Chewy's Q3 earnings missed the mark, but here's why I'm still bullish on the pet retail giant before 2024.

Dive into the recent performance of pet supply e-commerce giant Chewy (CHWY 1.23%), which saw its shares dip by 7% after falling short of analysts' third-quarter earnings estimates. But instead of focusing on the negative, consider this as an opportunity to invest in a well-performing company poised for further growth.

Shining a Brighter Light on the Third Quarter

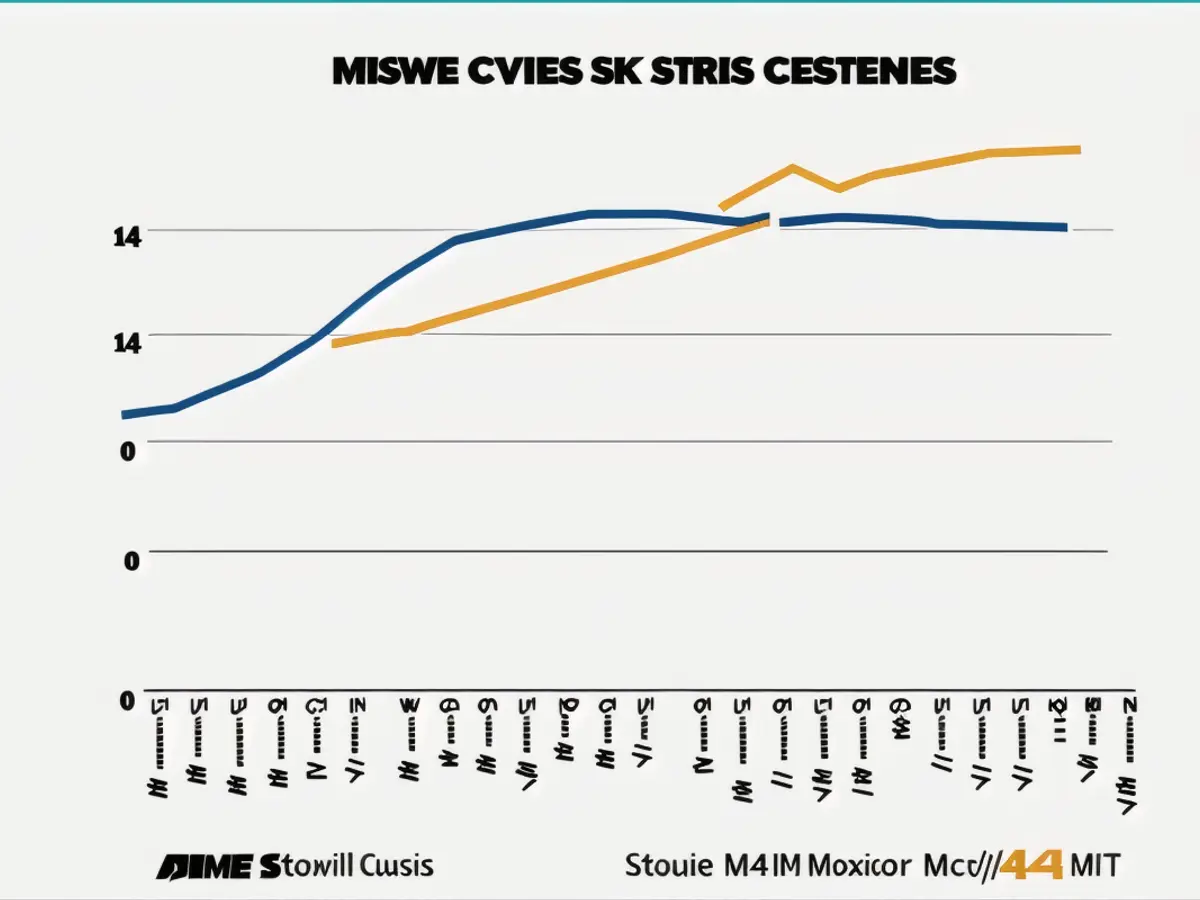

Chewy reported revenue of nearly $2.9 billion for the three-month finisher in October, slightly surpassing predictions. Even though earnings fell short of the anticipated $0.23 per share, profits skyrocketed, marking a 33% year-over-year improvement from $0.15 per share.

Regarding customers, although Chewy did lose a small number, it's worth noting that this trend reflects the post-pandemic shift in consumer habits when they returned to in-store shopping. In fact, Chewy's customer attrition has slowed significantly, with the rate of loss being the least robust in quite some time.

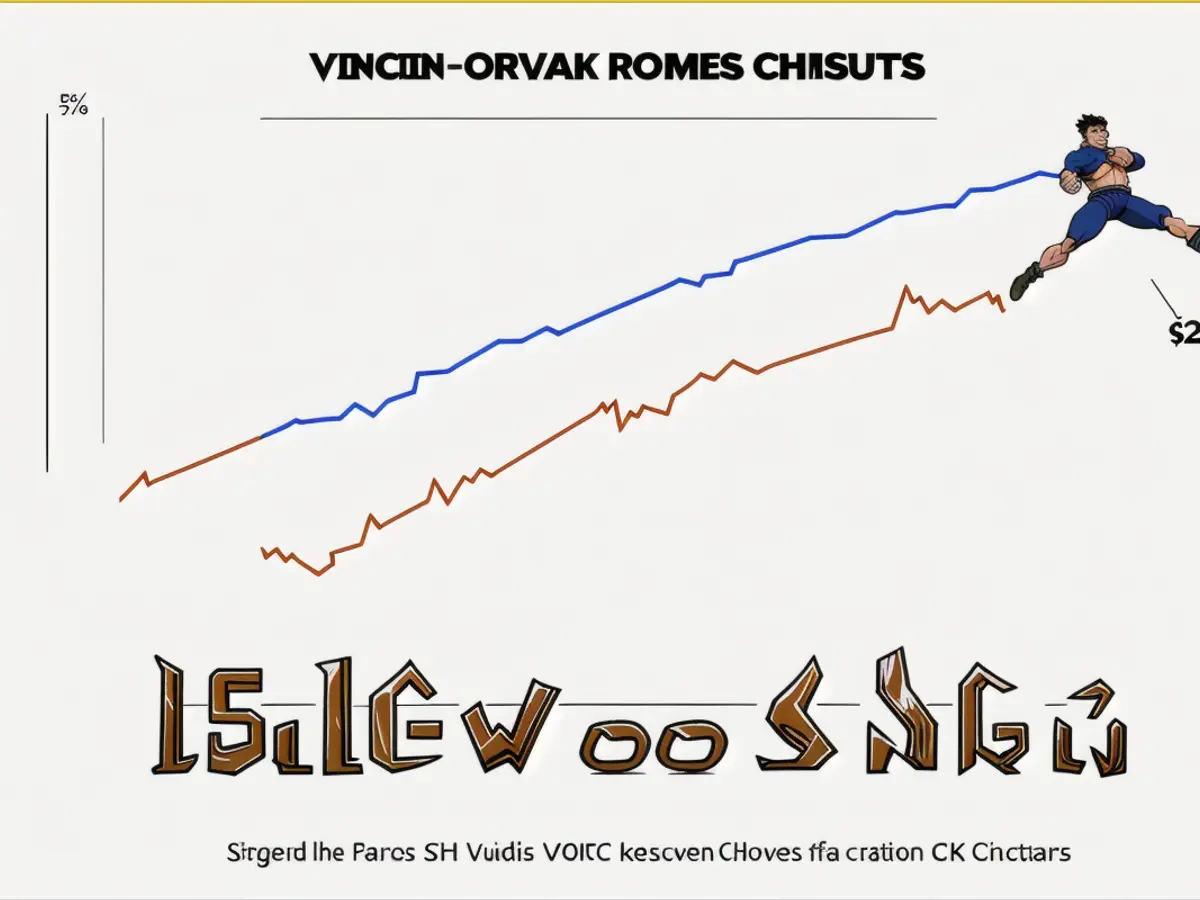

Looking ahead, expect a top-line uptick of about 13% for the just-commenced quarter, thanks to strategic measures such as last year's launch of their veterinarian business and an aggressive advertising campaign.

A Renewed Focus on Customer Relationships

What many overlooked was Chewy's fortified relationships with their customers. The core customer base is still expanding, and sales to these loyal customers are steadily climbing. Autoship revenue, which is a significant portion of their business, continues to grow. This not only reduces marketing and promotional expenses but also generates a sizeable recurring revenue stream.

More Glitter Than Gloom

While every stock carries inherent risks, Chewy's mainly revolve around its relatively high valuation and slower sales growth for an e-commerce company. However, viewing the situation from a broader perspective, the company's steady progress towards commanding a sizable share of the U.S. pet supply e-commerce market cannot be ignored. Bloomberg Intelligence predicts this market to nearly double in size between 2023 and 2030, a growth trend that Chewy is well-positioned to capitalize on.

In conclusion, with recent earnings behind it, Chewy presents an excellent opportunity to invest in a company boasting robust performance, a robust customer base, and a promising future. In the midst of investor distraction, seize this moment to join in the company's inevitable rise to further dominance in the pet supply e-commerce market.

Investors might find it worthwhile to consider allocating some money towards Chewy, given its financial performance and market potential. Despite falling short of analysts' earnings estimates, Chewy's profits significantly increased, indicating a strong financial foundation for potential investments.