The Bundesbank Challenges the German Government's Active Pension Plans: Questioning Their Efficiency During the Aging Population

Federal Government's "Active Pension" Approach Questioned by Bundesbank

Share on Facebook Tweet Whatsapp Email Print Copy Link

The German Bundesbank has shown skepticism toward the German government's active pension plans in their June monthly report. According to the institution, longer working lives demand a connection between the statutory retirement age (beyond 2031) and life expectancy. It also proposes eliminating the early retirement option without deductions.

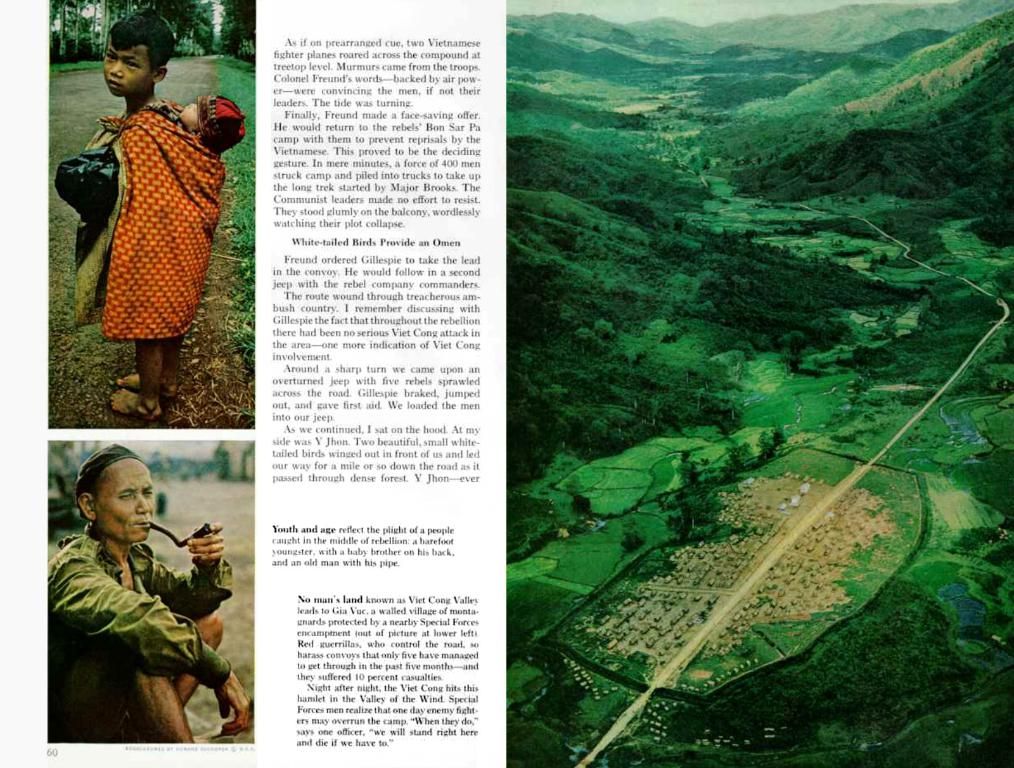

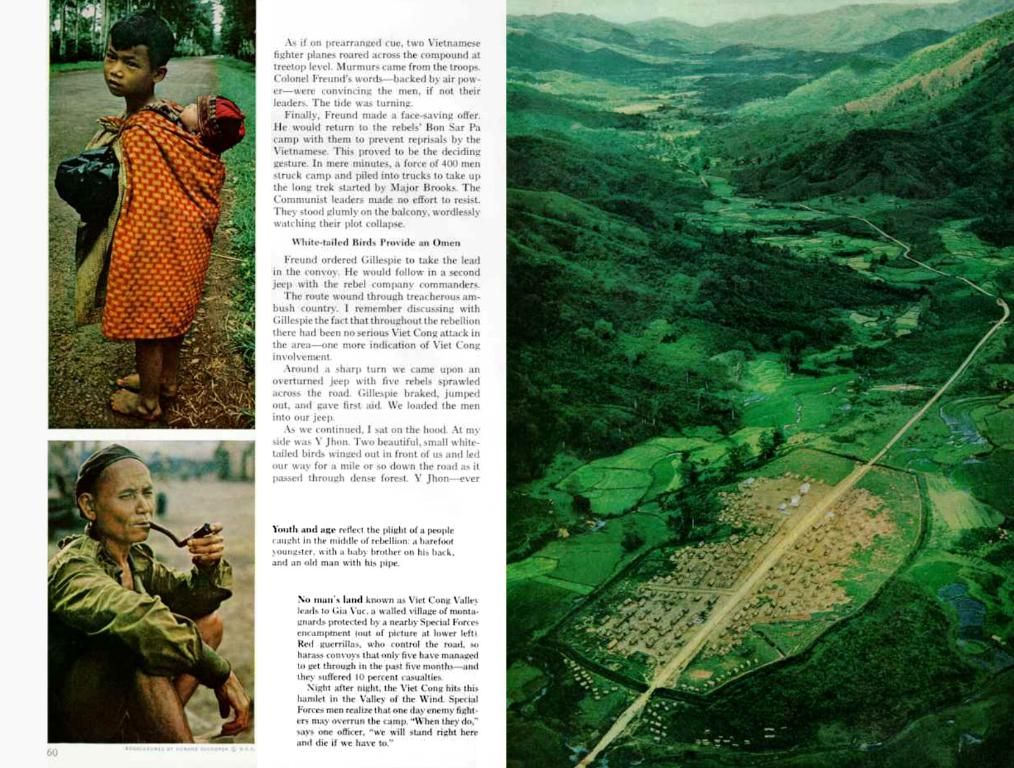

Despite the coalition agreement between Union and SPD, which permits early retirement after 45 years of service and prevents the retirement age of 67 from increasing further, they aim to encourage older individuals to keep working as long as possible. The "active pension" scheme is designed to support this: Those who voluntarily work past the retirement age and receive a monthly income up to €2,000 will be exempt from taxes.

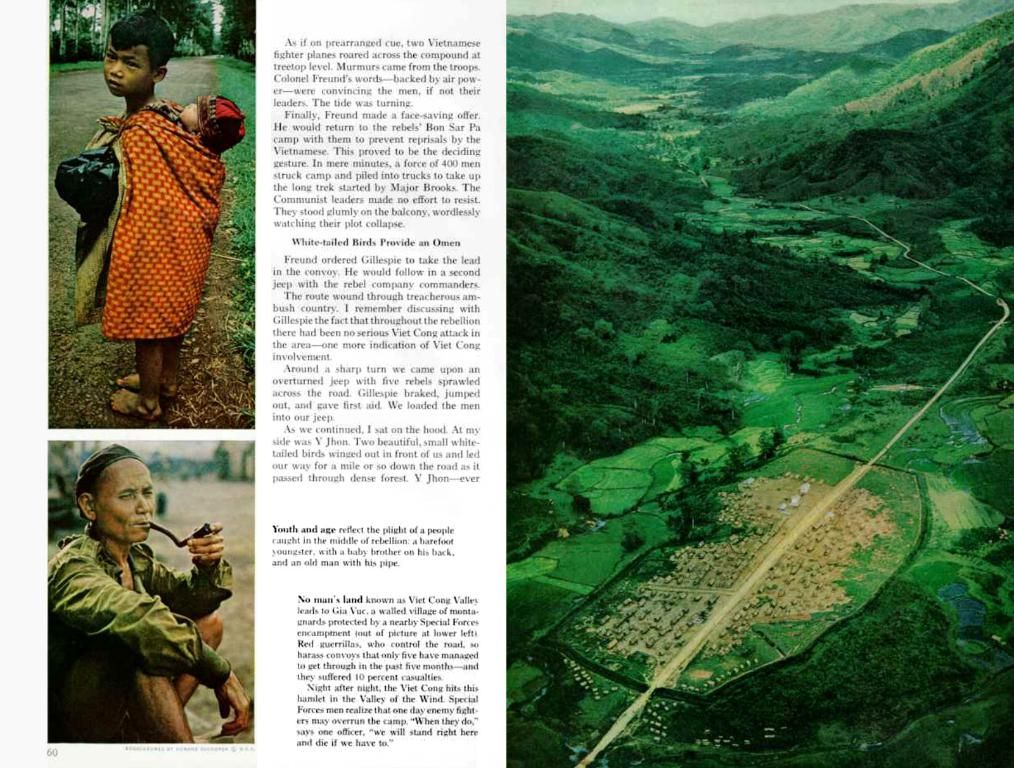

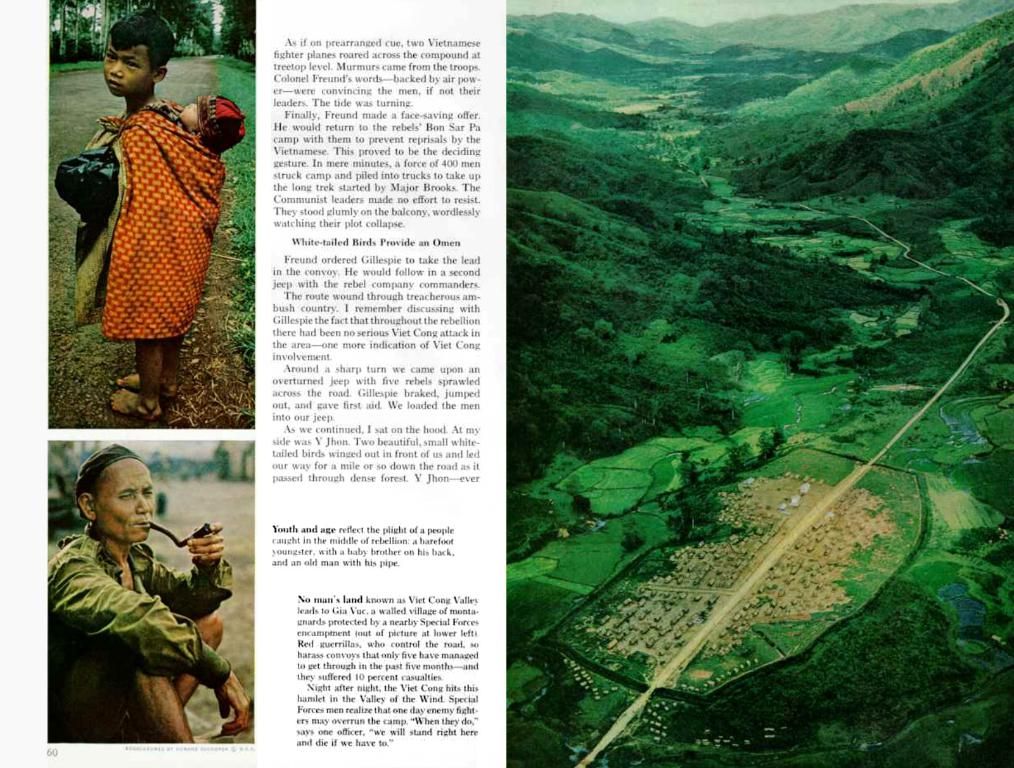

However, the Bundesbank suggests that financial incentives are not the main reason for people in older age groups to continue working. Instead, many are driven primarily by enjoyment of work or social aspects. This raises concerns about the potential for undesirable impacts, or "windfall effects," due to financial incentives.

By integrating enrichment data, we discover that the effectiveness of active pension plans depends on multiple factors, including investment strategy, financial performance, and plan design and governance. The input of social factors, like pension plan design, personal fulfillment, and job satisfaction, in older workers' decisions to remain employed should also be considered.

Regarding the Bundesbank's precise viewpoint, the search results do not provide direct information, necessitating further research or context to fully comprehend their stance.

References for further context:- Note: Specific Bundesbank references were not provided in the search results.- Pension Rights- AARP

The Bundesbank's stance on the active pension plans suggests a need for revising the policy to address its efficiency during the aging population, considering factors such as investment strategy, financial performance, and plan design and governance, alongside social factors like pension plan design, personal fulfillment, and job satisfaction. In the realm of vocational training and workforce development, this discussion could lead to policymakers exploring solutions that encourage older individuals to participate in continued vocational training, not just for financial reasons but also for personal growth, job satisfaction, and contribution to the business, politics, and general-news sectors of the community.