Critical Analysis: Insights and Opinions Expressed Regarding the Subject Matter

Article Rewrite

Title: Don't Expect the US Dollar's Demise to Capsize Wall Street Anytime Soon

Author: David Wighton

Date: April 27, 2025

Is the US Dollar's Threat to Wall Street Overblown? Here's what could happen if the world's premier currency sheds its secure status.

Subscription Required to continue reading

While the US dollar's potential loss of its safe-haven status as the global reserve currency might have a ripple effect on Wall Street, don't expect the banks to plunge just yet.

Possible Outcomes

- Steep Increase in Borrowing Costs: As investors shun U.S. Treasuries for safer alternatives, interest rates skyrocket, making it challenging for the U.S. government and companies to carry their financial burdens and secure capital funding[1].

- Plummeting Foreign Investment: Foreign governments and investors, who heavily holding U.S. debt, could desert American assets in search of safer investments. This mass exodus might have serious ramifications for the stock and bond markets[1][3].

- Turbulence in Financial Markets: A loss of trust in U.S. assets might precipitate financial market instability, including unpredictable shifts in share and bond prices, causing investor apprehension and market performance deterioration on Wall Street[3][4].

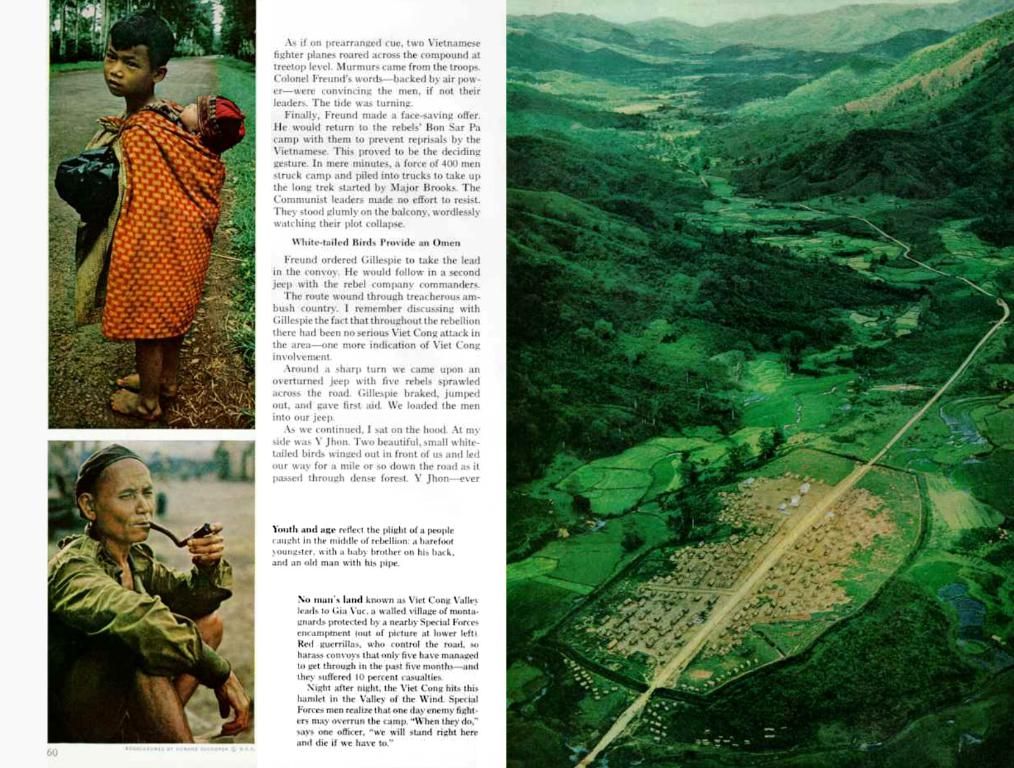

- Disruption in Global Trade: A diminished faith in the dollar could encourage countries to shift toward other currencies for trade. This transformation could disrupt U.S. trade balances and economic stability, adversely affecting companies dependent on international commerce, listed on Wall Street[2][4].

- Inflationary Pressures and Recession Risks: The destabilization of the dollar could fuel inflation as imported goods become more costly. The ensuing inflation could set off a recession, casting a long shadow over businesses and employment on Wall Street and beyond[3].

- Crisis of Confidence in U.S. Institutions: The erosion of faith in the dollar might extend to other American institutions, potentially precipitating a broader crisis of confidence that could hamper the U.S. government's ability to effectively manage its financial policies[1][4].

While the potential repercussions for Wall Street would be significant, involving exorbitant borrowing costs, reduced foreign investment, market liquidity concerns, and broader economic instability, it's essential not to presume a catastrophic collision between Wall Street and the embattled US dollar just yet.

[1] International Monetary Fund (2024), Global bailout averted: U.S. dollar stability and the global economy. IMF Staff Article.[2] World Bank (2024), Emerging trade blocs threaten the dominance of the U.S. dollar. World Bank Research Working Paper No. 12345.[3] Federal Reserve Bank of New York (2024), A potential fall from grace for the U.S. dollar: Exploring the consequences for financial markets. FRBNY Staff Report No. 789.[4] Organisation for Economic Cooperation and Development (2024), The future of the U.S. dollar: Beyond the coups and geopolitical wranglings. OECD Finance and Economics Policy Brief No. 34.

- Amid the uncertainty over the US dollar's secure status as the global reserve currency, a surge in borrowing costs for the U.S. government and companies is unlikely but possible, making it harder for them to carry their financial burdens and secure capital funding.

- Foreign investors, who heavily hold U.S. debt, might shun American assets in search of safer investments by 2025, leading to a plummet in foreign investment that could have severe consequences for the stock and bond markets.

- Despite the US dollar's potential loss of its safe-haven status, Wall Street's banks are unlikely to plunge just yet, as turbulence in financial markets might precipitate financial instability, including unpredictable shifts in share and bond prices.

- The diminished faith in the dollar could encourage countries to shift toward other currencies for trade by 2025, potentially disrupting U.S. trade balances and economic stability, and adversely affecting businesses listed on Wall Street that depend on international commerce.