Central Bank of Europe reduces interest rates again

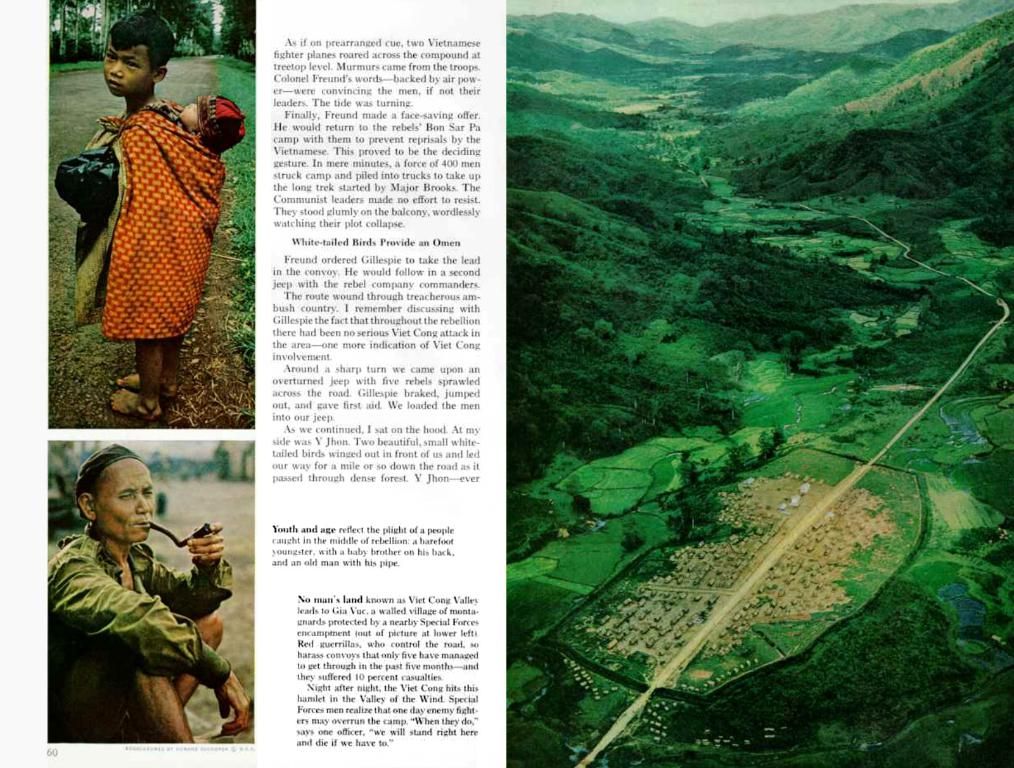

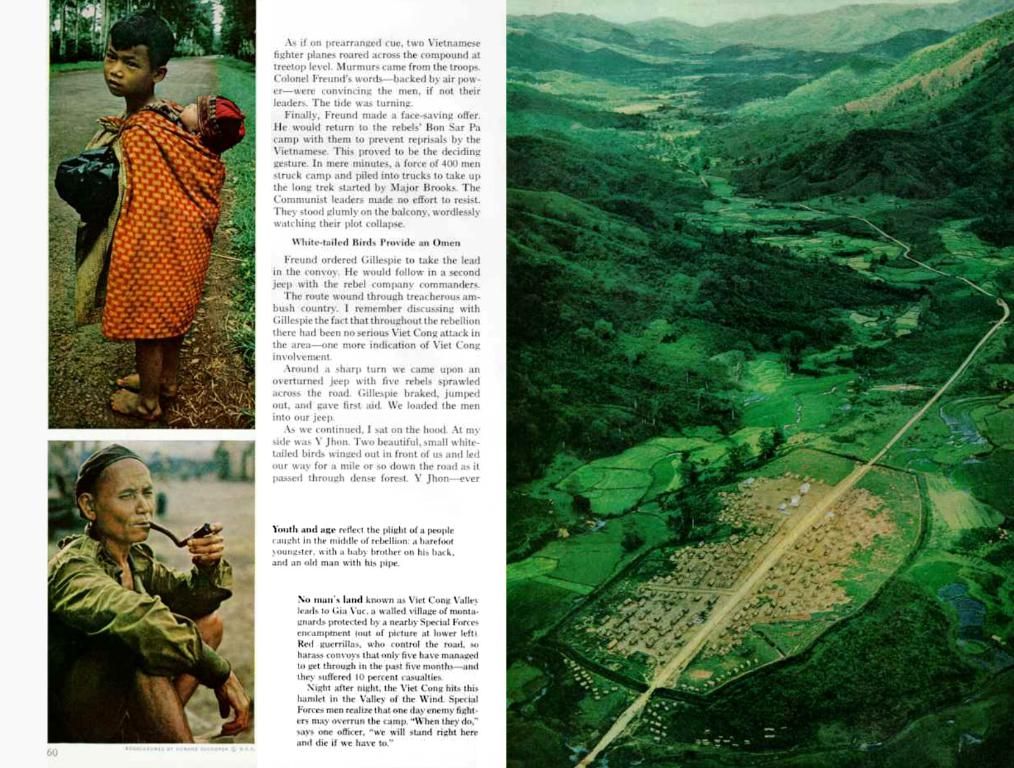

Heads Up! The European Central Bank (ECB) Just Lowered Interest Rates Again

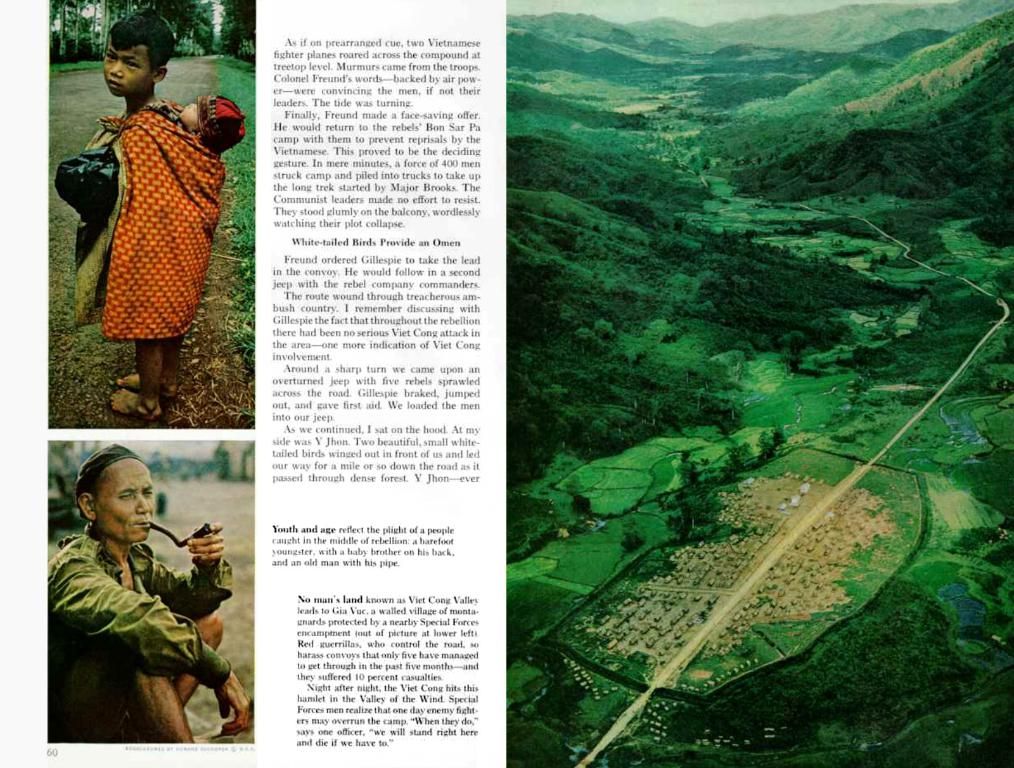

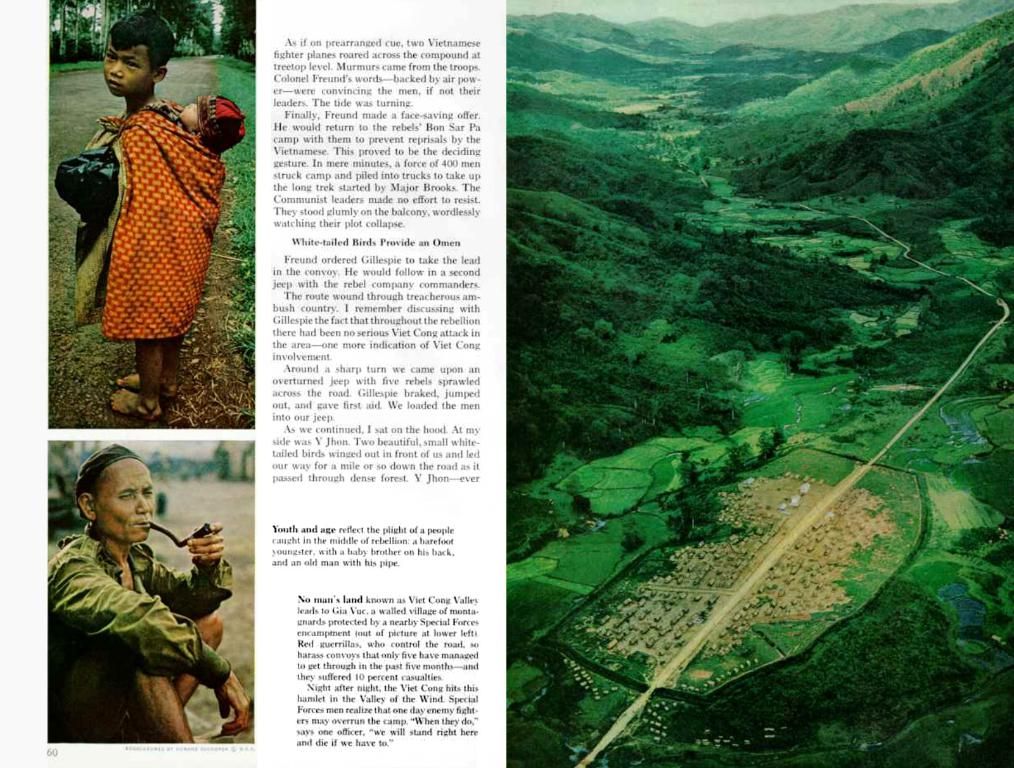

Hey there! Guess what's happening today? The European Central Bank (ECB) has made its eighth consecutive interest rate cut this year—against the backdrop of continuous inflation decline in the Eurozone. This recent move has lowered the key deposit rate down to 2.0 percent, as per reports from Tagesschau.

Wondering what this means for the Eurozone? Well, the deposit facility rate, which banks use to deposit money with the ECB, has been reduced to 2 percent. The interest rate for main refinancing operations has also been lowered to 2.15 percent, while the marginal lending facility rate for overnight loans from the ECB stands at 2.40 percent.

The pressuring factor behind the ECB's decision to cut interest rates once again is the ongoing inflation slowdown in the Eurozone. As a matter of fact, the inflation rate in the Eurozone hit 1.9 percent in May, dipping even below the ECB's target of two percent.

Now, let's dissect the reasons behind this move. The ECB opted for a rate cut largely due to the following factors:

- Inflation Outlook: Headline inflation is projected to hover around 2.0 percent in 2025, 1.6 percent in 2026, and 2.0 percent in 2027, primarily due to reduced energy prices and a stronger euro.

- Economic Growth: Despite uncertainties, particularly from trade tensions, the ECB forecasts real GDP growth to be 0.9 percent in 2025, 1.1 percent in 2026, and 1.3 percent in 2027.

- Strengthening Factors: Rising government investment in defense and infrastructure, coupled with favorable labor market conditions, is expected to bolster growth.

How will this affect the Eurozone in the long run? The rate cuts are designed to boost economic resilience by creating more favorable financing conditions. This should help the Eurozone shrug off global shocks like trade tensions more easily. However, analysts believe that this move could be the last "easy" one from the ECB, with further cuts depending on future economic developments and geopolitical factors.

Furthermore, there's a strong sense that markets have priced in a potential additional cut by the end of the year, potentially bringing the deposit facility rate down to 1.75 percent. However, it's important to note that this sentiment is closely tied to trade relations between the US and the EU.

So, there you have it! The ECB has made another interest rate cut, and the implications for the Eurozone are significant. Keep a close eye on the developments in the coming months! 📈

Other industries in the Eurozone may benefit from the lower interest rates, as easier access to financing could encourage investment and growth. The move by the European Central Bank could potentially impact the banking-and-insurance sector, as a decrease in deposit rates might lead to a reduction in savings and increased lending activities.