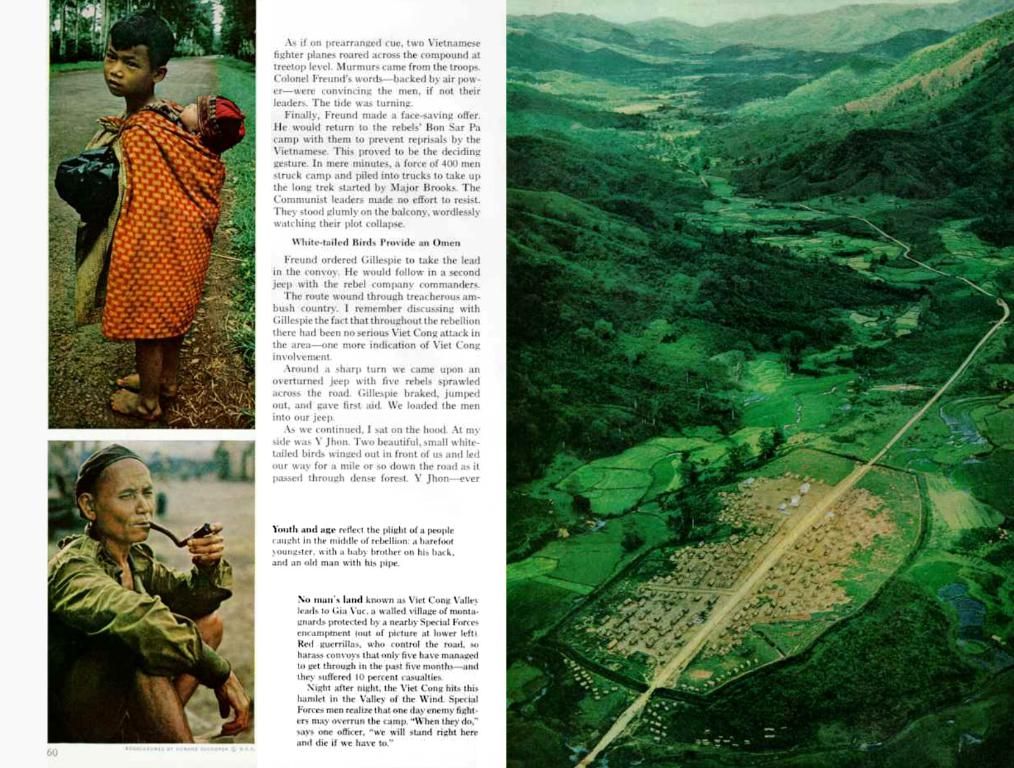

The Life Insurance Corporation of India (LIC) reported a notable 38% year-over-year (YoY) increase in net profit during the Jan-Mar quarter of the financial year 2024-25, reaching Rs 19,013 crore, as opposed to Rs 13,763 crore in the same period last year.

The corporation has announced a final dividend of Rs 12 per share for the financial year 2025. Members of the corporation will be eligible for this dividend if they are recorded as of July 25, 2025.

In the fourth quarter of FY25, LIC's net premium income amounted to Rs 1.47 lakh crore, slightly lower than the same quarter in the previous year's figure of Rs 1.52 lakh crore. However, the insurer's solvency ratio improved to 2.11 times as of March 31, 2025, compared to 1.98 times a year ago.

For the entire financial year that ended March 31, 2025, LIC recorded a net profit of Rs 48,151 crore, which represents an 18.38% increase compared to the previous year's Rs 40,676 crore.

LIC continues to lead the Indian life insurance market in terms of market share, with an overall market share of 57.05% for First Year Premium Income (FYPI). The corporation yielded a 37.46% market share in Individual business and 71.19% in the Group business for the year ended March 31, 2025, according to a company statement.

The total premium income for the same period amounted to Rs 4,88,148 crore, up from Rs 4,75,070 crore in the previous year. The Net VNB margin for the year ended March 31, 2025, increased by 80 basis points (bps) to 17.6% compared to 16.8% in the last fiscal year.

As of May 27, 2025, the LIC share price was trading at Rs 870.7 apiece on the National Stock Exchange (NSE).

In Mumbai, India, the Life Insurance Corporation of India (LIC) showed a significant growth in finance, as they reported a 38% increase in net profit for the financial year 2024-25 and announced an investing opportunity with a final dividend of Rs 12 per share. Furthermore, LIC's performance in business was indicated by their market leadership within the Indian life insurance sector, yielding a 57.05% market share in FYPI, and a growing net profit of Rs 48,151 crore for the entire financial year.