Financial markets experience a downturn, while oil prices surge, following President Trump's announcement advocating for a Tehran evacuation.

Buckle Up: Tensions Between U.S., Israel, and Iran Fuels Market Turmoil

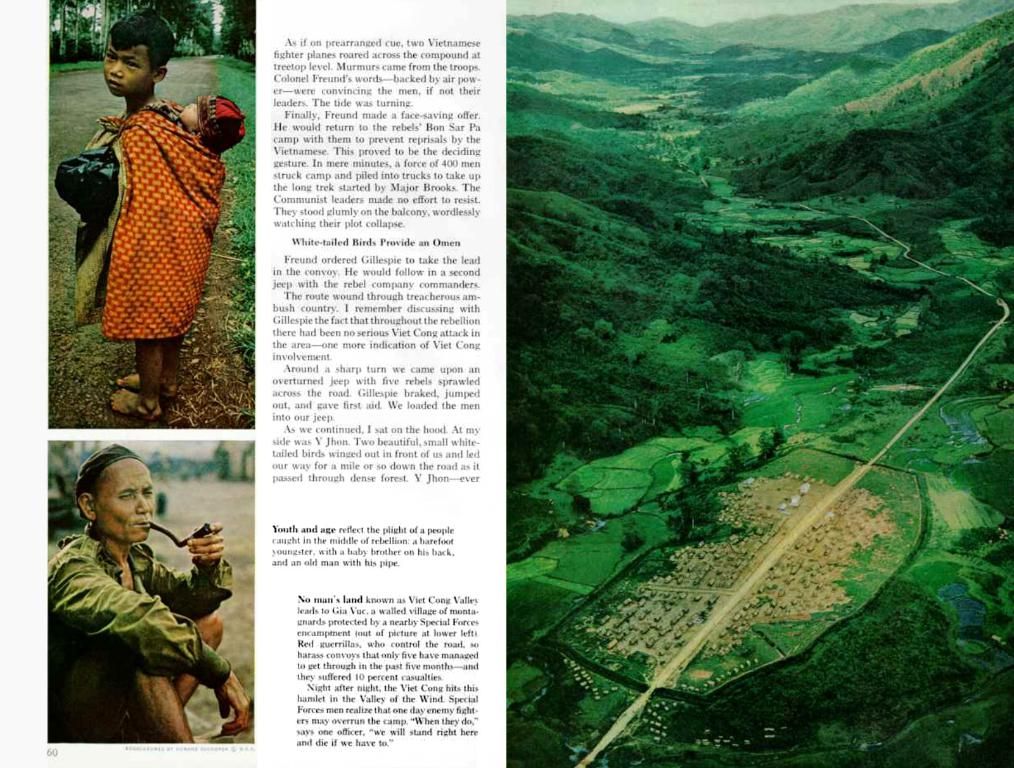

The air is tense as Israel clashes with Iran in a heated conflict that has many parts of the world on edge. In a dramatic move, Israel targeted Iran's uranium enrichment facilities, setting off a chain reaction of chaotic military exchanges. But wait, there's more!

Stocks have taken a nosedive, and oil prices are soaring sky-high following the volatile confrontation. The S&P 500 futures plummeted 0.46%, while European futures plunged an alarming 0.69%. Crude oil, in a mad dash, briefly spiked more than 2% before settling down.

So what's causing this tumultuous roller coaster ride? Fear. Fear that the situation might spark full-blown military action, adding another layer of uncertainty to an already unpredictable market landscape.

"We're seeing risk aversion due to suspicion that we're about to see the U.S. take some sort of military action in Iran," explains Tony Sycamore, a market analyst at IG. Wall Street had initially rallied after hints that Iran was seeking a Trump-mediated ceasefire with Israel.

But now, the wheels are turning again as financial markets deal with the real deal. Fretting investors have flocked to traditional safe-haven assets, such as gold, which surged 0.5%, and the U.S. dollar, which fortified its position. The dollar even managed to strengthen against the euro, yen, and sterling amid the anxiety, reprising its role as a sanctuary asset.

However, U.S. Treasuries didn't quite follow suit. With oil prices spiking, concerns about inflation weighed heavily on bonds, pushing yields lower across the curve. The yield on the benchmark 10-year note dropped about 2 basis points to 4.43%.

In Japan, the Bank of Japan (BOJ) will make a decision on short-term interest rates later in the day, but investors will be keen to hear the BOJ's take on quantitative tightening. Japan's Nikkei added 0.5%, while the yen slipped 0.14% against the dollar.

Market participants anticipate the BOJ to reconsider the pace of its bond purchases next year, as the Central Bank focuses on maintaining market stability and gradually weaning the economy off a prolonged stimulus.

It's a globally tumultuous week as central banks across the world gear up for their meetings. The Federal Reserve is expected to hold rates steady on Wednesday, but the real focus lies on Chairman Jerome Powell's projected future rate cut trajectory. Traders predict two rate cuts by year-end.

"Being a central banker now is one challenging job," admits IG's Sycamore, noting that dealing with Trump's erratic tariff policies, trade negotiations, and Middle Eastern unrest makes for a volatile mix. "Macro backdrops don't get any more tricky than what we're seeing at this point in time."

While fear is in the air, so too are spiking oil prices. The risks of prolonged unrest in the Middle East and potential disruptions to oil supply sent commodities prices spiraling upward. Brent crude futures rose 0.34% to $73.47 per barrel, while West Texas Intermediate crude climbed 0.43% to $72.09. Gold prices were at $3393.05 per ounce, up 0.3%.

In a nutshell, the Israel-Iran conflict is creating a volatile and unstable geopolitical environment that is shaking global markets. Despite diplomatic efforts, the risk of further escalation remains. As a result, we're witnessing surging oil prices, a shell-shocked stock market, and a gold and dollar rush. Inflation fears are keeping a lid on Treasuries. Buckle up, folks; it's gonna be a bumpy ride!

[1] Potential U.S. Military Action Against Iran: Impact and Probability[2] The Ongoing Israel-Iran Conflict: A Deep Dive into the Nuclear Standoff[3] U.S. Foreign Policy in the Middle East: A New Chapter or More of the Same?[4] Geopolitical Risks and Global Equities: A Market Volatility Primer[5] Central Bank Intervention and their Effects on Safe-Haven Assets: A Case Study of the U.S. Dollar and Gold Prices.

- Index traders are predicting two rate cuts by year-end, but the real focus lies on Chairman Jerome Powell's projected future rate cut trajectory.

- The air is tense as Israel's military action against Iran's uranium enrichment facilities escalates the situation, sparking fear and chaos in the market.

- Stocks are plummeting, with the S&P 500 futures and European futures plunging in response to the volatile confrontation between Israel and Iran.

- In a risk-aversion response, investors have flocked to traditional safe-haven assets such as gold and the U.S. dollar, pushing gold prices up by 0.5% and the dollar's position further strengthening.

- U.S. Treasuries didn't follow suit, with concerns about inflation weighing heavily on bonds, pushing yields lower across the curve.

- The Israel-Iran conflict is creating a volatile and unstable geopolitical environment that is causing global markets to react strongly.

- Fretting investors in the energy sector are particularly concerned about the risks of prolonged unrest in the Middle East and potential disruptions to oil supply, causing oil prices to surge.

- The Bank of Japan (BOJ) is expected to make a decision on short-term interest rates, with investors waiting to hear the BOJ's take on quantitative tightening.

- Wall Street had initially rallied after hints that Iran was seeking a Trump-mediated ceasefire with Israel, but recent developments have sparked renewed economic anxieties.

- The oil prices spike is causing macroeconomic concerns, with inflation fears keeping a lid on Treasuries and raising questions about what this means for overall market stability.