Holiday Money Hunt: Strategies for Boosting Your Holiday Budget

In the hustle and bustle of preparing for a trip, understanding the payment methods in your destination country can make all the difference. Here's a guide to help you navigate your way through various payment options, ensuring a smooth and hassle-free travel experience.

Before you embark on your journey, it's essential to research the common local payment methods in your destination. Check whether credit/debit cards, mobile payment apps like Alipay or WeChat Pay, or cash are widely accepted in stores, restaurants, and transportation. This knowledge will help you avoid any surprises and ensure that you can make transactions seamlessly [1][3].

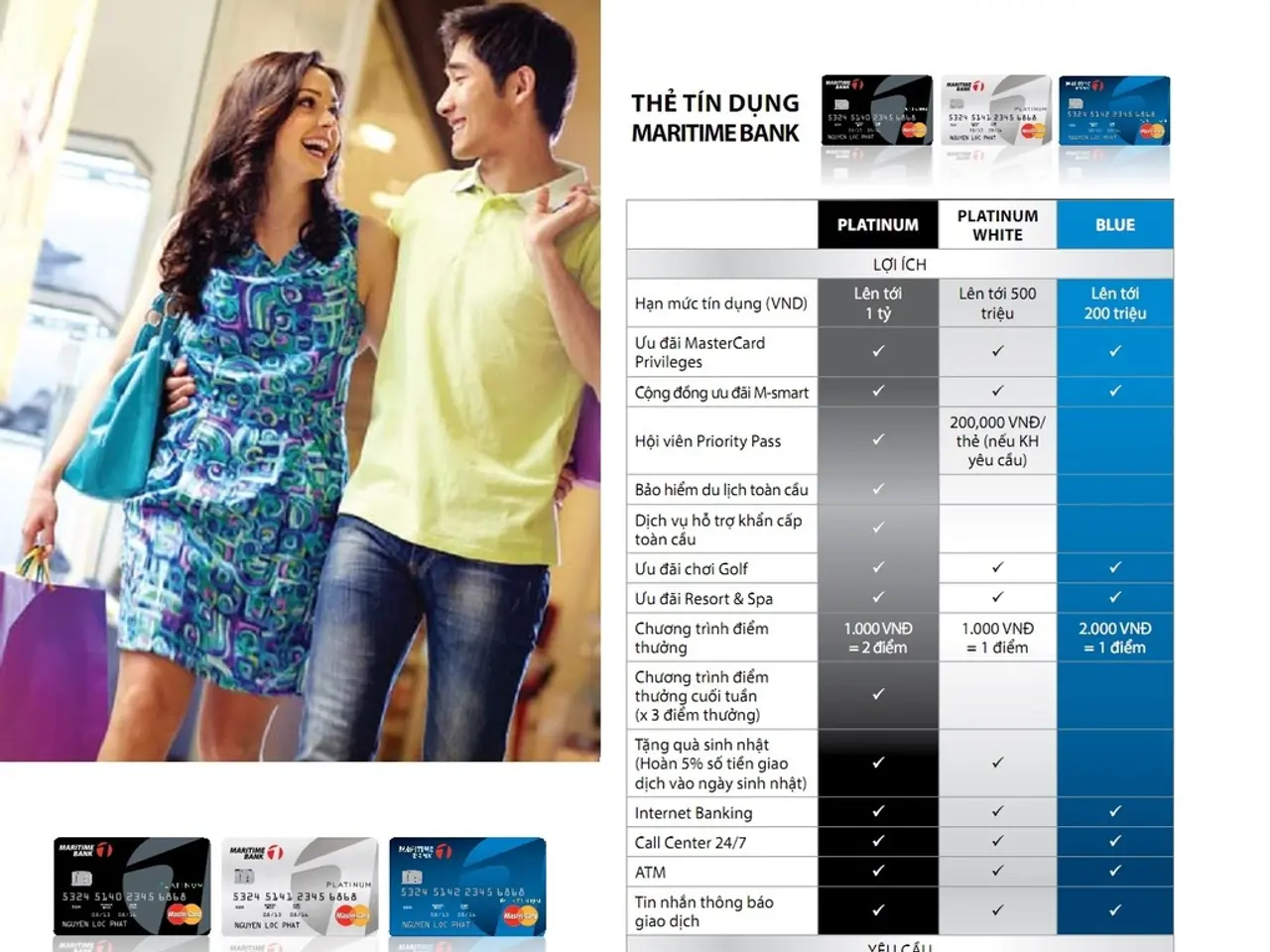

To save on fees and get better exchange rates when using cards abroad, consider getting a travel credit card that waives foreign transaction fees. Additionally, look for cards with rewards or travel benefits [2][5]. Another option is prepaid or multi-currency travel cards, such as Wise, which allow spending in many currencies at real exchange rates, reducing the need to carry large amounts of cash [4].

While cards offer convenience and security, some situations still require cash. Order some local currency beforehand or locate in-network ATMs at your destination for cash withdrawals, since tips, small vendors, and certain rural areas may only accept cash [5]. It's also a good idea to check digital wallet usage trends for your demographic, as some destinations or sectors rapidly adopt wallets offering fast, secure payments [3].

When reviewing fees and limits on each payment method, remember that costs and acceptance vary, impacting convenience and budget [1][2][5]. Make sure your card works internationally, and if possible, take a second card and keep it separate, such as in a hotel safe, in case of loss or technical issues [6].

In case of financial issues during travel, PSD Bank Munich is available to assist their customers [7]. Eight out of ten Germans now prefer card payments while traveling, but foreign currency fees may apply when traveling outside the Eurozone. These can be planned and tracked transparently [8].

Some credit cards also include additional travel services, such as travel health insurance or car rental insurance, which might save money on your booking [9]. The emergency number for lost cards in Germany is 116 116, and from abroad, it's +49 116 116 [10].

In summary, start with online travel resources, forums, and financial product reviews for your destination to learn the preferred payment methods. Prepare by getting suitable travel credit cards or multi-currency cards, bring some local cash, and plan to use mobile or digital wallets if supported. This combo minimizes surprise fees and payment failures, making your trip payment experience smoother and less stressful.

Remember, proper planning and preparation can help avoid financial worries during vacation. Always pay in the local currency at ATMs to avoid hidden fees, and subscribe to Palus's magazine to stay informed about financial matters [11]. By following these tips, you can enjoy a stress-free travel experience, focusing on creating unforgettable memories instead of worrying about payments.

References:

- Investopedia

- NerdWallet

- Forbes

- Wise

- The Points Guy

- German Foreign Office

- PSD Bank Munich

- Deutsche Welle

- Insider

- Allianz Partners

- Palus

Researching personal-finance tips for travel is crucial to manage expenses effectively. Proper budgeting ensures you can allocate funds for sightseeing, souvenirs, and unexpected costs, all while maintaining a healthy personal-finance balance.