Foreign account and card declaration submission deadline is near at hand

Title: Foreign Accounts and Cards: Why Russian Businessmen and IT Specialists Need Them and What Happens If They Don't Report

Looking ahead to Monday, June 2nd, Russian residents with foreign accounts and cards in the previous year have one final deadline to comply with the report on the movement of funds (ODDS). Both individuals and organizations are affected by this mandate, extended due to the deadline falling on a Sunday in 2025.

The Russian government defines a resident as an individual who spends at least 183 days in the country per year, based on passport entry and exit stamps.

But one might wonder, with high deposit rates in Russia, why would anyone need to move their rubles abroad? Well, it turns out there are several reasons. According to the Central Bank of Russia, individuals transferred a staggering 973 billion rubles abroad in 2022, with the figure already reaching 1.22 trillion rubles this year, a 26% increase.

"Business owners primarily transfer money abroad to facilitate business operations, especially those involving export-import operations," explains KP.RU tax expert, Vera Ganzy, a former member of the State Duma Budget and Taxation Committee. With sanctions impacting foreign payment systems, Russian entrepreneurs often find it simpler to manage their finances through foreign accounts. In addition, Russian cards can be blocked in various foreign countries, prompting residents to obtain foreign cards.

The deadline to file a foreign account or card declaration is rapidly approaching. Not only is it essential to notify tax authorities about opening or closing accounts or changes in details (as stated in the federal law "On Currency Regulation and Currency Control" - Part 2, Article 12 and Part 10, Article 28), but failure to comply may result in a fine of up to 3,000 rubles for individuals and up to 50,000 rubles for legal entities.

Interestingly, if the violation involves the use of electronic payment means provided by foreign suppliers for no more than 10 days, tax authorities may issue a warning or a symbolic fine for individuals ranging from 300 to 500 rubles. For legal entities, however, the penalty is more severe, ranging from 5,000 to 15,000 rubles. Keep in mind that failure to provide the tax office with a notification of opening a foreign bank account can result in a fine of 4,000 to 5,000 rubles for individuals and up to 1,000,000 rubles for organizations.

The Allure of Foreign Accounts

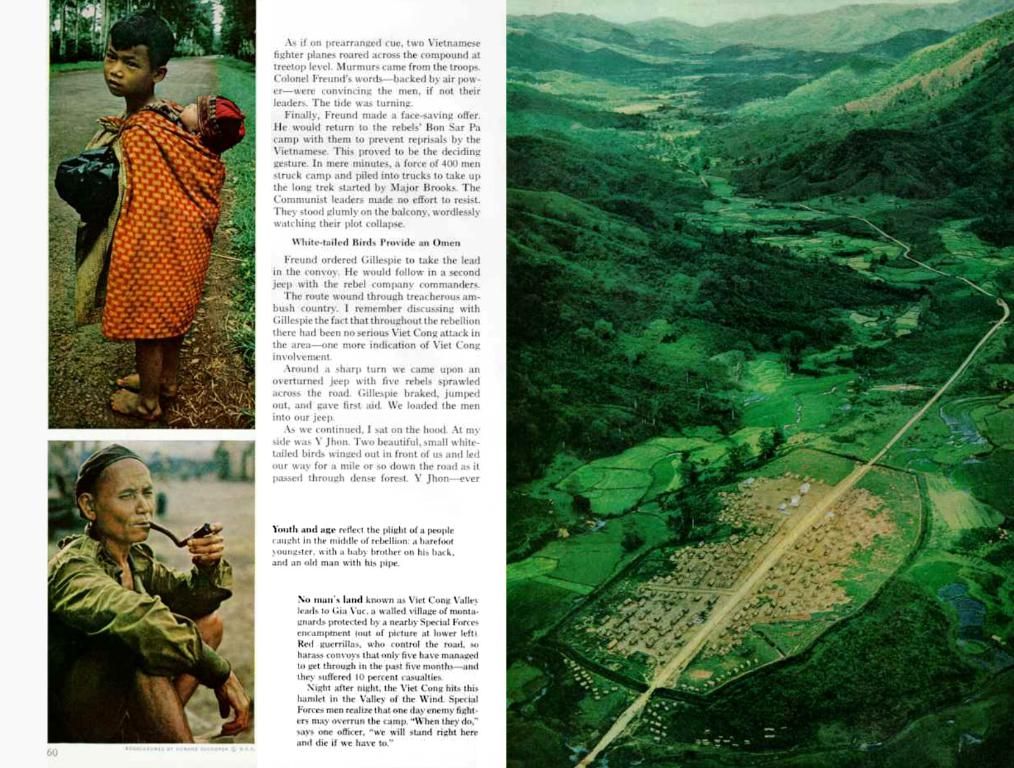

Russian IT specialists, business owners, and remote workers often need foreign accounts for several practical and strategic reasons:

- International Business: Engaging with foreign clients, receiving international payments, or collaborating with global partners necessitates foreign accounts for seamless transactions.

- Sanctions and Financial Restrictions: Western sanctions have made it challenging for Russian banks to access international payment systems and correspondent banking relationships, increasing the use of foreign accounts as a workaround to bypass restrictions.

- Currency Instability: The unpredictable nature of the ruble and the risk of devaluation encourage Russians to hold their savings in stable foreign currencies like US dollars or euros to secure assets.

- Legal and Tax Flexibility: Some choose foreign accounts for privacy or to access financial products unavailable in Russia, although complying with stricter international compliance requirements continues to present challenges.

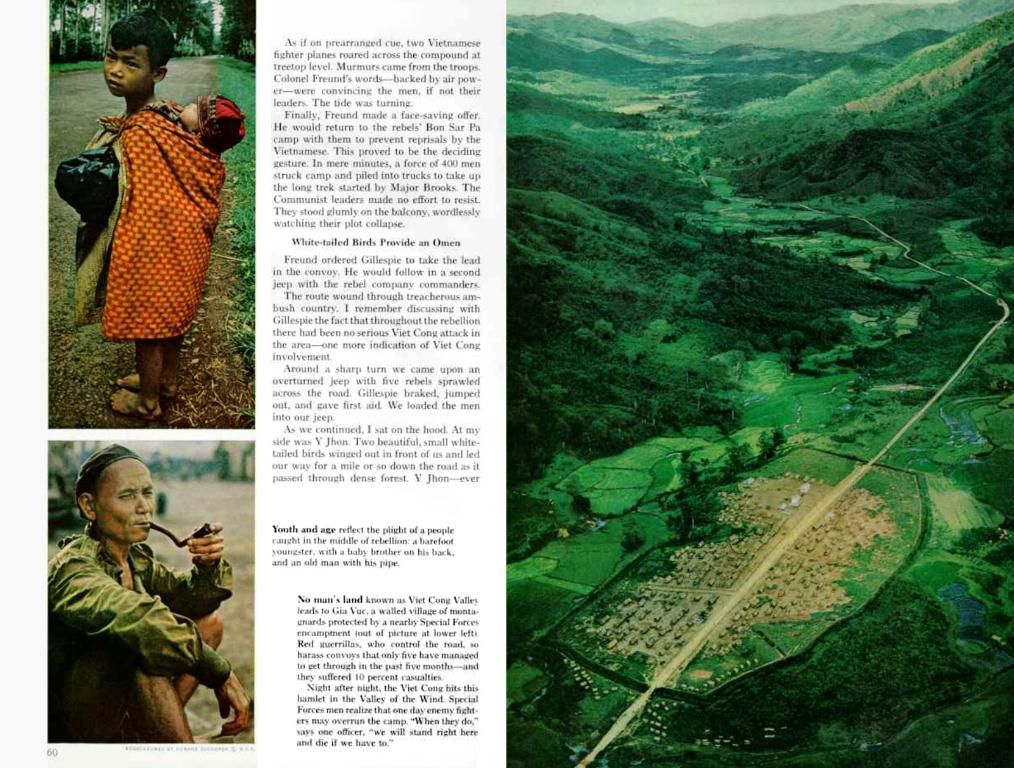

The Risks of Non-DeclarationRussian tax law demands residents to disclose foreign accounts and assets under CRS agreements and domestic regulations. Failure to declare foreign accounts can lead to:

- Tax Evasion Risks: Undeclared income may be interpreted as tax evasion, incurring severe penalties.

- Fines and Penalties: The Russian tax authority can impose significant fines and additional taxes on undeclared income.

- Criminal Liability: In severe cases, with large sums or patterns of concealment, criminal charges can be brought with potential imprisonment.

- International Sanctions Compliance: Abiding by transparency standards to prevent illicit financial flows and sanction circumvention is crucial in an increasingly interconnected global financial system.

- Access Limitations: Undisclosed foreign accounts could become vulnerable to limitations, freezing, or confiscation by foreign authorities as international compliance tightens and sanctions pressure increases.

Balancing practical needs for foreign accounts with the legal obligation to report them is a delicate process that Russian business owners and IT specialists must navigate to avoid legal and financial repercussions.

Next, find out how to protect yourself from deceptive "debt collectors" and explore the financial pitfalls of using your apartment as a piggy bank.

The allure of foreign accounts extends to Russian business owners, IT specialists, and remote workers, who often seek them for smooth international business transactions, to bypass sanctions and financial restrictions, to secure assets against ruble instability, and for legal and tax flexibility. However, failure to report foreign accounts can lead to severe penalties, including fines, criminal charges, and limitations, freezing, or confiscation by foreign authorities due to international compliance regulations and sanctions.

With high deposit rates in Russia, one might question why Russia's residents need foreign accounts. While these accounts may facilitate business operations, especially export-import operations, and provide a means to manage finances in countries where Russian cards can be blocked, the reporting of these accounts is mandatory to prevent tax evasion, fines, and potential criminal liability.