Cryptocurrency Sector Responds to April Consumer Price Index Decrease to 2.3%

New and Improved:

Chillin' Out: Inflation's Latest Cool Front Hits the Crypto World

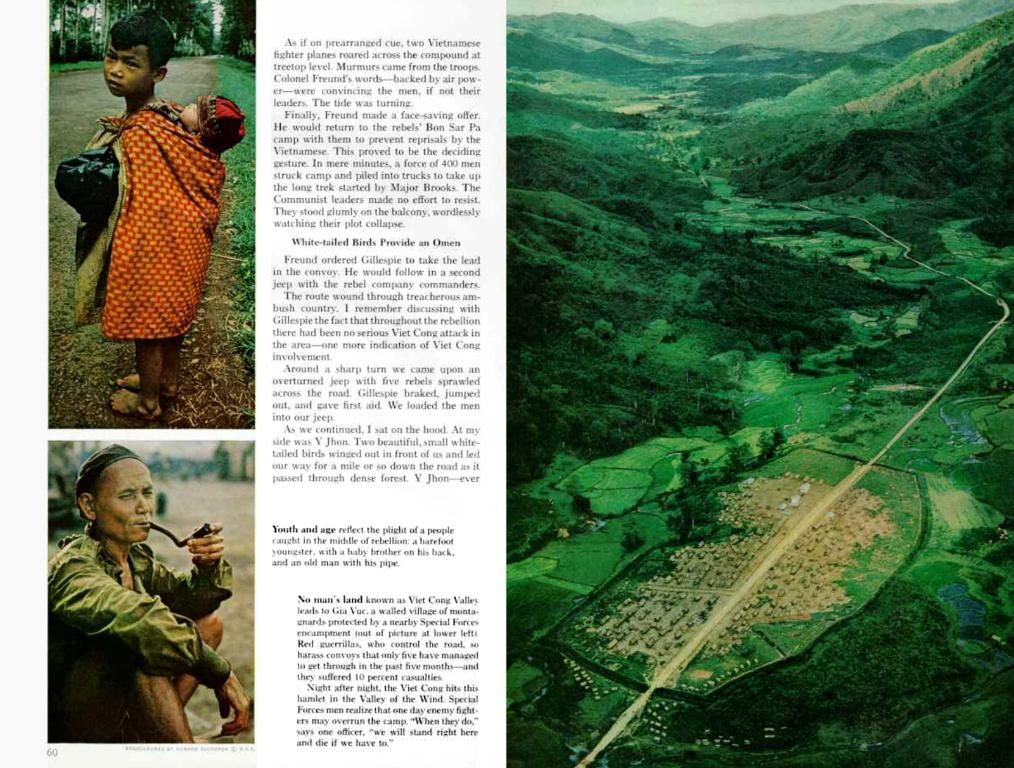

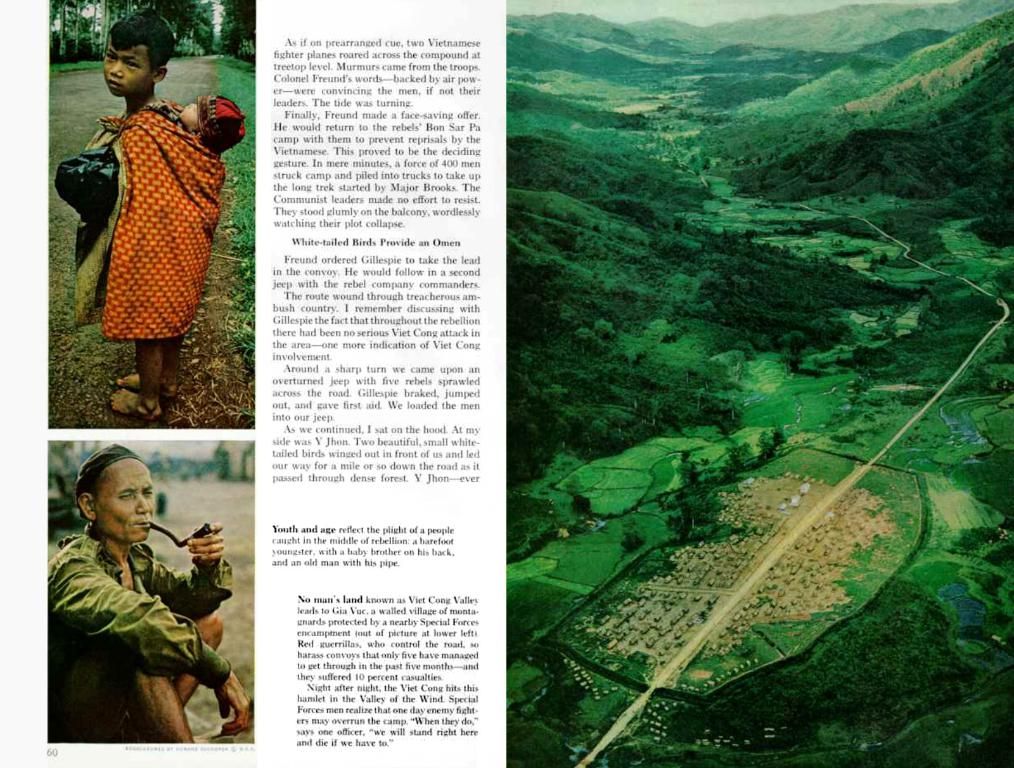

The Bureau of Labor Statistics in the U.S. recently revealed that April's Consumer Price Index (CPI) inflation took a casual stroll downwards, landing at 2.3%. Surprisingly, this more relaxed figure is a smidge under the anticipated 2.4%. Marking the third consecutive month of the chill pill for headline inflation, this fracture might foreshadow a pivot towards economic calm. Even as core CPI inflation remained at a steady 2.8%, it fell in line with predictions, implying that the underlying ripples in the economy's bed remain the same. This wave of cooling occurs despite the ongoing trade war, which could have a substantial impact on the financial scene, including cryptocurrencies.

Inflation: Putting on the Brakes or Just Taking a Break?

The recent CPI survey suggests that inflation is taking it easy after months of heated pressure. With the headline CPI inflation rate now winding down to 2.3% in April, we're witnessing the third month of steady retreat. This dip could imply that inflationary pressures might be easing—an excellent news break for consumers coping with rising essential costs like food, housing, and energy.

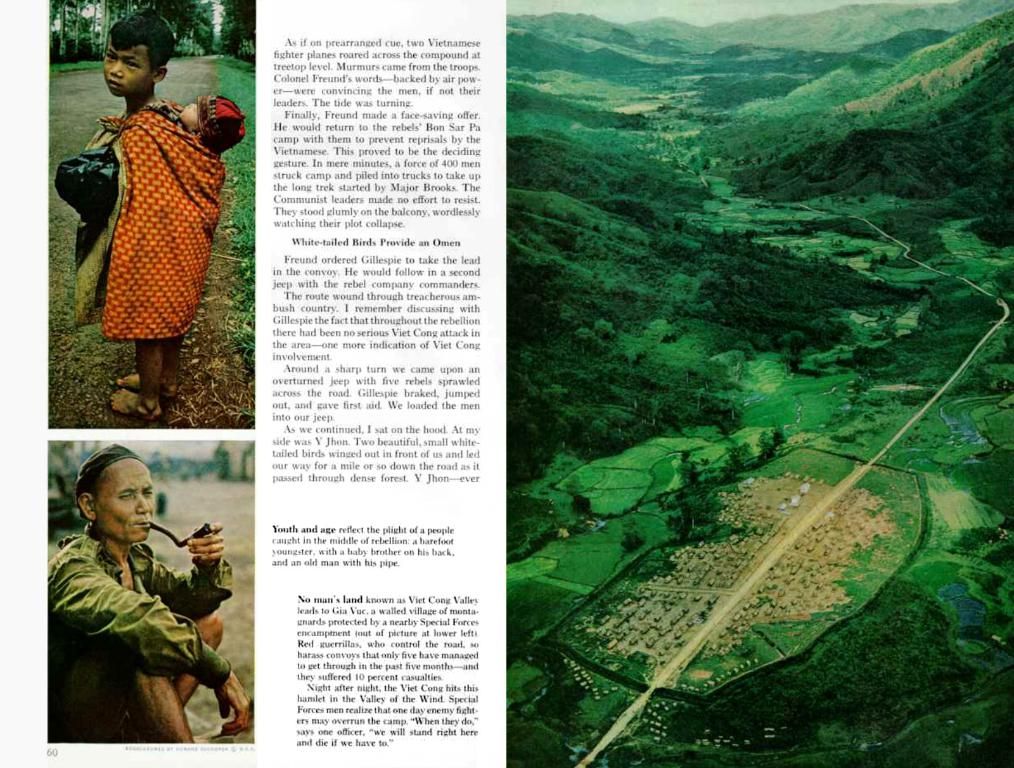

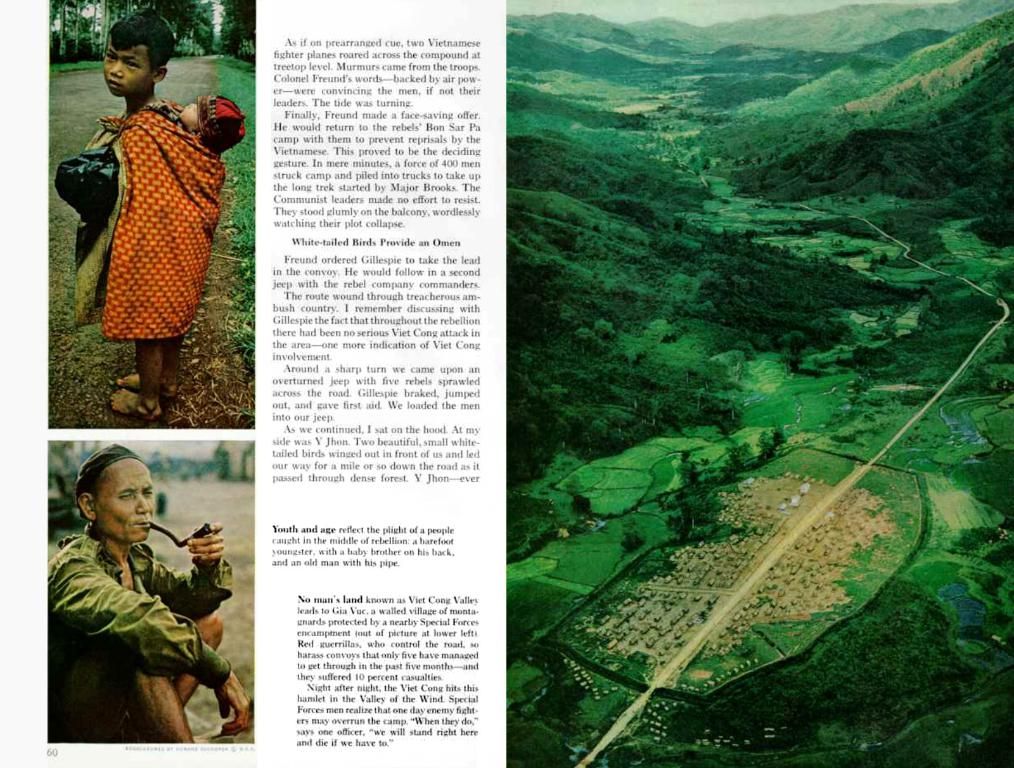

Meanwhile, the complex core CPI inflation—refined indices that discard volatile food and energy factors to paint a clearer picture of price trends—has managed to stay put at 2.8% and matched the forecasts. This suggests that while the headline inflation may be hitting the brakes, the underlying inflow of inflation is rather stable. The stability in core inflation may indicate that inflationary pressures are being contained, and overall, the economy might be easing into a steadier phase, even with the trade war headwinds roaring in the background.

Cryptocurrency: Inflation's Underdog Champion?

data-jobty="Cryptocurrency's New Best Friend? Cool Inflation Data"

"https://startupdigest.com"

"Startup Digest"

"Elaine Barker"

"2021-05-06"

"https://cdn.rawgit.com/startupdigest/posts/main/headlines/2021/05/Inflation.jpg"

"CPI chart with an upward trend and a sudden drop in April"

"Inflation's New Best Friend? Cool Inflation Data and Its Impact on Cryptocurrencies"

"The connection between crypto and traditional inflation hedges may change as inflation cools. Could slower inflation rates mean less demand for Bitcoin and other digital assets?"

"https://startupdigest.com"

"https://cdn.rawgit.com/startupdigest/posts/main/headlines/2021/05/Inflation.jpg"

"Inflation data such as this has a significant impact on the cryptocurrency market. Cryptocurrencies such as Bitcoin have often been used as an inflation hedge, particularly when their prices increase, coupled with the devaluation of the currencies. However, the connection between crypto and traditional inflation hedges may change as inflation cools. Here's what cooler inflation rates can mean for the crypto market and overall financial landscape."

Inflation data like this carries a substantial impact on the cryptocurrency market. Cryptocurrencies like Bitcoin have traditionally been used as a hedge against inflation, especially when their prices boom while traditional currencies struggle with devaluation. Historically, when inflation kicks up, investors have sought the refuge of Bitcoin and other digital assets, looking for a stable place to park their assets.

However, the relationship between crypto and classic inflation hedges could evolve as inflation cools. The decline in inflation rates might diminish the necessity for cryptocurrencies to protect against rising prices. This shift could ripple through the crypto market, impacting the currencies' value. Nevertheless, this doesn't signal a dramatic fall in the interest for Bitcoin and other digital currencies. As central banks worldwide implement policies like low-interest rates or quantitative easing, digital assets could remain a desirable haven for investors seeking to broaden their asset base with the potential to grow.

When inflation is falling, interest rates may remain low or plummet even further, making traditional investments like bonds and savings accounts less appealing. This may lure more institutional investors and retail buyers to join the crypto market in search of better returns. Even after inflation retreats, the demand for decentralized finance (DeFi) and digital assets could continue swelling for other reasons, such as technological advancements and the ascension of blockchain applications.

Crypto Meets Economy: Cool Inflation Fuels Warm Relationships

data-jobty="The Fed, Inflation, and Crypto: Navigating the Economic Forecast"

"https://www.cnbc.com"

"CNBC"

"Robert Frank"

"2021-05-05"

"https://image-cdn.financialpost.com/wp-content/uploads/2021/04/GettyImages-1234559188.jpg"

"Chart showing the decline in inflation rates over the past months"

"Can the Fed, Inflation, and Crypto Coexist in Harmony?"

"The decline in the CPI may pave the way for accommodative monetary policies and further interest rate cuts, which can induce favorable conditions for the crypto market to thrive."

"https://www.cnbc.com"

"https://image-cdn.financialpost.com/wp-content/uploads/2021/04/GettyImages-1234559188.jpg"

"The latest decline in inflation has created a fertile ground for both the crypto market and the Federal Reserve's monetary policy to flourish. The accommodative policies enacted by the Federal Reserve could contribute to a positive environment for the crypto market, ultimately with the potential to enhance investor returns."

Changes in inflation rates can influence the future course of the Federal Reserve's policy, especially as it pertains to interest rates. Should the decline in inflation persist and remain within manageable limits, the Fed might consider reducing interest rates further or slowing the pace of interest rate increases. Lower interest rates often make riskier investments, including stocks and cryptocurrencies, less daunting since the cost of holding them goes down in real terms.

For crypto investors, this could mean a landscape ideal for digital assets as traditional investments like stocks potentially gain traction. With institutional investors entering the crypto market, the combination of crypto with economic trends like low inflation and low-interest rates might foster sustained demand for cryptocurrencies.

- The cooling of inflation rates may impact the relationship between cryptocurrencies and traditional inflation hedges, with a potential decline in the necessity for cryptocurrencies as a hedge for rising prices.

- Historically, cryptocurrencies like Bitcoin have been utilized as a hedge against inflation, but the declining inflation rates could alter this relationship. This change might ripple through the crypto market, possibly affecting the value of various digital assets.

- While cooler inflation rates might decrease the demand for certain cryptocurrencies as inflation hedges, the demand for decentralized finance (DeFi) and digital assets could continue increasing due to technological advancements and the growth of blockchain applications.