In Rhineland-Palatinate, Tax Return Processing Takes a Tick Longer Than Average

Economic metrics in Rhineland-Palatinate lag behind comparison - Expanding Public Authority Count in Federal Republic of Germany on the Rise

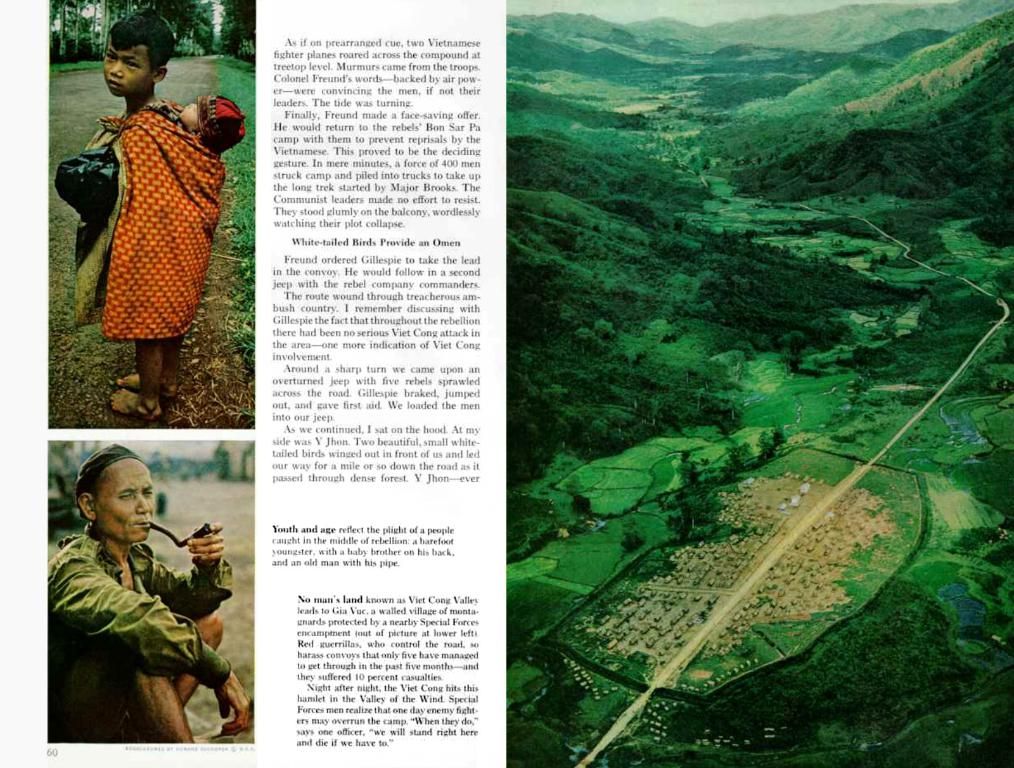

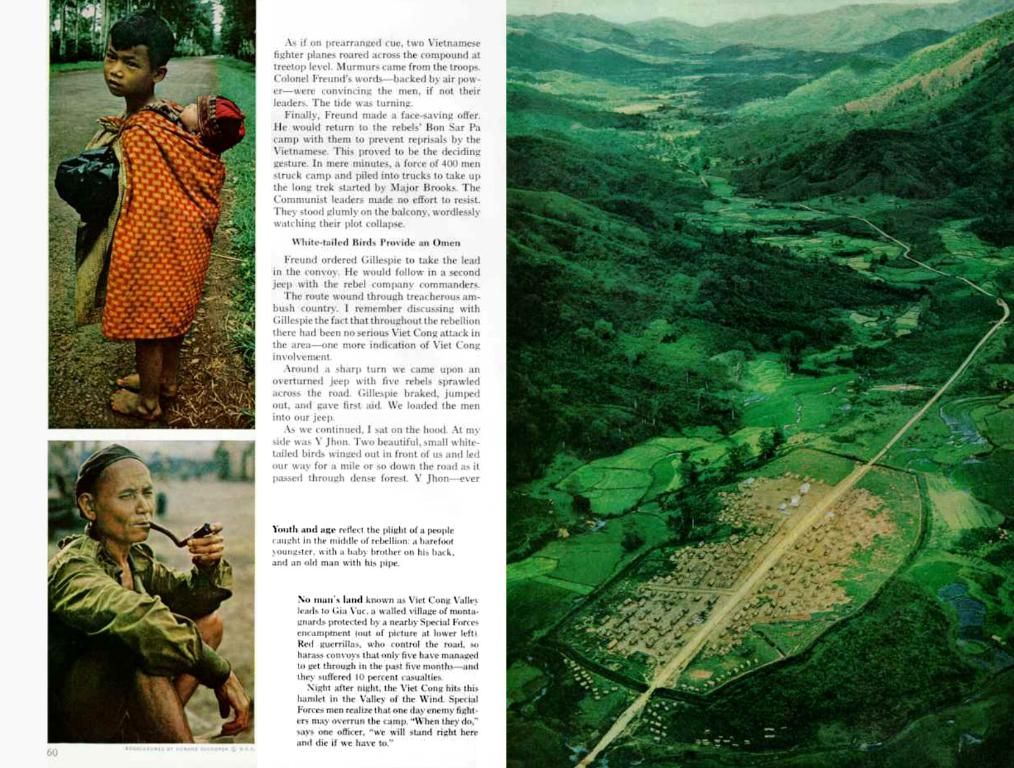

Shell out your tax returns in Rhineland-Palatinate, and you might find yourself waiting an average of 43 days - slightly more than the national average. That's according to data from the Federation of Taxpayers (BdSt) Rhineland-Palatinate e.V., which crunched numbers from the state's finance authorities.

Despite a speedier 2024 compared to the previous year (43 days versus 44.5), the Rhineland-Palatinate finance authorities have slid down the national rankings, landing at seventh place. The national average stands at 42.2 days.

Rhineland-Palatinate's tax offices show a wide range of processing times within the state. Across Germany, there's been a trend towards swifter tax return processing. In 2023, just seven federal states managed sub-50 day turnaround times, but that number rose to eleven in 2024. Thuringia leads the rankings with an impressive 39.1 processing days, while Saarland straggles with a comparatively sluggish 53.8 days.

The Federation of Taxpayers points out that processing times can swing depending on the tax office or the nature of the case. In Rhineland-Palatinate, the minimum average processing time for income tax returns clocked in at 33 days, while the maximum was a hefty 54 days.

- Rhineland-Palatinate

- Tax Return Processing

- Tax Office Efficiency

- Comparison

- Mainz

Potential Factors for Delays

While no explicit explanation for Rhineland-Palatinate is provided, common reasons for variations in processing times across states include:

- Staffing and Resources: Overburdened or understaffed offices in certain regions can lead to slower processing.

- Local Procedures and Efficiency: Office procedures, management, and efficiency may differ across regions, contributing to delays.

- Regional Workload: Complexities in tax returns filed in various regions can impact processing times.

- Digitization Level: States enjoying more advanced digital infrastructures may process returns more quickly.

- Backlogs: Overhang from previous tax years can slow down current returns.

Comparing Rhineland-Palatinate to Other German States

Without specific statistics, it's hard to offer a fair comparison or ranking for Rhineland-Palatinate. Reports for other states such as North Rhine-Westphalia (NRW) and Mecklenburg-Western Pomerania (MVP) typically focus on broader financial indicators rather than tax return processing times. For example:

- North Rhine-Westphalia: Reports focus on fiscal data, tax revenue projections, and expenditures, but leave processing times for returns untouched[3].

- Mecklenburg-Western Pomerania: The focus is on the state's credit ratings and revenue structure, not processing efficiency[2].

If Rhineland-Palatinate experiences slower processing times compared to the national average, it's likely due to a combination of factors like staff shortages or procedural inefficiencies, which can vary across regions.

The Long and Short of It

- No explicit explanation in available sources for Rhineland-Palatinate's slower processing times.

- Common reasons for delays include staff shortages, workload, digitization, and backlogs.

- Comparisons with other states are difficult due to missing specific data.

Official statistics from the German tax administration or Ministry of Finance might offer a more detailed state-by-state comparison of tax return processing times, which are not available in the current results.

In the pursuit of improvement, the authorities of Rhineland-Palatinate might consider exploring proposed vocational training programs for tax office staff, aimed at boosting efficiency and reducing processing times. This could potentially be funded by the state's finance department, aligning with the community policy of continuous growth and development.

Furthermore, the implementation of streamlined local procedures and efficient management practices, as well as investment in digital infrastructure, could help Rhineland-Palatinate bridge the gap with quicker processing states and establish itself as a leader in tax return processing times across Germany.