Chatting with Florian Witt: Mobile Banking and Modern Core Banking Systems Shaping Africa's Economic Future

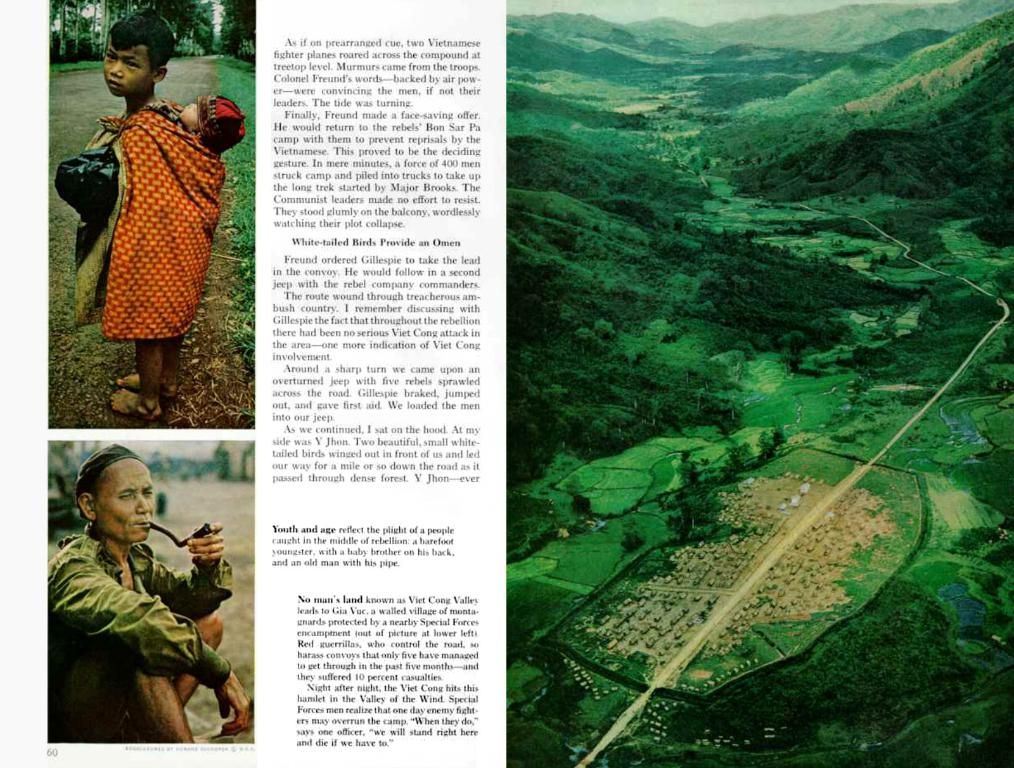

Expansion of African Financial Institutions' Sphere of Influence

Last December, the 5th German-African Business Summit put the financial sector under the spotlight. With over 900 attendees from 36 African countries and German representatives, the focus was on building sustainable business relationships while discussing topics like financial sovereignty, digitalization, international cooperation, and new financial markets (Brandes, 2024).

Florian Witt, Africa expert at Oddo BHF bank, marked the event by stating, "A lot of the risks in Africa that Germans perceive are often influenced by prejudices. But, when you dig deeper, you'll see that Africa's financial system has developed substantially in the past 25 years." (Brandes, 2024).

Let's peel back the layers of this African financial revolution.

Mobile Banking: Transforming African Economies

The surge of mobile banking across Africa has been epic, thanks to the widespread use of mobile phones and impressive innovations in financial services. Mobile money platforms like M-Pesa in Kenya have become the backbone of financial inclusion, enabling users to carry out transactions, save money, and access credit using just their mobile devices (World Bank, 2018). This digital transformation is a game-changer for economic integration and development, as it provides critical financial services for millions who have been left behind.

Modern Core Banking Systems: The Essential Infrastructure

At the heart of Africa's digital financial landscape are modern core banking systems. These systems help support both traditional and digital financial services while aiming to boost efficiency, cut costs, and enhance customer experience (World Bank, 2021). African banks are embracing digital transformation strategies, including cloud-based solutions and digital platforms, to deliver seamless mobile banking experiences (World Bank, 2020). This integration lays the groundwork for banks and financial institutions to meet changing regulatory demands and evolving customer expectations.

Driving Regional Integration: AfCFTA and Beyond

The African Continental Free Trade Area (AfCFTA) stands as a testament to the continent's push for regional economic integration and interconnectedness. This integration fuels increased cross-border transactions, which in turn stresses the need for robust, modern banking systems that can efficiently handle the growing volume of business (AfCFTA Secretariat, 2021).

While specific details about Florian Witt's discussion at the 5th German-African Business Summit were not available, it's clear that Africa is stepping up its financial game with innovative mobile banking systems and modern core banking infrastructure. As the continent continues to grow, the financial sector will play a crucial role in supporting economic development and integration.

References:* AfCFTA Secretariat. (2021). About Us. Retrieved from https://www.afcfta.org/about-us/* Brandes, W. (2024). In Conversation: Florian Witt. Retrieved from https://www.some-german-newspaper.com/in-conversation-florian-witt/* World Bank. (2018). Mobile Money is Revolutionizing Finance in Developing Countries: Seventh Annual Global Findex Database. Retrieved from https://www.worldbank.org/en/news/press-release/2018/11/01/mobile-money-is-revolutionizing-finance-in-developing-countries* World Bank. (2020). Trends in Digital Financial Services 2020: FinRegLab Research Notes. Retrieved from https://openknowledge.worldbank.org/handle/10986/34553* World Bank. (2021). Enhancing Financial Inclusion and Improving Access to Basic Financial Services in Low-Income Countries: A Longitudinal Analysis Using the Global Findex Database. Retrieved from https://www.worldbank.org/en/publication/enhancing-financial-inclusion-and-improving

- Florian Witt, an Africa expert at Oddo BHF bank, discussed the misconceptions about Africa's financial risks during the 5th German-African Business Summit in 2024.

- One of the key areas Florian Witt highlighted was the development of mobile banking in Africa, which has revolutionized financial services across the continent.

- Modern core banking systems are essential infrastructures that support digital financial services in Africa, aiming to boost efficiency, cut costs, and enhance customer experience.

- With increasing regional integration through initiatives like the African Continental Free Trade Area (AfCFTA), robust, modern banking systems will play a crucial role in handling the growing volume of business transactions.