A glimpse of the equilibrated MSCI Global Index composition is provided here.

A Peek at an Equally-Weighted MSCI World ETF: Breaking Away from Traditional Indexes

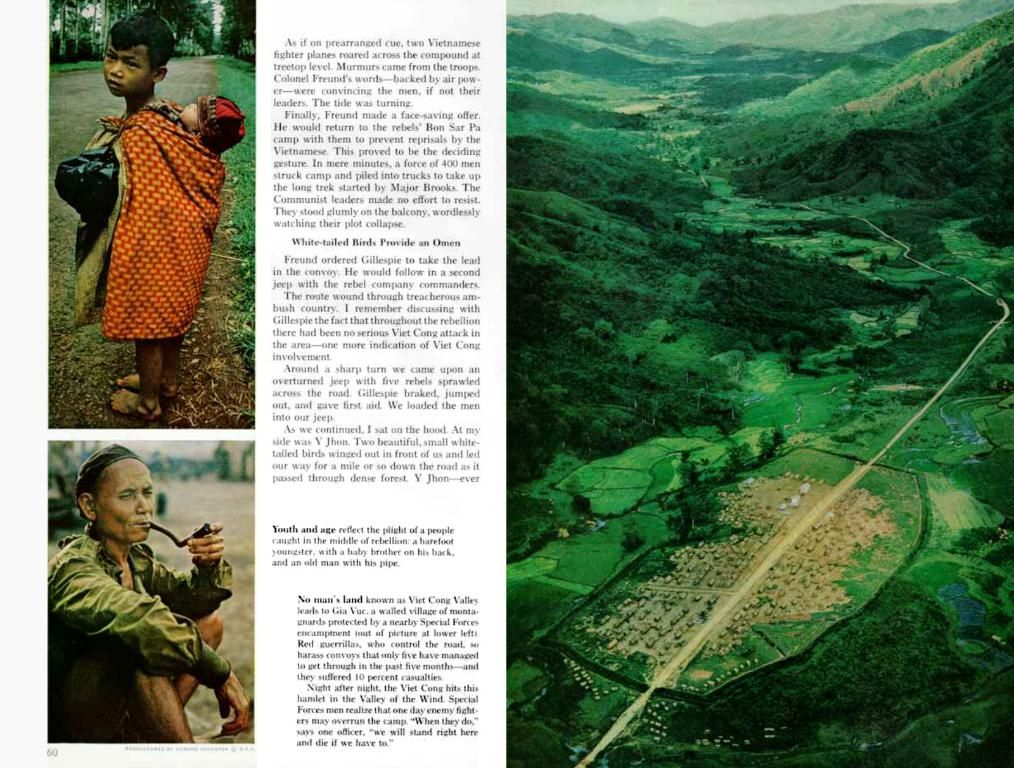

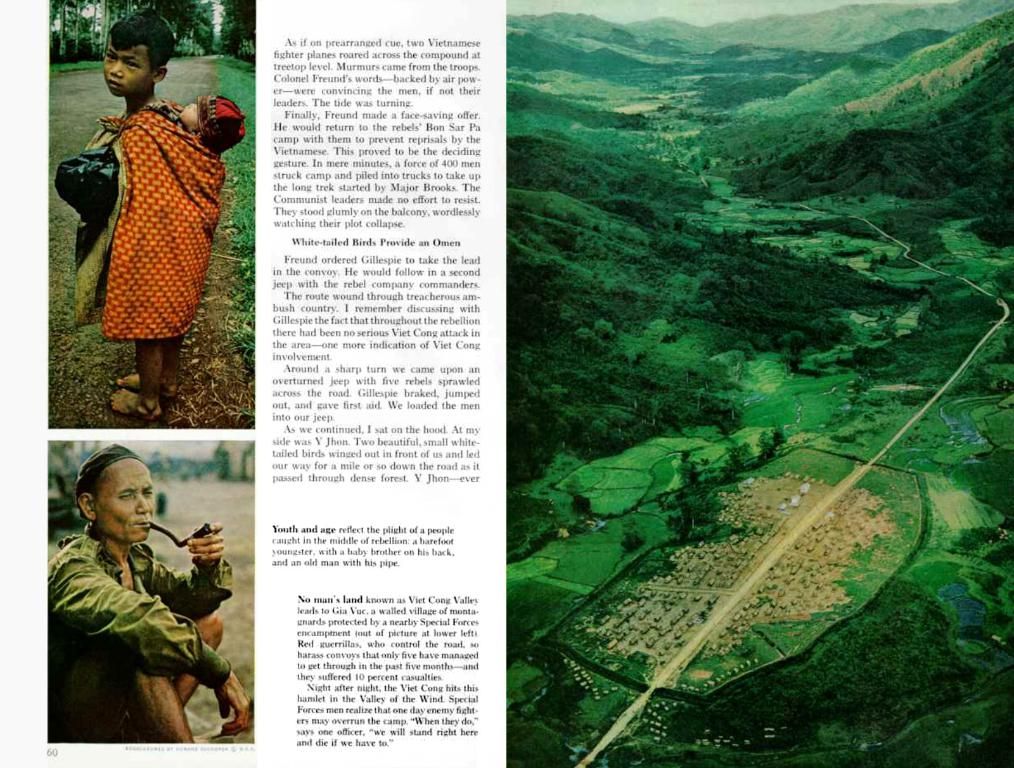

Stepping off the beaten path, investors can consider the equally-weighted MSCI World ETF, a departure from the common market-cap weighted index funds. Let's take a closer look!

A Few Equally-Weighted Options

When it comes to equally-weighted stock ETFs, the pickings are somewhat limited. For example, the Xtrackers S&P 500 Equal Weight ETF equally distributes holdings among the 500 US stocks it tracks, each taking up around 0.2% of the portfolio. Alternatively, the Ossiam Stoxx Europe 600 ESG Equal Weight ETF gives about 0.167% weight to each of its 600 European stocks.

The MSCI World Equal Weighted Index: A Change of Pace

However, a truly global equally-weighted ETF, covering companies from various countries, remains absent, as the MSCI World Index has yet to launch such a fund. The MSCI World Equal Weighted Index, on the other hand, does exist, but it takes a different approach. Instead of being heavily biased towards the US, like its market-cap counterpart, the equal-weighted version has a more balanced distribution, with US stocks making up just 40.8% of the portfolio.

A Tech-Lite Outlook

When it comes to sectors, too, there are differences. The MSCI World Equal Weighted Index slashes the weight of tech stocks, allotting only 11.9% compared to the 22.1% in the market-cap version.

Say Goodbye to Tech Giants' Monopoly

The biggest differences, though, can be seen in individual stocks. For instance, in the market-cap index, the top five holdings – Apple, Microsoft, Amazon, Tesla, and Alphabet A – account for 13.9% of the portfolio. In the equal-weighted index, these titans each take up a much smaller slice of the pie, with no single stock exceeding 0.13%.

Disclosure: The author owns shares in Amazon, Apple.

The MSCI World Equal Weighted ETF: What Makes It Special?

The equality-weighted ETF reallocates constituents to equal weights, resulting in significant differences compared to the market-cap weighted MSCI World Index:

1. Diversified Country Exposure

The standard MSCI World Index has a ~70% US exposure[1], while the equal-weighted version would grant equal allocations to all countries proportionally to their number of constituents. Since the MSCI World index contains 1,465 stocks (70% US by market cap but fewer by company count), the equal-weighted ETF's US allocation would likely be lower than 70% but still the largest single-country exposure.

2. Diluted Tech Concentration

In the MSCI World Index, the IT sector leads at 23.68%[1], mainly due to tech giants like Apple and Microsoft. An equal-weighted ETF would dilute this concentration since:- Market-cap leaders receive equal weight (e.g., Apple's weight drops from ~4%+ in cap-weighted to ~0.07% in equal-weighted)- Sector allocation becomes proportional to constituent count rather than market value

3. Leveled Individual Stock Weights

| Metric | MSCI World (Cap-Weighted) | MSCI World Equal Weighted ||--------|----------------------------|---------------------------|| Top 10 Stocks | 21.47%[1] | ~0.7% each (collectively ~7%) || Apple | 4-5% (estimated) | 0.07% (1/1465) || Microsoft | 3-4% (estimated) | 0.07% || Amazon | 1-2% (estimated) | 0.07% || Tesla | ~1% (estimated) | 0.07% || Alphabet A | 1-2% (estimated) | 0.07% |

Key Implications:- Neutralized mega-cap dominance: Equal weighting nullifies the "Magnificent 7" effect seen in cap-weighted indices[1][4]- Boosted small/mid-cap exposure: Lesser-known companies gain equal voting rights in portfolio construction[3][4]- Increased trading activity: Quarterly rebalancing necessitated to maintain equal weights[4] leads to more frequent trading vs cap-weighted indices.

While ETF compositions may vary based on issuer, the MSCI World Equal Weighted Index methodology inherently reduces sector and country concentrations and mega-cap overexposure compared to the traditional index[1][3][4].

- The MSCI World Equal Weighted Index, unlike its market-cap counterpart, offers a more balanced distribution of countries, with potential equal allocations to all countries proportional to their number of constituents.

- An equal-weighted ETF would dilute the concentration of the IT sector, as market-cap leaders receive equal weight, and sector allocation becomes proportional to constituent count rather than market value.

- In an equal-weighted ETF, individual stock weights are leveled significantly, with no single stock exceeding 0.13%, a stark contrast to the top 10 stocks in the market-cap index, which collectively make up ~21.47%.

- By neutralizing mega-cap dominance, boosting small/mid-cap exposure, and increasing trading activity, the MSCI World Equal Weighted Index methodology inherently reduces sector and country concentrations and mega-cap overexposure compared to traditional indexes in finance and business investing.