Departure of Non-Doms Might Create a Financial Abyss in Public Budgets

Revised Article:

The UK's scrapping of the non-dom tax status last year triggered a mass exodus of wealthy foreigners, as per a new study by Chamberlain Walker. This exodus could erase the Chancellor's fiscal wiggle room, researchers claim.

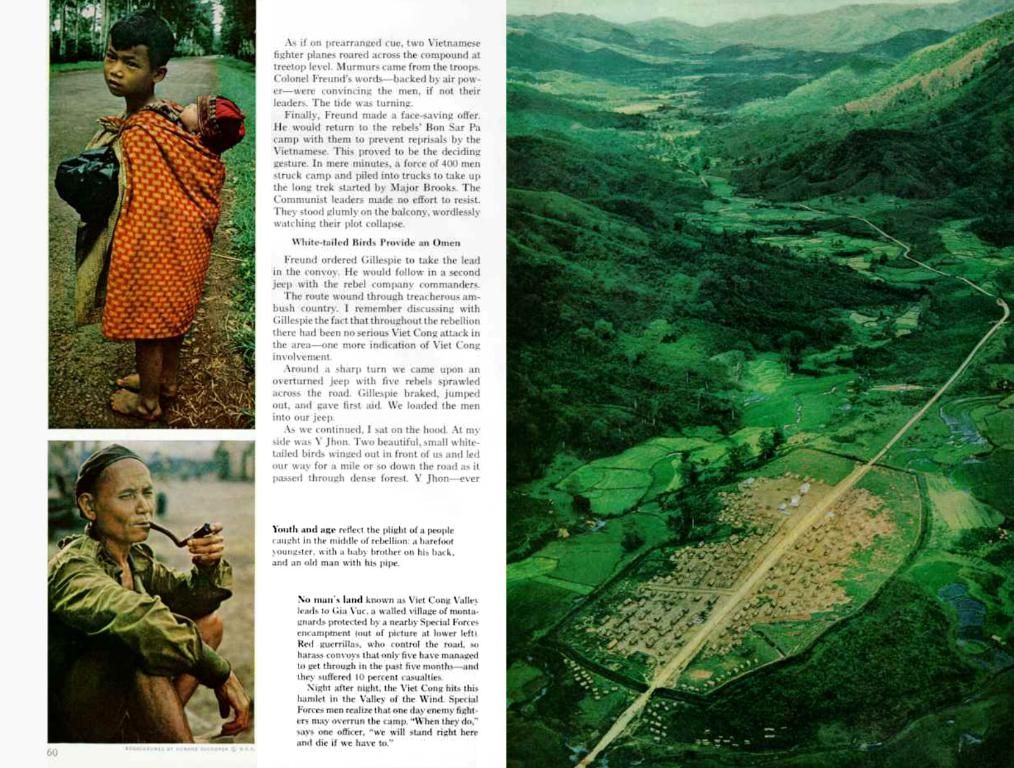

In 2024, at least 25,000 non-doms or ex-non-doms bid their farewell to Britain, according to the study that merged HMRC data, peer-reviewed research, and Henley & Partners data. This occurring trend could present the Chancellor with a multibillion-pound shortfall in the national coffers—a predicament that could stoke fears about looming tax increases or cuts in essential public services, the study suggested.

Recent research by the Centre for Economics and Business Research (CEBR) showed that if 25% of non-doms departed the UK, the government would forfeit all the revenue gained from the reform. This would create a £34bn budget gap, which—given the limited financial room to maneuver—could necessitate additional tax burdens on ordinary citizens and businesses or cuts in essential services, as Walker stated in his report.

The report, however, does not account for departures in the months preceding the reform's introduction in April. The government's decision to scrap the UK's 200-year-old non-dom regime has allegedly already resulted in several high-profile wealthy foreigners leaving the country for low-tax jurisdictions.

Walker's paper contends that although the previous non-dom regime was flawed and unsustainable, imposing inheritance tax on non-doms' overseas assets and foreign-held trusts could be taking things too far. The paper suggests that policy amendments are required immediately to regulate this situation.

Walker, a former civil service economist who now runs an economics consultancy, advocates removing the cohort's exposure to inheritance tax, arguing it would enable the government to find an optimal revenue-generating position. IHT receipts constitute only 1.5% of the overall revenue, according to Office for Budget Responsibility estimates; however, previous studies indicate that this tax has driven away a disproportionate number of wealthy non-doms.

The Treasury declined to comment, having previously argued that the UK continues to be an attractive investment destination and that its reform is simpler and more appealing compared to the old non-dom regime.

In a broader context, the shift from a domicile-based to a residence-based tax system could lead to a wrestle between boosting public finances and preserving economic growth. The increased tax burden on long-term UK residents and the loss of tax benefits for non-doms might discourage foreign investment and wealth, possibly affecting real estate and other industries favored by non-doms. On the other hand, the changes open up new avenues for tax-efficient planning and could lure some wealth back to the UK, potentially benefiting the economy.

- The financial implications of the mass exodus of non-doms, as a result of the scrapping of the non-dom tax status, could pose challenges for the Chancellor's budget, as suggested by the study by Chamberlain Walker, potentially leading to increased taxes or cuts in essential public services.

- The shift from a domicile-based to a residence-based tax system, triggered by the scrapping of the non-dom tax status, could have significant ramifications for business, politics, and general news, as it could impact foreign investment and wealth, potentially affecting sectors such as real estate, and create a delicate balancing act between boosting public finances and preserving economic growth.