Berkshire Hathaway's Fourth Quarter 2024 Investment Portfolio Shifts

Berkshire Hathaway's (BRK/A, BRK/B) latest 13F filing, dropped on Valentine's Day, offers a peek into Warren Buffett's and his investment team's strategies. This report highlights the details of Berkshire's U.S. publicly traded stock investments. Berkshire's fourth-quarter earnings report, boasting Buffett's annual letter and a rundown of its wholly-owned operating companies, will be disclosed on February 22.

Top Ten Berkshire Holdings

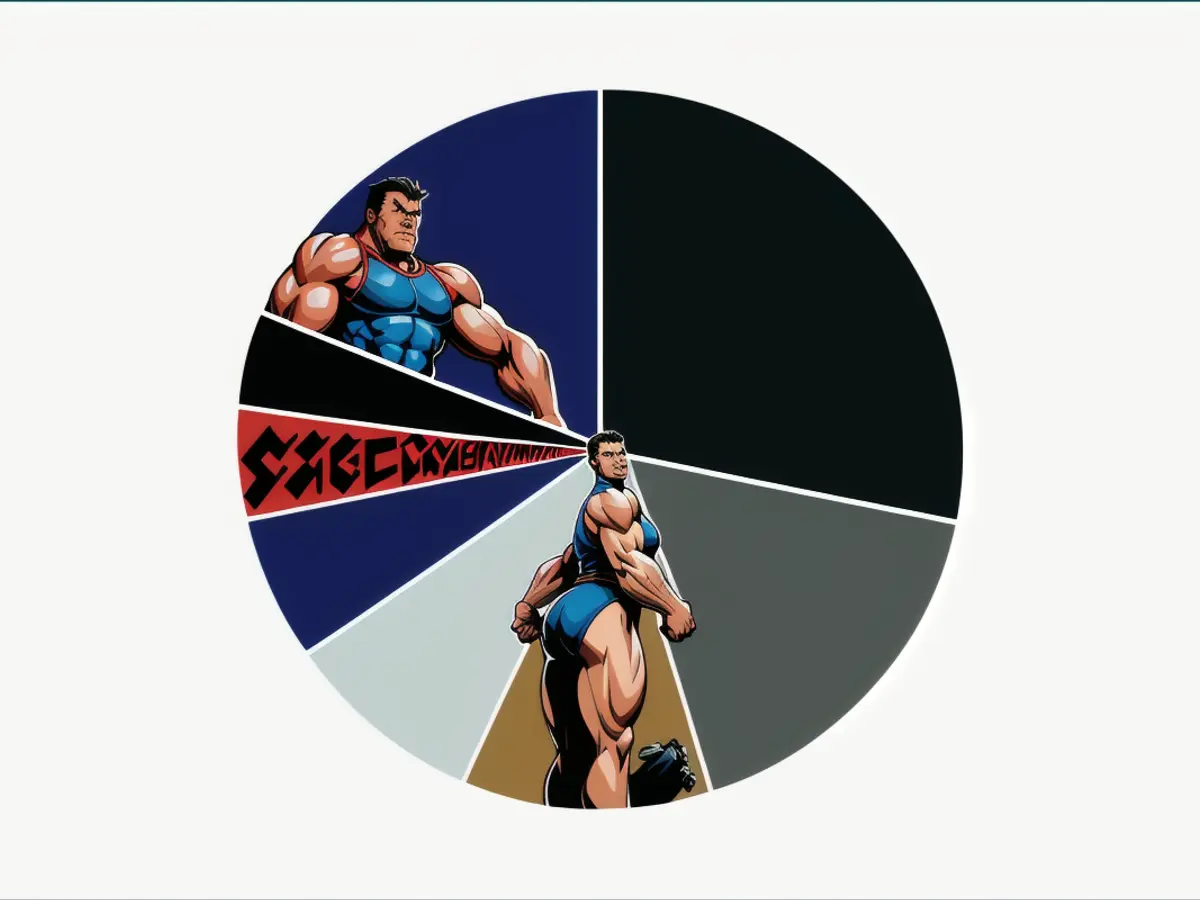

Berkshire's $267 billion investment portfolio consists of 38 companies, with a decrease of two from the previous quarter. The top five holdings, in descending order, include Apple (AAPL), American Express (AXP), Bank of America (BAC), Coca-Cola (KO), and Chevron (CVX). These heavy hitters account for nearly 71% of the portfolio, experiencing a decline from 76% during the first quarter. The investment portfolio remains strongly concentrated, with nearly 90% of assets vested in the top ten holdings.

Sectoral Breakdown of Berkshire's Portfolio

Apple's stake sales in the fourth quarter ceased. Previously, Apple comprised over 50% of Berkshire's publicly traded portfolio, but it currently stands as the largest holding at around 28%. Berkshire's tech-heavy portfolio was overweight due to its massive Apple stake, but the trimming of Bank of America (BAC), Capital One Financial (COF), Citigroup (C), and Nu Holdings (NU) has resulted in a slight underweight status for technology. The financial sector is the most significant overweight in the portfolio, making up nearly 40% of assets, despite the reduction of Bank of America, Capital One, Citigroup, and Nu Holdings. Berkshire's strong positions in Occidental Petroleum (OXY) and Kraft Heinz (KHC) contribute to the portfolio's considerable overweight in consumer staples and energy, compared to the S&P 500.

Berkshire's acquisition of approximately 5% of five Japanese trading companies, Itochu Corp., Marubeni Corp., Mitsubishi Corp., Mitsui & Co. Ltd., and Sumitomo Corp., was announced at the end of August 2020. Buffett subsequently revealed that Berkshire increased its stake in these companies to 7.4%, which may potentially rise to 9.9%.

Portfolio Changes

Berkshire added Constellation Brands (STZ) as a new holding, worth over $1.2 billion and equivalent to half a percent of assets. Constellation is recognized for owning Corona and Modelo beers in the U.S., along with various wine and spirit brands. Berkshire increased its positions in Domino's Pizza (DPZ), Pool Corporation (POOL), Occidental Petroleum (OXY), Verisign (VRSN), and Sirius XM Holdings (SIRI).

Ulta Beauty (ULTA) was eliminated from the portfolio following a quarterly trimming. Minor holdings in the Vanguard S&P 500 (VOO) and SPDR S&P 500 (SPY) exchange-traded funds (ETFs) were also removed. Berkshire reduced its positions in T-Mobile (TMUS), Charter Communications (CHTR), Liberty Media–Formula One (FWONK), and Louisiana-Pacific (LPX).

Berkshire's continued reduction in its banking sector exposure is noteworthy, despite being a renowned bank stock investor like Warren Buffett.

Portfolio Valuation Metrics

Berkshire's portfolio provides a more affordable price-to-earnings (P/E) valuation compared to the S&P 500, along with superior profitability, as indicated by return on equity (ROE) and operating margin, with somewhat analogous debt levels. The long-term (next 3 to 5 years) consensus EPS growth rate for Berkshire's portfolio is expected to be lower than the S&P 500, highlighting Buffett's preference for powerful companies generating substantial cash flows.

- Ted Weschler and Todd Combs, two of Warren Buffett's investment managers at Berkshire Hathaway, also contributed to the company's stock purchases outlined in the latest 13F filing.

- Berkshire Hathaway made significant stock purchases of Apple, adding to its already substantial holding, but also sold some of its Apple stocks, as mentioned in the report.

- Depreciation was not a significant factor in Berkshire's portfolio changes, as the report focused mainly on stock purchases and sales of publicly traded stocks.

- Berkshire's decision to add Constellation Brands to its portfolio and reduce its positions in T-Mobile, Charter Communications, and Liberty Media–Formula One, among others, were strategies outlined in the latest 13F filing.

- In response to the Berkshire Hathaway's 13F filing, analysts noted that the bank stocks in its portfolio, including Bank of America, were underrepresented compared to its historical holdings.

- According to a filing, Berkshire Hathaway's portfolio has a more affordable price-to-earnings (P/E) ratio compared to the S&P 500, but its long-term (next 3 to 5 years) consensus EPS growth rate is expected to be lower.

- Warren Buffett, the CEO of Berkshire Hathaway, has traditionally been known for his investments in bank stocks, but the company's latest 13F filing showed a continued reduction in its banking sector exposure.