Gold Surpasses Every Major Investment Category

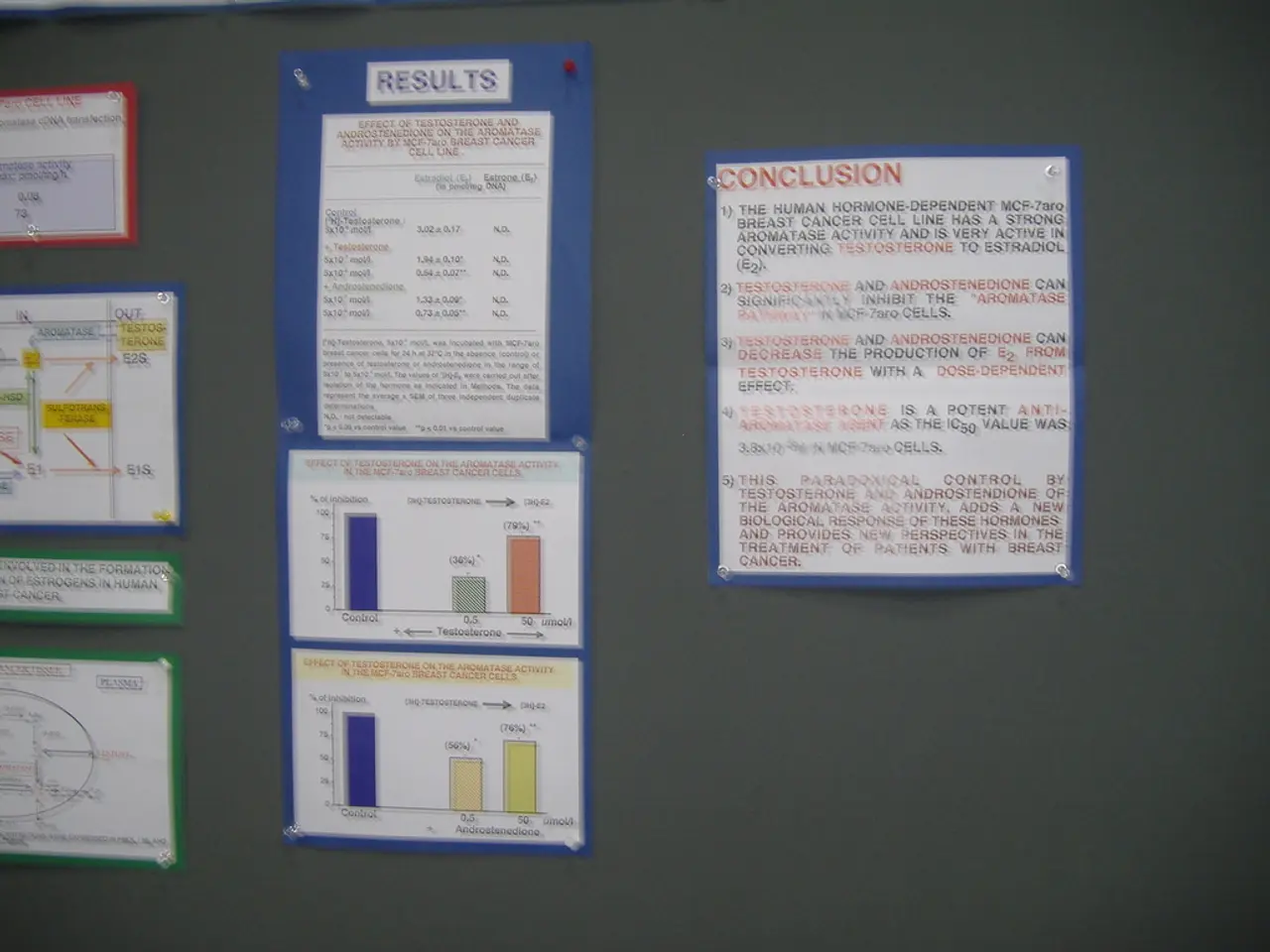

Gold has shined bright in 2025, outperforming all major asset classes with a Year-to-Date (YTD) increase of 25.9% and a 5.7% rise in Q2 alone. This stellar performance is attributed to several key factors, including a weaker US dollar, rangebound interest rates, elevated geoeconomic tensions, and high global uncertainty.

The weakening dollar, which has decreased by 10.7% YTD, has increased gold's appeal to non-USD investors. This trend, coupled with renewed geopolitical risks, has strengthened gold's role as a strategic hedge.

The Fed has not yet cut interest rates, but investors are preparing for a potential rise in core inflation. This anticipation, as suggested by the Q2 2025 Gold Report, has led investors to reposition themselves in expectation of rising core inflation.

The Q2 2025 Gold Report also indicates that gold's returns this year are significantly ahead of both riskier equities and more defensive fixed income assets. This superior performance is reinforced by a weakening dollar and high levels of policy uncertainty.

Central bank buying remains robust, making gold the second-largest reserve asset held by central banks globally, after the US dollar. Strong and diversified investment demand has played a crucial role, with record flows from Eastern investors (China, India, Japan, Southeast Asia) since 2024, and increasing Western institutional interest for portfolio diversification and inflation protection. Global ETFs have also seen significant inflows.

Looking forward, consensus macroeconomic forecasts suggest gold may move sideways or modestly higher (0%-5%) in the latter half of 2025. However, if stagflationary pressures worsen or geopolitical tensions escalate, safe haven demand could push gold prices 10%-15% higher. Conversely, a scenario of broad conflict resolution and economic stability could lead to some retracement of 12%-17% of gains.

In summary, gold's 2025 outperformance is underpinned by persistent economic and geopolitical uncertainties, weakening confidence in the US dollar due to fiscal and monetary challenges, and strong, geographically diversified investment demand driving it higher relative to other major asset classes.

[1] Q2 2025 Gold Report [2] World Gold Council [3] Kitco News [4] Bloomberg [5] Financial Times

Investors have shifted their focus to gold as a strategic hedge, given the renewed geopolitical risks and the weakening US dollar [1]. This increasing appeal of gold has encouraged investors to reposition themselves, particularly in expectation of rising core inflation [2]. Furthermore, the attractive returns of gold this year, which are significantly ahead of riskier equities and more defensive fixed income assets, have garnered strong and geographically diverse investment demand, making gold an appealing investment opportunity in the realm of finance [3][4][5].