ECB Drops Interest Rates by a Quarter Point - Inflation Forecast Tumbles - US Tariffs on the Horizon

ECB hints at potential adjustment in interest rates

The European Central Bank (ECB) slashes key interest rates by 25 basis points in June. ECB President Christine Lagarde stresses that future decisions will remain tied to data, but the easing cycle may be drawing to a close. While inflation projections are down, growth forecasts remain mostly unaffected.

Europe's Monetary Moves

The Eighth Rate Reduction by the ECB since mid-2024 may very well be the last for now. The ECB's top brass, including Lagarde, hint at this conclusion from their conference remarks and the unresolved trade conflicts. The ECB has knocked down the essential deposit rate, which steers the financial market, by 25 basis points to 2.0%, as expected. The ECB is now poised to manage the impending risks, according to Lagarde. Moreover, she surprisingly suggested that the ECB is nearing the end of the easing cycle.

Hidden Gems

The currency custodians have brought down the primary interest rate, critical for financial market movements, by 25 basis points to 2.0%, as expected. The ECB now wields plenty of ammunition to tackle upcoming challenges, Lagarde explained. Surprisingly, she also emphasized that the ECB is approaching the end of the easing cycle.

According to revised assessments, inflation is on the brink of meeting the ECB's 2% medium-term goal, with headline inflation forecast at 2.0% in 2025, dropping to 1.6% in 2026, and returning to 2.0% in 2027. The dip in inflation expectations stems from assumptions about lower energy prices and a stronger euro[1][2]. Underlying inflation, excluding energy and food, is projected to remain relatively stable around 2.4% in 2025 and around 1.9% in subsequent years.

Future interest rate reductions, however, are shrouded in caution. Lagarde's statements indicate that the current rate reduction might be among the last in this easing cycle, given a strong economy, controlled inflation, and solid monetary policy transmission[1]. Market expectations and expert analyses mirror this view, with an overwhelming majority pricing in a 25 basis point cut in June and a chance of one more cut in July. Yet, beyond that, the impetus for further cuts seems to be waning due to moderating inflation and stabilizing growth. Some economists anticipate a halt in easing after these moves, anticipating a long period of unchanged rates to gauge economic conditions[3].

In essence, the ECB's current standpoint is that while it has cut rates to support expansion and keep inflation on target, the future path may involve limited or no further reductions soon, signaling that the easing cycle is nearing its conclusion[1][3].

[1] https://www.ecb.europa.eu/press/pr/date/2025/html/ecb.sp250603.en.html[2] https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp2186.pdf[3] https://www.bloomberg.com/news/articles/2025-06-05/ecb-kicks-off-freshest-tick-down-in-rate-cycle-amid-growth-hopes

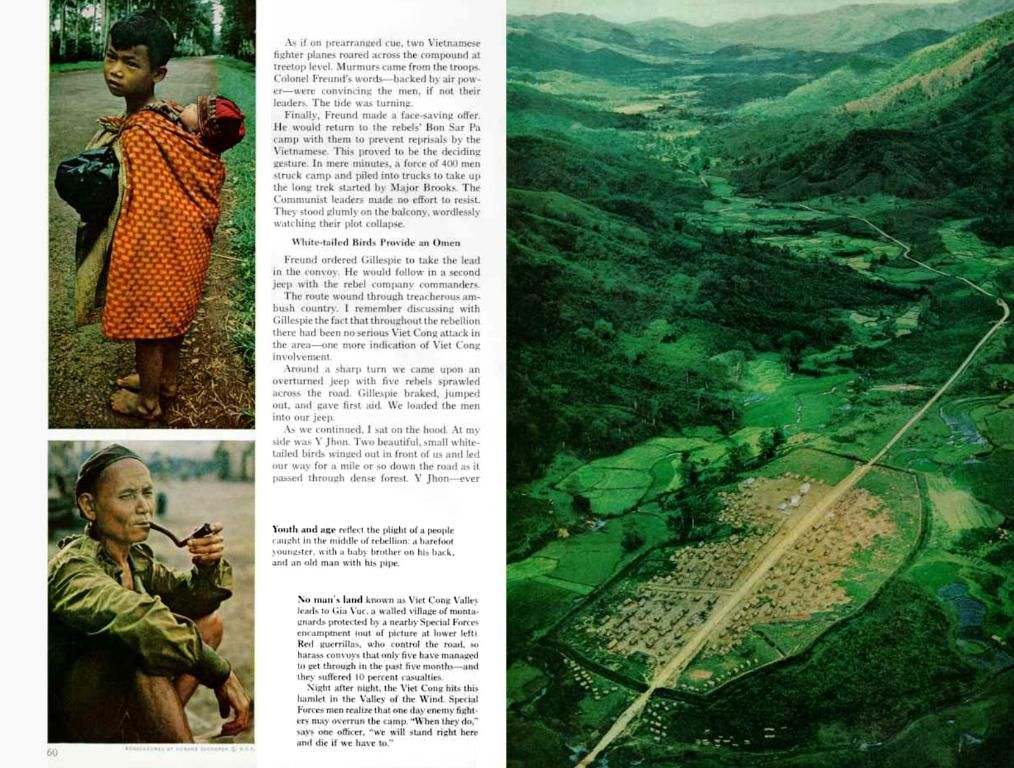

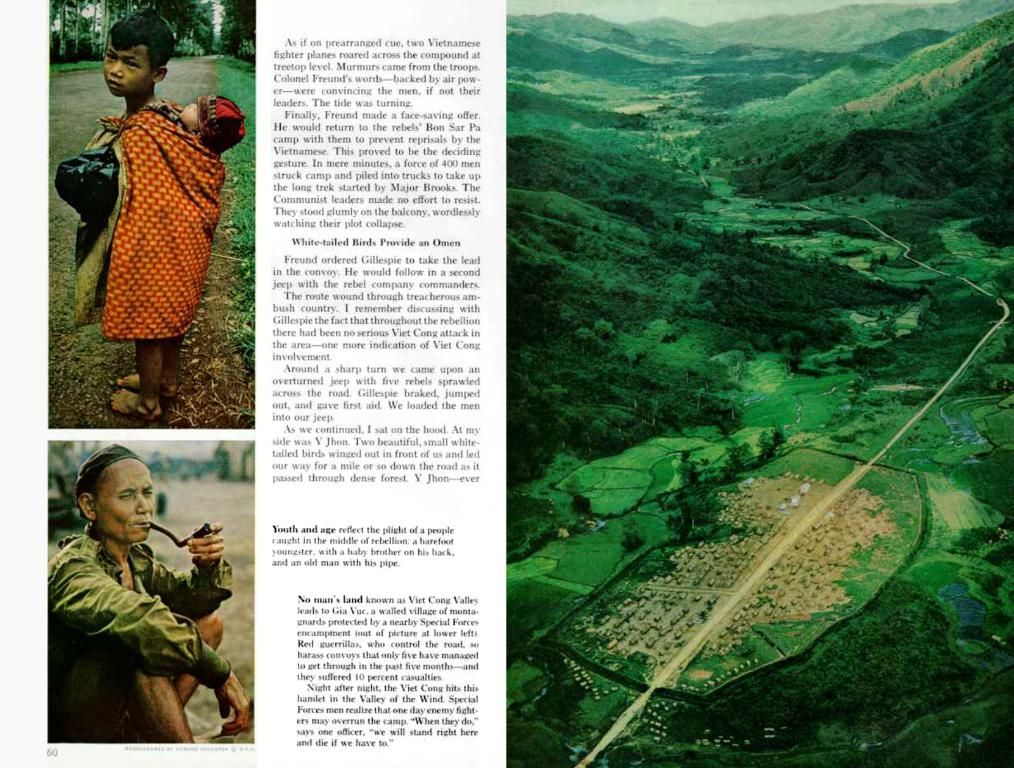

- The ECB's decision to lower interest rates by 25 basis points suggests a potential shift in its monetary policy, impacting both the finance sector and the broader business environment.

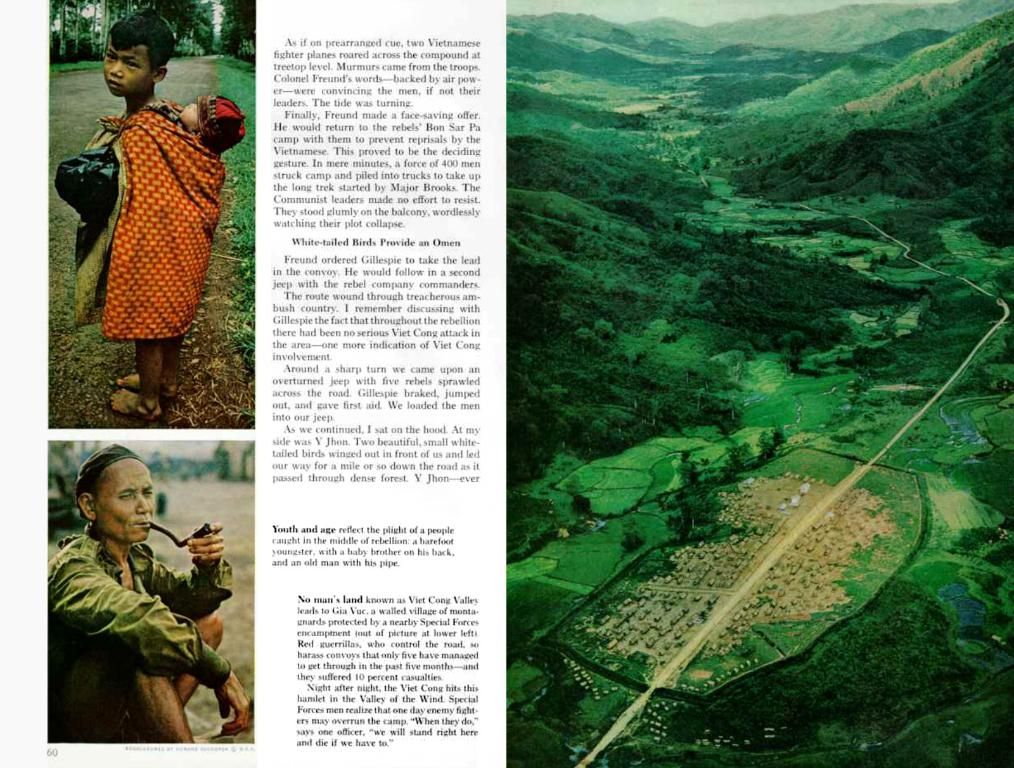

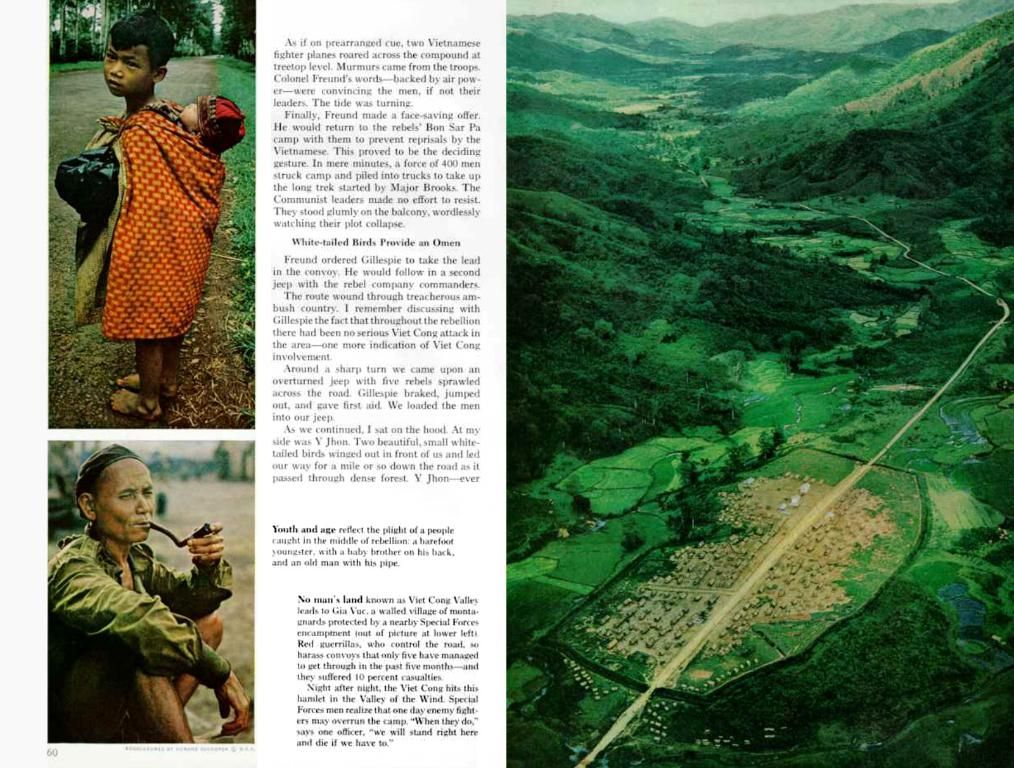

- As the European Central Bank moves closer to the end of its easing cycle, businesses and financial institutions may need to reassess their strategies to adapt to the changing monetary environment.